Don Julio leads spirits in creator marketing rankings

By Georgie CollinsAs creator marketing matures, the spirits industry is proving that success doesn’t require the biggest budgets or the loudest presence.

Creator marketing is a form of marketing that sees brands partner with content creators – those who build audiences on platforms such as TikTok, Instagram, YouTube, and Twitch – to promote products or shape brand perception through their own content.

Now, new data from creator marketing platform Traackr’s The Creator Advantage 2026 report shows that spirits brands are winning attention in a fundamentally different way than their counterparts in beauty, fashion, and personal care, by prioritising cultural relevance, repeatability, and platform-native content over scale.

Compared with the other consumer categories explored in the report, spirits brands have been found to generate relatively lower overall Brand Vitality Scores (VIT) – a metric that helps brands understand what is actually driving their creator marketing performance by breaking impact into four core levers: creator volume, frequency, content performance, and average audience size.

By looking at how these levers work together, brands can begin to understand where they are over-investing, where they are under-leveraging opportunity, and where to focus next.

The average VIT score across the top 25 brands by industry is led by beauty (687,000), closely followed by fashion (672,000).

Food and beverage take the third position with 258,000, and personal care takes fourth with 62,800.

Spirits have a significantly lower average VIT score of 26,000, however, this smaller footprint appears to reflect the realities of a highly regulated category where fewer creators participate, and where audiences are more selective.

In the list of 2025’s top spirits brands in the US, according to their VIT ranking, Diageo-owned Don Julio Tequila has come out on top, with a VIT score of 62,800. This is followed by Pernod Ricard-backed Bumbu rum (57,100) and LVMH’s Hennessy Cognac (52,000).

Cutwater Spirits, Aperol, Teremana Tequila, and Patrón Tequila follow next, with Jack Daniel’s whiskey, Grey Goose vodka and Johnnie Walker whisky rounding off the top 10 spirits brands.

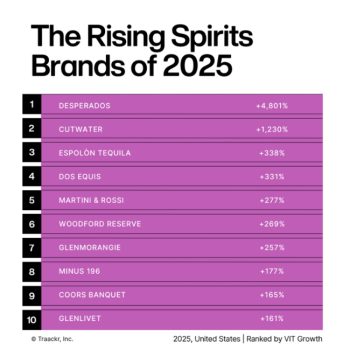

In terms of the rising spirits brands of 2025, AB InBev’s Cutwater came out on top, with a VIT growth of 1,230%.

Traackr’s report has further analysed the growth of Cutwater, and notes that the brand’s breakout “wasn’t driven by a single campaign”. Rather, its success was built as creators continued to feature the brand in engaging ways on TikTok.

“After a quiet first half of the year, creator activity spiked in July and remained elevated, as Cutwater became embedded in DrinkTok, comedy, and reaction-led content.

“That momentum was fuelled by sharp gains in content performance,” it added. “In 2025, Cutwater’s VIT rate rose to 6.8% (from 2.21%) and engagement rate to 4.71% (from 1.41%), signalling that creators weren’t just posting more – their content was landing harder.

“Debates around the brand name, jokes about its high ABV, and repeatable ‘it sneaks up on you’ formats drove stitches, duets, and sustained creator participation.”

The data highlights how the fastest-growing spirits brands in 2025 did not rely on singular campaigns but instead became culturally ‘reactable’ brands that creators could easily incorporate into everyday content.

This pattern underscores a broader trend in spirits – that growth comes from being talked about often, not just talked about loudly.

Pierre-Loïc Assayag, founder and CEO of Traackr, explained to The Spirits Business: “The spirits category is more competitive than ever, and data shows something interesting, in that the biggest wins came from brands understanding the unique social levers that matter most for them (and only them).

“[Tequila-laced beer brand] Desperados grew by 4,800% by doing fewer things better, like doubling down on existing partnerships, increasing frequency of posting, and choosing new creators with even larger (and engaged) audiences.

“Cutwater took a completely different path, becoming embedded in the summer DrinkTok trend, and leaning into naturally engaging comedy and reaction-based content, with things like debates around the brand name, jokes about its high ABV, and repeatable formats. Both dominated their category in 2025, but they got there differently. That’s the real competitive advantage: having the data set to deeply understand the signals that matter for your brand, and the tools to take action quickly.”

With engagement rates – defined as the number of engagements divided by total video views – hovering around 1.9%, spirits brands face a higher performance threshold, and content must earn attention rather than assume it. As a result, brands that succeed tend to do so by fitting naturally into creator narratives rather than relying on overt promotion.

The data further shows that audience size alone is not a reliable driver of impact in spirits. Instead, performance is shaped by how naturally a brand integrates into creator content.

Humour, commentary, taste tests, rankings, and reaction-led formats have been found to consistently outperform more polished or scripted posts.

This dynamic has typically rewarded creators who already participate in online drinking culture and brands that allow creators to maintain their own voice. Authenticity and cultural alignment, rather than reach, are what determine whether content resonates.

TikTok drives success

Video sharing platform TikTok has emerged as the primary growth engine for spirits creator marketing, accounting for the majority of VIT among both top-performing and fastest-rising brands.

The platform’s remix-friendly ecosystem – built around stitches, duets, and ongoing trends – allows spirits brands to show up repeatedly without relying on formal partnerships. These features have allowed brands to circumvent the alcohol advertising rules, regulations and restrictions in place on the platform, and still find viral success.

The report indicates that there is no universal creator marketing strategy, and what works in beauty or fashion does not automatically translate to spirits. Winning brands have demonstrated an understanding of the nuances of their category and have adapted accordingly – focusing on cultural fit, creator-led storytelling, and formats that invite participation.

Furthermore, the report suggests that the spirits industry demonstrated that restraint, relevance, and repeatability can be more powerful than scale, and for brands that show willing to let creators lead, the payoff is not just visibility, but lasting momentum.

For brand benchmarking, Traackr analysed more than 760,000 influencers in the Us who produced more than 10 million pieces of content mentioning at least one of the brands from its Brand Leaderboard, consisting of 2,725 beauty brands, 357 personal care brands, 703 fashion brands, 160 food & beverage brands, and 226 spirits brands.

Related news

Cask Liquid Marketing plans fifth spirits showcase