Investor rescues Powerscourt Distillery from receivership

By Nicola CarruthersAfter entering receivership last year, Irish whiskey maker Powerscourt Distillery has found a buyer for most of its assets, saving the business and its jobs.

Powerscourt Distillery, based in Enniskerry, County Wicklow, appointed Mark Degnan of Interpath Advisory as its receiver in June 2025 to manage and sell its assets.

The receiver has now entered into an agreement to sell most of its assets to US investment firm Altiva Management, which is expected to be completed in the coming weeks. Financial terms of the deal have not been disclosed.

The transaction includes the sale of a large volume of bulk whiskey produced at Powerscourt Distillery, along with all brands, intellectual property and a transfer of the leasehold interest in the operating distillery and visitor centre.

The receiver is now seeking to sell the remaining bulk Irish whiskey, which includes liquid acquired from County Louth-based Cooley Distillery several years ago.

All current members of staff – 13 in total – are expected to be transferred to the buyer.

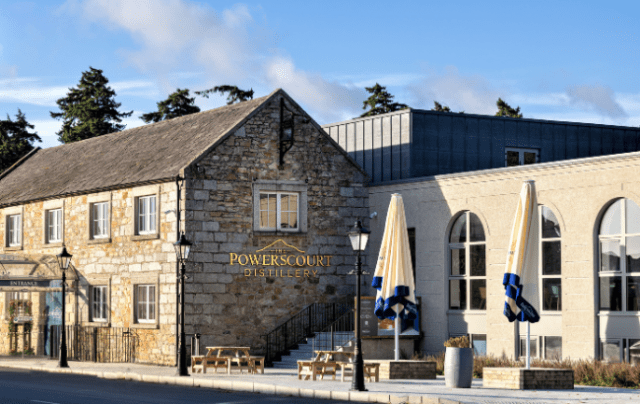

The sale will enable the business to continue to operate, including the 20,000sqft, state-of-the-art whiskey distillery and visitor centre, located in the Old Mill House on the Powerscourt Estate.

The €10 million (US$11.8m) distillery and visitor centre opened to the public in 2019 and has maintained operation throughout the receivership.

Powerscourt is behind the Fercullen whiskey brand. It operates in markets across Europe, North America, Asia and Africa.

Roger Duggan, the distillery’s CEO, said: “This is a great day for Powerscourt Distillery having secured a strong and supportive new ownership structure. It marks the beginning of an exciting new chapter for our business.

“With the backing of Altiva, we are well-positioned to build on our exceptional brand reputation with our premium product, Fercullen Irish Whiskey, that is loved by our customers across the world. This gives us the opportunity to invest in that brand along with the visitor experience at our excellent facility in Wicklow.”

The business entered receivership after suffering “cashflow difficulties and a disruption to trade amid global tariff volatility”.

Powerscourt owes €21.5m (US$24.8m) to PNC Business Credit through a master financing agreement, a loan that was provided in 2023 to drive the brand globally. Powerscourt did not confirm if this debt had been paid off.

Altiva has pledged to provide substantial capital investment into Powerscourt Distillery to support its growth plans and the operational stability of the business.

The investment will further enhance the brand and visitor experience along with maximising opportunities in existing and emerging markets.

‘Tremendous potential’

Adam Morgan, director of Altiva Management, added: “We see tremendous potential in Powerscourt Distillery and are committed to supporting its talented team as they look to grow and thrive over the coming years.

“Our focus will be on strengthening the market position of the business, growing its brand and investing in innovation to ensure sustainable success.”

Degnan described the deal as “a great vote of confidence from an international investor in this indigenous industry and a fantastic Irish brand”.

He continued: “The sector has been facing some challenging trading periods in recent times but there are opportunities that exist when strong brands and talented teams are matched with the right funding partner and structure.”

Related news

Irish whiskey exports fall 5% in 2025

World Spirits Report 2025: Irish whiskey

IWA launches ‘landmark’ tourism initiative for Irish whiskey