Best-selling liqueur Brand Champions

New innovations in flavour and celebrity-studded campaigns have helped to create excitement around liqueurs, but how did the category’s leaders perform last year?

Data from Irish food agency Bord Bia indicates a bright future for cream liqueurs. Category exports rose by 5% to €380m (US$426.8m) in 2024, with strong sales in the UK and 41% growth in Spain.

Exports to the US and Canada accounted for more than 60% of total cream liqueur exports and grew by 13% and 8% respectively.

Central and South America have emerged as future markets, Bord Bia highlights, led by Chile and Panama. In Asia, exports of cream liqueurs to China soared by 30%, to reach around €4.5m.

Only one brand was in decline among the liqueur category’s biggest players in 2024, compared with the previous year, when the majority struggled to grow their volumes.

From fruit-flavoured brands to cream and coffee liqueurs, the category remains a small but mighty pack with little change in terms of the ranking.

One brand did, however, return to The Brand Champions after its parent company provided its latest figures. Meanwhile, French firm Rémy Cointreau opted not to share figures for its Cointreau liqueur brand for the third year running, alongside Dutch producer De Kuyper.

Scroll down to see the biggest performers from The Brand Champions 2025 report.

The data is listed to one decimal place for ease of reading, but the percentage changes were calculated on the full data supplied. All data is recorded in millions of nine-litre cases.

7. Amarula

Owner: Heineken Beverages

Volume: 2020: 0.9m | 2021: 1.2m | 2022: 1.4m | 2023: 1.1m | 2024: 1.2m

% change: 13.2%

Place last year: 6

Cream liqueur Amarula returned to growth last year, rising by 13.2% in 2024 to post the biggest increase of the top-selling liqueurs. The previous year saw the South African brand plummet by a quarter to 1.1m cases, so the double-digit increase is welcome news for Amarula.

Heineken Beverages completed its purchase of Amarula in April 2023, so perhaps the brand has been able to benefit from the brewing giant’s resources and extensive footprint in the past year.

6. Disaronno

Owner: Illva Saronno

Volume: 2020: 1.0m | 2021: 1.3m | 2022: 1.4m | 2023: 1.4m | 2024: 1.4m

% change: 0.0%

Place last year: N/A

Popular amaretto Disaronno made its comeback to The Brand Champions after its parent company disclosed the brand’s 2024 figures. Its last appearance in the report was in 2019, when it reported case sales of 1.2m for the previous year.

The Italian liqueur experienced increases between 2020 and 2022, but it has peaked at 1.4m cases for the past three years.

This year marks the brand’s 500th anniversary and, with celebrations planned in 160 markets, could Disaronno hit a new milestone in 2025?

5. Choya

Owner: Choya Umeshu

Volume: 2020: 1.7m | 2021: 1.6m | 2022: 1.5m | 2023: 1.5m | 2024: 1.5m

% change: 1.4%

Place last year: 5

Japanese liqueur Choya Umeshu has retained its fifth position on the best-selling list, rebounding in 2024 with a slight uptick of 1.4% to 1.5m cases.

Traditionally made with ume fruit, Choya is exported to more than 90 countries worldwide.

Last September, the brand opened a bar dedicated to umeshu cocktails in Hong Kong, a market where Choya has expanded significantly.

The first Choya Ginza Bar originally opened in Tokyo’s Ginza district in November 2019 as a flagship venue with the aim of cultivating Japanese ume fruit culture.

4. Lubelska

Owner: Stock Spirits Group

Volume: 2020: 1.9m | 2021: 1.9m | 2022: 1.9m | 2023: 1.9m | 2024: 1.9m

% change: 0.0%

Place last year: 3

Polish liqueur Lubelska has hovered at the 1.9m mark for the past five years, failing to report any growth in 2024.

The vodka-based Lubelska range includes flavours such as lemon, cherry, grapefruit, pear, mango and cranberry.

Parent firm Stock Spirits is aiming to become the leading mainstream spirits company in Europe, which could mean a renewed push behind one of Poland’s top flavoured liqueur brands.

3. Kahlúa

Owner: Pernod Ricard

Volume: 2020: 1.6m | 2021: 1.8m | 2022: 1.8m | 2023: 1.9m | 2024: 1.9m

% change: 2.1%

Place last year: 4

The ‘unstoppable rise’ of the Espresso Martini helped Kahlúa take the title of Liqueur Brand Champion for the second year in a row. A key ingredient in the popular serve, Pernod Ricard‐owned coffee liqueur Kahlúa grew its volumes by 2.1% last year to 1.9 million nine‐litre cases.

The brand’s growth has been attributed to the “global coffee‐cocktail boom”, led by the Espresso Martini, according to Craig van Niekerk, vice‐president of marketing for Kahlúa and Malibu.

Kahlúa saw strong growth in all regions last year, with the US being the brand’s number-one market (where sales were up by 3%). Meanwhile, sales of the coffee liqueur in the UK soared by 15% to become the brand’s second‐biggest market.

Last year, the brand brought in several famous faces to drive sales. Kahlúa teamed up with singer Sabrina Carpenter on its Short n’ Sweet Espresso Martini kit, and partnered with rapper Cardi B’s Whipshots to create a limited edition chocolate liqueur.

2. Malibu

Owner: Pernod Ricard

Volume: 2020: 4.4m | 2021: 4.9m | 2022: 4.8m | 2023: 4.4m | 2024: 4.3m

% change: -2.0%

Place last year: 2

Rum-based liqueur Malibu continued on its downward trajectory, falling by 2% to 4.3m cases in 2024 – its fourth year in decline.

In the second half of 2024, Pernod Ricard reported a 4% organic sales drop for Malibu.

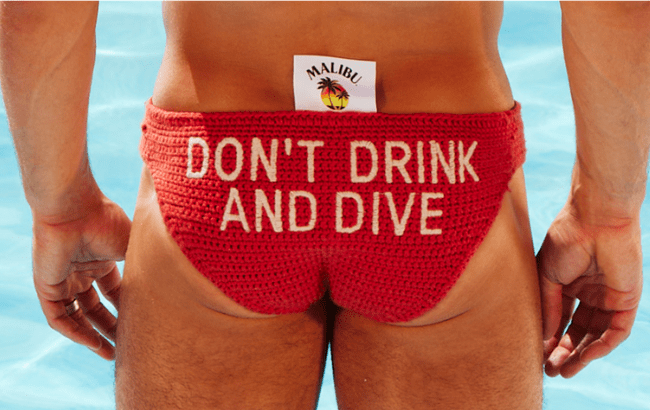

The brand continued to invest in the UK market in 2024, partnering with diver Tom Daley on its ‘Don’t Drink and Dive’ campaign and collaborating with Oatly to create a dairy-free Piña Colada-flavoured soft-serve ice cream.

However, last year, it was discovered that Kahlúa and Malibu are not considered vegetarian products due to how the sugar used in their recipes is processed. Could this have hindered the brand’s growth last year?

1. Baileys

Owner: Diageo

Volume: 2020: 7.1m | 2021: 8.8m | 2022: 8.8m | 2023: 8.2m | 2024: 8.4m

% change: 1.7%

Place last year: 1

When it comes to liqueurs, one brand has managed to stay at the top of the leader board for many years – Diageo-owned Baileys.

The brand managed to post a 1.7% increase last year after declining in 2023, but it failed to surpass its sales high of 8.8m cases in 2021 and 2022.

The cream liqueur continued its innovation efforts in 2024, releasing a cinnamon churros flavour, alongside bottles made of paper and aluminium.

In the second half of 2024, Diageo reported a 3% sales drop for Baileys, driven by a 13% decrease in the US. However, the brand posted an 11% increase in Latin America and the Caribbean and a 1% gain in Europe.

Related news

Sazerac House creates six liqueurs for cocktails