Can travel retail unlock rum’s potential?

By Kevin RozarioCertain sub-channels in travel retail are booming but, overall, rum is still very much in demand, by airport retailers in particular.

*This feature was originally published in the December 2025 issue of The Spirits Business magazine.

Rum has both fans and detractors in global travel retail (GTR). This important spirits segment – the sixth largest in the channel – brings varied taste profiles and vibrancy to stores.

However, many observers say that brands need to do more to raise rum’s profile against rivals like whisky, gin, and rapidly developing Tequila – and change ingrained consumer perceptions.

“To unlock growth, brands will need to shift consumers beyond the traditional rum and Coke mindset by encouraging exploration across a broader repertoire and sparking curiosity through education and experience,” says Charlotte Reid, senior insights manager GTR, at IWSR.

IWSR data indicates that rum moved in the right direction in 2024, outperforming gin, vodka and agave-based spirits in 2024. Rum’s volumes rose by 4% year on year, and by 9% in value terms. For comparison, across all GTR spirits, volumes grew by 5%, and 7% by value, showing that rum has done a better job at premiumising than rival segments. Spiced rum has also been a big driver, accounting for roughly 10% of rum GTR volume.

Bacardi, which claims to hold 24.9% of the rum category (by value), believes the premiumisation trend is finally taking hold. A GTR spokesperson says: “While rum has historically trailed categories such as whisky, Tequila, and gin in trading consumers up the value ladder, momentum is now accelerating, driven by interest in craftsmanship, aged expressions and elevated serves.”

The 2023 launch of Bacardí Caribbean Spiced – a blend of aged rum, fragrant spices, and flavours of coconut and pineapple – directly targeted premium rum enthusiasts and an expanding spiced rum audience. The spokesperson says: “Spiced rum surged by 18.4% in value, as travellers explored new flavour profiles and mixable formats.”

At Proximo Spirits, Kraken has seen success in the UK and Australia. Roy Summers, head of GTR, says: “Kraken resonates with Gen Z and younger Millennial travellers who want bold flavour and easy cocktail-making. Our job is to bring that excitement into duty free through energy and education.”

However, Summers warns: “Rum still needs clear storytelling to compete with more established categories like whisky or gin. Travellers often don’t see the variety in rum, but the spiced segment is showing the way.”

New tastes

Andrew Cowan, managing director of Diageo Global Travel, says: “Flavours and spiced rums are popular as consumers explore new tastes. Rum is also unique in the sense that it is heavily linked to local provenance and craft, especially for GTR consumers looking for a reminder of their destination.”

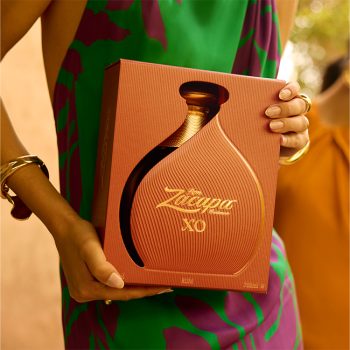

In November, Diageo unveiled a striking new design for Zacapa XO, its high-end Guatemalan rum to “redefine luxury rum”. Cowan says: “It has been crafted for those seeking exclusive and unforgettable experiences during their journeys.”

Also premiumising has been Pernod Ricard’s Havana Club, a major rum brand in GTR. “We restaged the Icónica Collection last year, which includes expressions like Selección de Maestros and Gran Reserva 15 Años, and it has landed really well with prestige consumers,” says Rae Gibson, director of power brands and emerging categories at Pernod Ricard GTR.

The division also launched Caribbean rum, Bumbu, into the channel. “Bumbu has enjoyed incredible success in Europe with its eye-catching design capturing travellers looking for innovation and exploration. Bumbu is injecting a disruptive energy into the category,” says Gibson. It is now available in Europe, the Pacific, and Americas GTR.

At Shelftrak, which uses AI to provide airport SKU-level analytics, managing director, Garry Stasiulevicuis, told SB: “Rum’s global share of total alcohol space is 4%, based on analysing 75 global travel retail stores in Q3. There are about 400 unique rum SKUs in travel retail today, and the top-five suppliers take up 70% of the space, dominated by Bacardi (28%) Diageo (21%) and Pernod Ricard (14%).”

Dark rum has the lion’s share, at 54%, followed by spiced (18%), flavoured (12%), and white (10%), while the aged segment (SKUs above 12 years old) has about 6%. “But there are big regional variations to consider,” notes Stasiulevicuis.

For instance, pricier dark rums heavily over index in the Americas at 70% (vs 54%) as do aged lines 15% (vs 6%), while the UK has a bias towards flavoured, spiced and white, reflecting holiday-driven consumption.

Regional impacts are especially noticeable in the Americas and Caribbean. At Duty Free Americas (DFA) – which has 250 stores globally, mostly concentrated in the Americas – vice-president Dov Falic says: “Rum is a key category in Latin American airports. During our recent DFA Festival, it was one of the main growth drivers and all the major suppliers participated.” Among them were Havana Club, Brown-Forman-owned Diplomático, Panamanian aged rum Ron Abuelo, and Diageo-backed Zacapa.

The cruise sector is also buoyant, especially Caribbean itineraries. Stuart Brown, head of liquor, tobacco and confectionery at global cruise retailer Harding+, says: “On ships sailing the Caribbean season, guest demand for rum naturally strengthens. When we layer in brand activations, limited editions, and exclusives, rum becomes a true hero of the onboard experience.”

Regionally, Harding+ has seen rum momentum led by Diageo’s Bundaberg in Australia, Bacardí Carta Blanca in Europe, and Mount Gay in the Caribbean.

Limited editions such as the Kraken Lighthouse have performed particularly well. “Our data consistently shows that emotional connection drives higher conversion,” Brown says. A good example is Tidal Rum, listed on P&O’s Arvia and Britannia ships. “Its performance benefits not only from the routes but from the unique story that it is distilled onboard. Guests love a behind-the-scenes narrative,” says Brown.

Highest engagement

At another large cruise retailer, Starboard Group, buyer Lindsey Mitchell, takes a similar line: “Caribbean itineraries are, by far, our best-performing routes for rum. Sailings that include stops in legendary rum-producing islands – such as Barbados, Jamaica, and the Dominican Republic – see the highest engagement.” The natural connection between cultural exploration and the duty free rum experience is a big win.

However, elsewhere, for example in the fast-expanding Indian GTR market, there is still work to do.

At Ospree Duty Free – which operates in multiple airports and seaports, including Mumbai, Amritsar, and Jaipur – a spokesperson says: “Rum is our smallest subcategory in liquor. While we see small pockets of interest, growth is still modest compared with other spirits. That said, we are open to nurturing high-potential rum labels.

“At the moment, rum is on the outer periphery of consumer preference and has slipped slightly out of fashion in GTR. The category would certainly benefit from renewed storytelling, innovation in premium and craft expressions, and stronger brand building that highlights craftsmanship. The category needs fresh energy.”

In Europe, economic factors are weighing on traveller sentiment. At Germany’s Gebr Heinemann, head of spirits buying Manuel Schilling says: “The premium segment within rum has seen a noticeable shift. For the first time in an extended period, year-on-year volume growth (19.2%) has significantly outpaced value growth (6.3%), suggesting a more price-sensitive consumer.”

He notes, however, that spiced variants “remained stable and noteworthy”. Despite the premium slowdown, which continued into 2025, the segment still represents approximately 25% of Heinemann’s rum sales. Additionally, ready-to-drink (RTD) products in GTR have had a positive impact: RTDs now account for a 2.5% share.

Schilling believes rum is still relevant in GTR but faces pressure from categories like Tequila and Cognac. “Rum lacks the heritage storytelling and craftsmanship narrative that whisky and gin have successfully leveraged,” he says. “Premium rum also needs clearer differentiation through age statements, cask finishes, and provenance messaging.”

Avolta, which has strong travel retail presences in the UK, Spain, and the Americas, voiced a similar message. Eduardo Heusi, global category director for liquor, says: “Travellers are increasingly seeking aged and craft expressions, with provenance and quality shaping their choices. Stronger storytelling, targeted activations, and a mix of established brands and emerging producers will be key to capturing momentum. We see 2026 as a positive year for rum, driven by premiumisation and an appetite for rum discovery.”

IWSR’s 2024-2029 forecasts for rum in GTR (by value) indicate a compound annual growth rate (CAGR) of 3%, and premium rum doing slightly better at 4%. The currently fashionable spiced segment will only deliver a 3% CAGR. It means brands will have to work harder to keep rum in the limelight.

“Price remains a barrier, with 74% of volume concentrated in the standard tier,” says IWSR’s Reid. “While rum is gaining traction in premium-plus segments, it remains under-represented compared to other categories that leverage strong quality cues and compelling storytelling.”

In the immediate 12 months to come, cruise retailers are optimistic, but not necessarily expecting huge growth. Starboard’s Mitchell says: “In 2026, we anticipate rum maintaining its position while gaining traction in premium segments. The key to unlocking momentum will be engagement – specifically tastings.”

For Heinemann, an upward trend is anticipated, “but not particularly pronounced”, says Schilling. He adds: “Rum’s performance will be driven primarily by products in the standard mid-price segment, and rum-based RTDs will contribute positively.”

IWSR also expects RTDs to do well. Reid says: “They are a growing segment in GTR, with rum-based formats appealing to younger travellers.” Structurally, the analyst sees the super-premium segment remaining strong, resulting in a clear price ladder.

Reid adds: “Another potential driver is improved training on rum heritage in line with whisky and Cognac categories to encourage trading up.”

Rum in GTR is at a crossroads. The category has been resilient and shown premiumisation momentum with spiced rum a way in for younger consumers and provenance-driven brands like Zacapa and Havana Club reinforcing luxury and heritage credentials. But challenges remain: rum still lacks the storytelling of whisky, or aspirational cues of Cognac. The category must therefore double down on education and experiential engagement – through activations or disruptive new launches – to remain relevant in GTR.

Related news

Will Smith partners with Dictador Rum