Rémy Cointreau Q1 sales slip 35%

By Nicola CarruthersFrench firm Rémy Cointreau saw sales fall by more than a third in the first quarter of 2023/2024 after Cognac plummeted in North America.

The French group’s organic sales declined by 35% to €257.5 million (US$284.9m) from April to June 2023.

The drop in sales was attributed to an ‘exceptionally high’ comparison base for the first quarter (Q1) of 2022/2023 when the group’s sales were up by 27%, as well as a ‘significant’ Cognac inventory reduction in the US and ‘continued’ normalisation of consumption in the market.

The Americas region saw a ‘massive’ drop in Q1, while Asia Pacific soared by double digits, and Europe, Middle East and Africa (EMEA) registered a ‘mid-teen’ growth.

The decline in the first quarter followed a 10.1% sales rise for Rémy Cointreau in the year ending 31 March 2023.

Q1 performance

The Cognac division recorded a 44.7% organic sales decrease to €155.1m (US$171.6m) for the first quarter, primarily due to a double-digit fall in North America. Cognac in Latin America, on the other hand, grew by double digits.

Cognac sales in China saw ‘very strong growth’, boosted by on-trade recovery and Rémy Martin Club. E-commerce sales also helped to drive sales of Cognac in the market, namely on online platforms T-Mall and JD.com during China’s second-largest shopping festival, 618, in June.

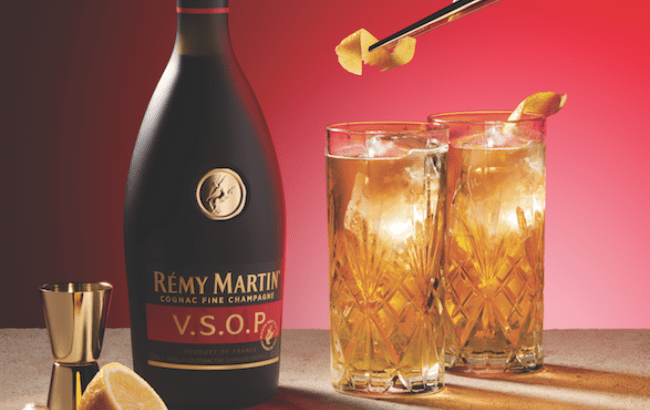

In the rest of Asia, Rémy Cointreau noted that Cognac was up by double digits, led by Louis XIII and VSOP in Malaysia, Thailand and the Philippines.

Sales of Cognac in the EMEA region were also positive, particularly in Africa, the Middle East and Western Europe.

The liqueurs and spirits subsidiary also recorded a double-digit organic sales decline for the first quarter, down by 11.4% to €95m (US$105.1m). The company attributed the decrease to the build-up of US inventories by distributors ahead of price increases on 1 April 2023, and a ‘very high’ comparison base in last year’s Q1 when the division grew by 127.2%.

For spirits and liqueurs in the Americas, sales slipped by double digits. The group highlighted ‘very good momentum’ for Cointreau liqueur after the brand partnered with actor Aubrey Plaza on a new campaign.

The group expects spirits and liqueur sales in the Americas to return to growth in the next quarter.

Sales were also ‘very good’ in the EMEA region, notably in Western Europe (Germany, France, Greece and the UK). Growth in the region was led by Cointreau, the whisky portfolio, and St-Rémy brandy.

The group said Asia Pacific sales of spirits and liqueurs had a ‘good start’ in North and Southeast Asia, and in travel retail.

Full-year outlook

For the 2023/2024 financial year, Rémy Cointreau expects the normalisation of consumption to continue strongly in the US, but trends will ‘remain significantly higher’ than in 2019/2020.

The group also predicts ‘strong growth’ for the rest of the world, driven by China, EMEA and the rest of Asia. The firm’s travel retail business is forecast to return to pre-pandemic levels.

The company anticipates a ‘strong decline’ in sales for the first six months of its current financial year, due to a ‘very strong fall’ in the US. But it said recovery will follow in the second half of 2023/2024 as the States rebounds from the third quarter.

Rémy Cointreau estimates currency rates to cause a sales drop of between €50m and €60m (US$55m-US$66m).

Related news

World Spirits Report 2025: Cognac & brandy