Canada’s ban on US alcohol boosts Corby H1 sales

By Nicola CarruthersPernod Ricard’s Canadian affiliate, Corby Spirit and Wine, saw organic revenue rise by 13% during the first half (H1) of its fiscal 2026 year.

Based in Ontario, Corby is the second-largest marketer and distributor of spirits and wines in Canada. It is majority-owned by Pernod Ricard, which distributes its products in the region.

For the six months ended 31 December 2025, Corby reported organic revenue of CA$142.3 million (US$104.9m) – its highest sales ever recorded for the group’s first half.

In the second quarter (Q2), which covered October-December, sales grew by 10% to CA$66.9m (US$49.3m). It followed growth of 16% in its first quarter and a prior full-year sales rise of 2%.

Corby attributed its double-digit growth in H1 of fiscal 2026 to the expansion of its ready-to-drink (RTD) business and ‘enhanced’ shelf presence due to Canadian retailers’ focus on local products.

Since March last year, most Canadian provinces have banned American products from shelves due to trade tensions with the US.

Corby’s president and CEO, Florence Tresarrieu, noted the business “delivered another strong quarter”.

She continued: “Our record H1 revenue and continued earnings growth attest to the strength and balance of our diversified portfolio, the ongoing success of our RTD expansion, and the disciplined commercial execution of our teams across the country.

“In a volatile and declining market environment, our team has responded with tenacity and resilience to capture significant incremental market share in both spirits and RTDs, highlighting the relevance of our strategy, the power of our partnerships, and Corby’s ability to deliver strong performance irrespective of the market backdrop.”

The firm’s RTD portfolio includes Nude, which it acquired in April 2024, and Cottage Springs, which joined the lineup in 2023 following Corby’s purchase of a 90% stake in its parent company.

Corby reported domestic case goods revenue of CA$113.7m (US$83.8m) in H1 – an increase of 14% year on year. This gain was attributed to RTDs, and ‘significant spirits market share gains’, partly due to the removal of American products in retailers, and the timing of the Liquor Control Board of Ontario’s (LCBO) strike last year.

For Q2, domestic revenue rose by 12% to CA$53.4m (US$39.3m).

Export revenue soared by 38% to CA$9.7m (US$7.1m) in H1, led by the ‘strong recovery’ of US shipments and new launches in the UK. Q2 export revenue grew by 25% to CA$4.8m (US$3.5m).

Corby outperforms Canadian spirits market

In terms of market trends, Corby highlighted its ‘exceptional results in a weaker market’ affected by the alcohol landscape in Ontario, and amplified by the British Columbia General Employees’ Union (BCGEU) labour strike.

The company said the overall spirits category in Canada decreased in value in Q2, while Corby’s spirits retail sales reported value growth of 2%.

In addition, it said Corby’s represented spirits portfolio (which includes Pernod Ricard’s range) has “outperformed the Canadian spirits market in value for 13 consecutive quarters”.

The group’s RTD portfolio saw a value increase of 28% in Q2, which outpaced the wider RTD category (up 11% in value).

For the year to 31 December 2025, Corby’s spirits portfolio grew by 2% in value, against an overall spirits market that declined by 4%.

It also highlighted that the group’s RTD portfolio soared by 28% in 2025 compared with the previous year, outpacing the wider category at 12% growth.

Looking ahead, Tresarrieu said the business would focus on investments in its core brands, accelerating its RTD portfolio and “unlocking new opportunities as the Canadian retail and regulatory landscape evolve, while remaining disciplined on costs”.

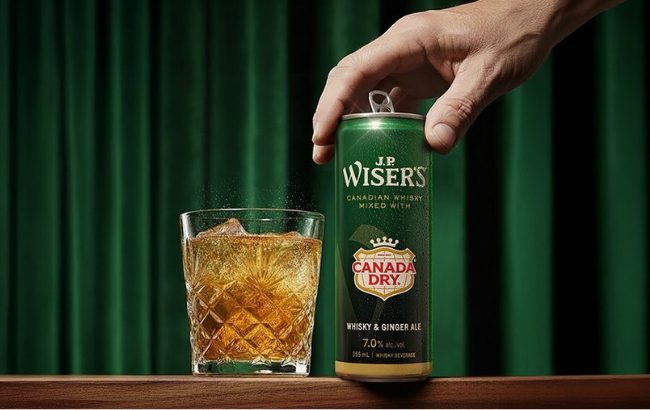

Corby also owns Ontarian-made whisky brand JP Wiser’s, which was the third biggest-selling spirit for the LCBO from June to October last year, after Diageo’s Smirnoff and Crown Royal brands. Pernod Ricard’s Absolut Vodka brand was the fifth top-selling spirit on LCBO while stablemate Jameson Irish whiskey was the eighth best-selling product.

Earlier this month, JP Wiser’s teamed up with Canada Dry to launch a canned whisky and ginger ale.

Related news

Ex-Gucci exec is new Rémy Cointreau US & Canada CEO