Uncle Nearest founders fight receivership as sales plunge

By Nicola CarruthersThe founders of Uncle Nearest are pushing for an expedited court hearing, warning that a court-appointed receivership is damaging the Tennessee whiskey brand’s sales and long-term value.

The emergency motion argues that a court-appointed receivership is causing “irreversible harm” to the brand’s sales performance and enterprise value, as speculation continues over a potential sale of the Tennessee whiskey producer.

Fawn Weaver, her husband Keith Weaver, and holding company Grant Sidney Inc filed the motion on 20 January in the US District Court for the Eastern District of Tennessee, asking the court to fast-track a hearing on their request to reconsider the appointment of a receiver at Uncle Nearest.

The filing comes amid ongoing uncertainty surrounding the future ownership of the brand. There are reports that the company could be put up for sale after lender Farm Credit Mid-America moved to place the business into receivership. In November, the Weavers filed a motion challenging the receivership, warning that the process risked damaging the value of the business and its relationships with distributors and retailers.

Earlier this month, an investor group was exploring a potential acquisition of Uncle Nearest.

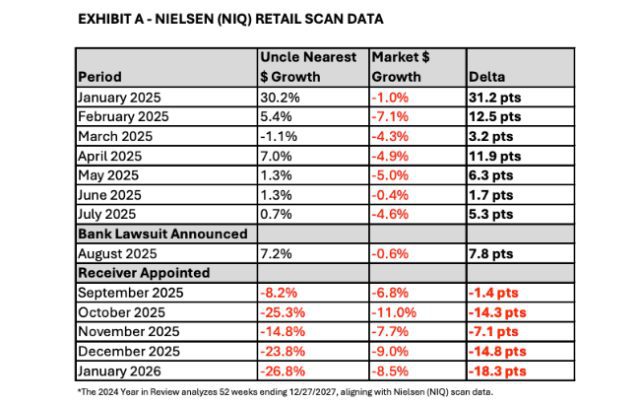

In their latest filing, the Weavers argue that Uncle Nearest’s performance has deteriorated sharply since the receiver was appointed in September 2025. They cited Nielsen retail scan data that shows the brand moving from consistent outperformance of the wider American whiskey category to significant underperformance.

According to Nielsen figures included in the court documents, Uncle Nearest outperformed the overall US whiskey market throughout the first eight months of 2025. However, following the appointment of the receiver, sales growth reportedly turned negative, with the brand underperforming the category by more than 18 percentage points in January 2026.

The Weavers attribute the decline to operational disruption, inventory shortages during key selling periods, and what they describe as a lack of category-specific expertise in managing a premium American whiskey brand under receivership.

“The continued delay risks irreversible harm to the company’s brand and enterprise value,” the filing states, adding that uncertainty around governance and ownership has weighed on distributor confidence and consumer sentiment.

The motion asks the court to schedule a two-day evidentiary hearing “within the next two weeks” to reassess whether the receivership remains necessary. Alternatively, the Weavers are seeking interim relief that would limit the receiver’s role to asset monitoring while restoring day-to-day operational control to the company’s board and leadership team.

They argue that Uncle Nearest remains solvent and viable as a going concern, and that a forced sale or liquidation-style process could undervalue the business at a time when the broader American whiskey category is already under pressure.

The filing also denies allegations surrounding missing inventory and loan defaults. It claims that disputed whiskey barrels were never missing and that any payment defaults were cured. The Weavers further state that loan proceeds were invested in hard assets such as barrels and distillery infrastructure that exceed the value of the outstanding debt.

Founded in 2017, Uncle Nearest claims to be one of the fastest-growing independent American whiskey brands of the past decade, positioning itself as the second-largest Tennessee whiskey brand in the US behind Brown-Forman-owned Jack Daniel’s. The company’s Nearest Green Distillery is also said to attract more than 200,000 visitors annually.

The Weavers contend that the leadership team responsible for building the brand is best placed to stabilise performance and restore growth, warning that continued exclusion from operational decision-making could further erode value.

Farm Credit Mid-America and the court-appointed receiver have filed responses under seal. A magistrate judge is expected to consider the request for expedited proceedings later this month.

Related news

Investor group eyes Uncle Nearest purchase