World Spirits Report 2025: Vodka

By Nicola CarruthersDespite challenging conditions around the planet, the spirits industry is resilient, as our 2025 World Spirits Report shows.

Similar to 2024, the global spirits sector continues to face a period of pronounced strain, shaped by a convergence of cyclical macroeconomic pressures and deeper structural shifts in consumer behaviour.

According to Spiros Malandrakis, Euromonitor International’s global insights manager for alcoholic drinks, the sector is effectively in a “state of suspended animation”, facing simultaneous headwinds from the global cost‐of‐living crisis, persistent inflation, weakening employment markets, geopolitical tensions, and ongoing tariff volatility. Consumers are becoming increasingly cautious, cutting back on discretionary purchases, and shifting their drinking habits in ways that place additional pressure on traditional spirits categories. IWSR data showed a 2% volume decline for spirits globally last year, but excluding national spirits, such as Chinese baijiu, the sector was down by 1%.

One of the biggest spirits markets in the world, the US, has become a significant drag on global performance. In the US market, softer consumer spending, tariff impacts, immigration‐ related demographic disruption (affecting Tequila and Mexican beer), and high inventory levels continue to weigh on results. Euromonitor expects Canadian whisky and Cognac to decline this year and next year, while alcohol‐ free ‘spirits’ are forecast to grow.

China, another core growth engine of the past decade, is also under pressure. Premium spirits are struggling in a weaker economy, reduced consumer confidence, and the government’s ban on alcohol at official events – directly affecting categories like Cognac, which relies heavily on China and the US for global volumes, according to Emily Neill, chief operating officer at IWSR. EU brandies were also hit by an anti‐ dumping investigation in China, which led to the removal of Cognacs from duty free shelves. This has been concluded, and should help the sector’s recovery.

Against this backdrop, India stands out as the major bright spot. Both Euromonitor and IWSR point to India’s favourable demographics, rising incomes, and premiumisation as key drivers of robust growth – benefitting whisky in particular. India is expected to be the single largest contributor to global spirits expansion over the coming years.

Neill describes India as the “market with the most momentum at the moment”, thanks to rising incomes and consumers premiumising. Agave spirits and RTDs (ready‐to‐drink) remain the only categories seeing growth according to IWSR, although both have slowed in recent years. Irish whiskey, Japanese whisky, and more affordable standard‐priced segments of gin, rum, and vodka are benefitting where consumers trade down from higher‐priced prestige spirits. Non‐ alcoholic ‘spirits’ continue to expand at double‐digit rates, albeit from a tiny base, but face challenges over regulations and pricing.

Malandrakis comments: “People are just consuming less because there is this fear on the horizon of things getting worse.”

Times of crisis

Malandrakis also stresses that in times of crisis, drinkers tend to return to familiar and established brands and segments, such as spirits made locally.

A downward trend is still expected for spirits this year but the decrease is lessening. For 2025, IWSR expects a 1% increase for spirits globally, without national spirits (like baijiu). For 2026, spirits sales globally are expected to be flat, in both volume and value.

Structural behavioural shifts – mindful drinking, ‘sober‐curious’ lifestyles, and possible future GLP‐1 medication effects and a shift towards cannabis in the US – add longer‐term uncertainty. Yet in this challenging context, opportunities remain, particularly in emerging markets and segments such as no‐alcohol and agave spirits.

Vodka

While vodka has experienced periods of ‘flavour fatigue’ and a general market downturn, particularly in the US, the sector looks set to stabilise and return to growth in the years ahead. In terms of volume, Euromonitor International data predicts a small 0.4% rise for 2025, and a 0.6% increase for 2026. By value, the sector could grow by 2.3% in 2025, and by 3.9% the following year.

There are also some positives for the category, especially at the higher‐end tier, according to Marine Rozenfeld, brand director for Grey Goose in Europe.

Citing NIQ on‐trade data for Great Britain in 2024 compared to 2023, she said: “Premium‐plus vodkas are delivering strong, sustained growth, up by 5% in value and by 6.7% in volume, clear evidence that consumers remain willing to trade up when they see quality, provenance and authenticity.”

She notes that Grey Goose has maintained its position as the number‐one super‐ premium vodka, with sales up by 6.2% in 2024, compared with 2023.

“Vodka has remained a reliable and familiar choice for many drinkers,” adds George Hood, head of marketing at Sapling Spirits. “People are buying with more intention, which is helping the premium end of the category.” Hood notes drinkers are looking into how products are made and the values behind a brand, including sustainability.

Cocktails also continue to play a key role for vodka. The Pornstar Martini, which combines vodka and passion fruit liqueur, was the most‐searched cocktail on Google last year. “Vodka remains central to cocktail culture,” says Hood. “Cocktails continue to be one of the strongest drivers of spirits consumption, both in the on‐trade and at home. Vodka’s versatility allows it to shine in simple, refined and enjoyable serves.”

Grey Goose is betting on savoury cocktails as a trend for 2026. “We’re seeing a real shift across London as bartenders move firmly into the world of brines, ferments, oils and fats, and the savoury Martini has quickly become the serve of the moment,” Rozenfeld adds.

This December, Grey Goose embarked on a chip shop activation in London, pairing Martini cocktails with British chip‐shop flavours including pickled onion twists and truffle‐forward dirty serves. “What makes the pop‐up exciting is that it isn’t a one‐off gimmick; it reflects a wider industry pivot toward culinary‐driven flavour profiles and Londoners’ growing appetite for experimentation,” Rozenfeld notes. “It’s a moment that shows just how firmly savoury cocktails have stepped into the mainstream, and how they’re shaping the way premium bars think about flavour.”

Brands to watch in 2026

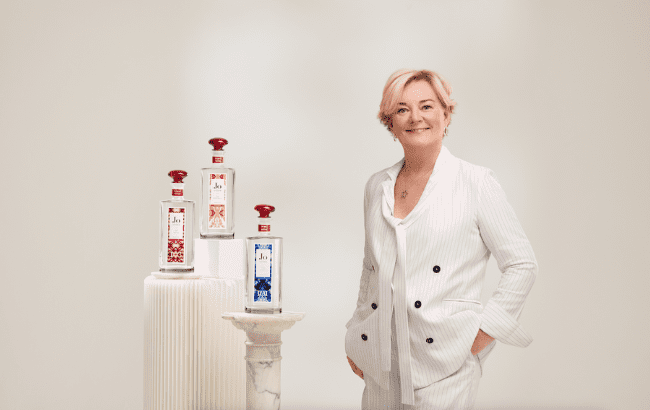

Jo Vodka

Famed perfumer Jo Malone CBE entered the spirits world this summer with a trio of vodkas, created by Joanne Moore, master distiller for the premium gin portfolio at Quintessential Brands. The range debuted in global travel retail, securing a listing in 100 airports through Avolta, with plans to launch in UK retail and the on‐trade this year.

Sapling Spirits

The UK‐based producer of “climate‐positive” spirits recently hired ex‐Belvedere executive Cathy Steen to help it become the “leading independent super‐premium vodka” in the US. The brand is also aiming to raise £8 million (US$10.7m) by the end of this year to enter the States.

Le Philtre Vodka

French organic brand Le Philtre could be set to shine on the world stage after selling a majority stake to Chairman’s Reserve owner Spiribam this year. Spiribam, known for its extensive rum portfolio and distribution arms in France, the UK, and the US, is planning to expand Le Philtre globally.

Related news

World Spirits Report 2025: Low & no