Public appeal: how can mezcal win over consumers?

Mezcal might be all the rage at many of the world’s best bars, but producers are still figuring out how to transfer that enthusiasm to the casual drinker. Leading producers divulge their strategies.

*This feature was originally published in the February issue of The Spirits Business magazine.

Over the past decade, mezcal has gained in notoriety, having emerged from Tequila’s shadow as a bartender favourite. The spirit can be seen on the menus of bars in some of the world’s most cosmopolitan cities, from London and New York to Hong Kong and Sydney. But while cocktails have opened the door for mezcal, there is still work to be done for it to shake the ‘niche’ tag in the minds of drinkers, so it can find favour on bar carts at home, too.

Although mezcal has been embraced by the bar community, brands are still working to capture the imagination in retailers and liquor stores, much in the way that its agave peer Tequila has in recent years.

Hector Gomez Martinez, global marketing manager of Pernod Ricard-owned Del Maguey, says it is challenging, especially with more than 100 mezcal brands on the global market. For Martinez, “premiumisation and differentiation are key”, considering the current spirits-buying climate, in which drinkers might be more inclined to explore new things but, understandably, need to know what they are getting into first.

“Right now there’s a lot of confusion because consumers can feel overwhelmed when they see a shelf. There are heaps of options of mezcal brands, and they are all quite similar,” he notes. It isn’t because consumers don’t like mezcal – it’s often simply because they still don’t really know what it is. Unlike Tequila, mezcal can be made from many types of agave, and it even has its own subcategories: industrial, artisanal, and ancestral. There is a lot of information to unpack, and the category’s complexity and depth can be intimidating. Martinez feels that there needs to be a “360-degree comprehensive education system” if the category is to take off beyond the bar. He says qualitative and quantitative research in the US and the UK, carried out by Pernod Ricard’s House of Tequila, has shown that in the US, 70% of spirits drinkers haven’t tried mezcal, but at the same time “they’re really curious about it”. In the UK, 50% of those surveyed replied in the same way.

“There are a lot of bartenders who are already engaged with mezcal because it’s so unique, it’s so rare compared with other liquids, and not so commercial,” he says.

“We have to build this 360-degree consistent ecosystem that lives in digital channels, and even experiences with retailers, with restaurants, with wines and liquor stores, local travel retail and, of course, also the bars themselves.”

Mezcal has certainly been able to piggyback on Tequila’s breakthrough in recent years, but while Tequila is “easier to understand”, if you want to get into mezcal “you would need to be curious about it”, Martinez believes.

He says the common stereotype often thrown mezcal’s way is that it’s just “a smoky kind of Tequila”, when in actuality, it’s the “great grandfather of Tequila. It’s a much bigger, more ancient animal. There are lots of ways to create excitement for mezcal, but there is no ‘right way’ because each brand and each liquid has its own value proposition, and that’s what makes them special. “In a nutshell: it’s closer to a single malt whisky than Tequila if you want to get into what it really is. You have to understand the people, the process, the plant, the place it comes from.”

To build an engaging story for consumers, he says that for Del Maguey, an artisanal mezcal, “we lean a lot on the authentic part of it, the historical part of it, and that lets people understand how this is so special – it’s like when you’re talking about a good wine and where that comes from, what the altitude is. Leaning into this is how we generate hype.”

Endless learning

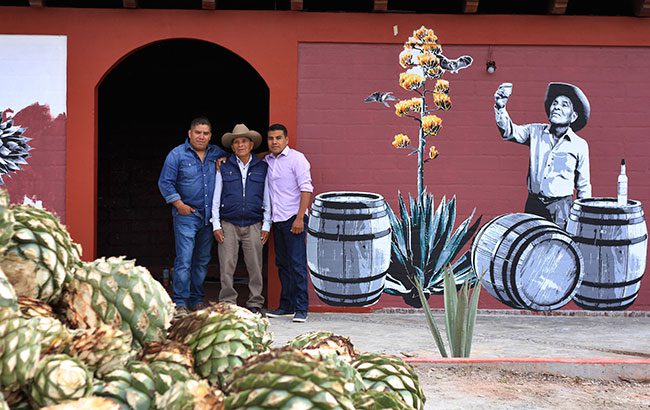

Alejandro ‘Champ’ Champion, global brand ambassador and co-founder of Mezcal Unión, which was bought by Diageo in 2017, agrees that education will also be what “continues to open up new palates and [create] aficionados”. As its name suggests, the brand produces mezcal through a ‘union’ of farmers in nine regions of Oaxaca. Champion, who travels the world sharing the brand’s story, as well as that of the wider mezcal category, says there is an “endless learning” needed with mezcal, and the only way to learn is to be active. Active, he explains, “not only in a commercial aspect, but in the sense of being connected to Oaxaca and having that interest for other states that produce mezcal, connecting with the farmers, the producers, understanding their heritage and how agave is cultivated”.

For Champion, “tradition needs to be preserved” and as long as it is, the category will grow. He believes it is not necessarily about how many cases are sold, or talks of expansion, but rather understanding “how versatile [mezcal] is, and how much cultural wealth there is behind it”, as well as “the fact that rural communities are ones producing the juice”. Mezcal Unión’s offering consists of two variants: Uno, the flag-bearer for the company, more affordable and made for the on-trade and cocktails, and El Viejo, which is geared towards more developed palates that already have an understanding of the category, and are more open to trying wilder agave species.

The reasoning behind the expressions, Champion explains, is to “democratise the opportunity for tonnes of people to have access to mezcal, while generating diversified opportunities among rural communities in Oaxaca”. He adds: “The reason why mezcal has such a universal appeal is that it has that aspect of exploring, discovering, learning.”

Agave expert and Casa Lumbre founder Iván Saldaña, who oversees two mezcal brands, Montelobos and Ojo De Tigre, (among other Mexican spirits), is well aware of the category’s jump into the mainstream over the last 15 years, but suggests past messaging has perhaps not done the category any favours.“Mezcal has gone from almost nothing – it was super small – into a more relevant category, or a subcategory of agave spirits. In general, mezcal is 4% or 3% globally of what Tequila is,” he notes.

Alcohol percentages

Saldaña says at the start of the category’s initial boom, with the exception of a few brands, the entrepreneurs who typically sold mezcal had very little knowledge about it, and so they tried to make expressions with ABVs that were more ‘standard’, down from 46% ABV to 40%, or even lower.

The alcohol volume was reduced using tails, a “greedy way to proof mezcal because it is the last bit of the distillation”, he says, and that then creates “an enormous amount of smoke via acidity, plus a funky lactic element”. This has often hampered mezcal with a ‘weird’ taste profile. Saldaña, himself well-acclimatised to drinking the many types of mezcal, loves these flavours – but he also thinks they can be “harsh for the new consumer to connect with. In most cases, [traditional] mezcal is the worst mezcal in the sense that they do not present the most beautiful, accessible elements of agave. Mezcal is so much more than that. It is not only smoke.”

Montelobos is not designed for the bar, nor is it traditional, but rather a “modern mezcal”, Saldaña says of the liquid. “My generation goes away, they study elsewhere, and they come back, fall in love with Mexico, and they want to express their craft by bringing the tradition with their own perspective – and that is valid. That is what Montelobos is. Some purists believe that things have to stay the same. I don’t think that. Montelobos shows these different expressions of mezcal that reflect what I believe is worth bringing to the world.”

This ties into messaging in mezcal, where Saldaña thinks brands have “made a mistake in creating brands for the trade instead of brands for the people” and, in turn, what he calls an “obscure-blog-type of exclusivity”. He continues that with mezcal in the Anglo world, sometimes the strategy is “oh, now we are cool”, and there are other ways to sell the spirit. “As mezcal becomes more refined, we have better chances of people understanding that there’s a lot of quality, and there is not only smoke,” he says.

“On one side, mezcal also provides herbal, fresh green notes, and another dimension to the caramelly cooked agave – with all of these also present in Tequila.

“I believe the most balanced approaches will be the ones that will win in the end. Mezcal is an exotic thing, it needs to be a little bit of an adventure, and sometimes a little bit of an acquired taste.”

Luxury-minded Perro Verde has an aim of becoming the “go-to” mezcal for gifting and special occasions, according to co-founders Juan Santiago Rodriguez and Mariana Carvajal. With that lofty ambition, the pair heed the importance of having something that is also smooth and easily drinkable.

“There are a couple of key things in terms of bringing mezcal from cocktail menus into sipping or people’s homes,” Carvajal notes. “We profiled mezcal in a way where we did lots of research on which agave plants are more balanced, and also also the alcohol volume – because locally there’s a tendency to have mezcals at around 45% ABV. We found that having Perro Verde at 42% ABV gave a better experience of the flavours, and not being too overpowering.” She feels this is both “very important for the brand and for the category in general, to find mezcals that have a wider appeal to the global palate”.

Why mezcal is like wine

Rodriguez adds that he has a personal goal of getting consumers to see mezcal in the same light as wine. He explains: “Mezcal behaves more like a wine than a spirit, where you take into account the terroir, the flavour of the land, and that the same plant can have different flavours, even if it’s cultivated across the street from another.”

While we’re not yet near the stage of people perusing shelves for Espadín, Tepeztate, and Tobalá, as they might when buying wine varieties such as Chardonnay or Sauvignon Blanc, Rodriguez says that as consumers learn more about the category, “this will eventually be where mezcal is headed”. As to why Espadín and Tobasiche were chosen as Perro Verde’s agave varieties, Rodriguez describes the train of thought as “really being about finding the right smoothness of a product. We believe that premiumness is not only about aromatic profiles, but also about the ease of drinking.

In particular mezcal has gone down a route where you need to have extreme flavour and extreme power, rather than understanding about having certain percentages of alcohol with certain varieties.”

Ilegal Mezcal’s business, meanwhile, leans 60% towards the off-premise and 40% towards the on-trade, which founder John Rexer believes comes from the efforts the Bacardi-owned brand made with education during the pandemic. When bars and restaurants were not able to operate, Rexer says “we suddenly found ourselves without a customer base, and we had to flip our business, but that also created a really exciting opportunity”.

Rexer has even been taking people – whether they be bar managers, bartenders or the consumers themselves – to Oaxaca, directly into the culture of mezcal. He says people return home and pass on the experience to friends and family, and mezcal’s tale grows from there. He notes that one of the things he finds exciting with mezcal is that “originally you had a lot of the specialists (the mixologists and so forth) who were very knowledgeable about mezcal, which was great as they did a great deal of work in educating people about it. But let’s also always remember that you drink for occasions. You drink for fun. You don’t drink to go to ‘school’. To see mezcal now enjoyed in cocktails as pedestrian as the Margarita or the Paloma is wonderful because it’s introducing people to it, and it’s great.”

Champion adds that beyond how the spirit is produced, the other educational part needed is teaching people how to drink mezcal. There are many ways to do this.

Of course, cocktails come into play here. But mezcal’s usefulness is not just in agave serves. Using it in a twist on classics such as a Negroni and an Old Fashioned can also help to elevate the category.

Culture shift

Champion says: “The shift in the culture of where people drink, particularly now replicating recipes from home, allows us to expand from the on-trade and off-premise.” Saldaña says in the UK and the US, cocktails are still the path to grow mezcal, but in other cultures where sipping neat is more prevalent, cocktails are “not necessary as the first introduction”.

Rexer adds: “Now is a great moment to light more of a fire under the category. My philosophy has always been when everybody zigs, it’s our time to zag, and go in and spend more time doing education. There should be a great deal of reverence for mezcal – it has such a long-standing history, and the actual process of creating it is an art.”

Industry insights

How can mezcal increase its popularity beyond bars and bartenders?

Diego Sotomayor – commercial director, Oxa Mezcal

“To enhance the popularity of mezcal beyond the bar scene, it’s crucial to educate a broader audience about its rich traditions, diverse flavours, and artisanal production methods. Incorporating mezcal into mainstream media, creating engaging social media content, and partnering with influencers can play a significant role in attracting and educating new consumers. These strategies will help demystify mezcal, and showcase its versatility, appealing not just to connoisseurs but to casual drinkers as well.”

Bernardo Sada – founder, Noble Coyote

“The mezcal industry can thrive through sustainable educational tourism, where distilleries offer immersive experiences that highlight environmentally friendly practices and cultural heritage. Collaboration with local artists and celebrities can enhance these experiences, creating unique events and products that attract visitors while promoting the artistry and authenticity of mezcal.”

Sheyan Patel – chief commercial officer, The Lost Explorer

“Mezcal can grow its popularity and recruit consumers in three ways. First, educating consumers about its heritage, artisanal production and unique taste profiles. Second, by storytelling – highlighting its cultural roots, versatility and the mezcaleros behind each bottle. Last, simplify the category – from brand names to easy and accessible cocktail recipe, as well as curating approachable and fun food pairings to inspire exploration beyond the bar.”

Related news