How the spirits market in China is recalibrating

After Covid-19 lockdowns and new economic conditions, the relevance of spirits in China has changed. Here’s what that means for brands.

*This feature was first published in the May 2025 issue of The Spirits Business magazine.

It’s been a challenging few years for spirits in China, affected by broad economic conditions and the lasting effects of the Covid-19 pandemic, all the way to changing consumer preferences and demographics. But while overall volumes might be down, this remains a vibrant market for spirits, both for imports and domestic brands alike.

Baijiu continues to dominate, with imported spirits said to account only for somewhere between 3% and 5% of the overall spirits market, but both are feeling the pinch.

“China’s economic slowdown has coincided with a slowdown in demand growth for domestic and premium spirits alike,” says Jens Eskelund, president of the European Union Chamber of Commerce in China.

An IWSR 2024 Preliminary Read, ahead of full data out this month, confirms this, with year-on-year volume for spirits in China between 2023 and 2024 down by 7%. This includes a decline for brandy of 17%, with whisky and national spirits down by 6% and 7% respectively.

Mixed momentum

The spirits market is “cautious but recalibrating”, according to Bobby Carey, creative director of Proof Creative, a bar-and-beverage consultancy with a number of projects in China. “The bounceback was never going to be linear, and we’ve seen mixed momentum outside the top-tier cities,” he says. “That said, in places like Shanghai and Shenzhen, there’s a return to form – people are going out, spending intentionally, and engaging more deeply with brands that offer genuine substance. This isn’t just a slow recovery – it’s a reshuffling of what relevance means for spirits in China.”

Chris Lee, deputy general manager, Kavalan, King Car Group, who oversees the Chinese market, notes “the rising demand for premium spirits is driving growth. As a pioneer in new world single malt whisky, Kavalan is well-positioned to meet this trend with innovation and quality.”

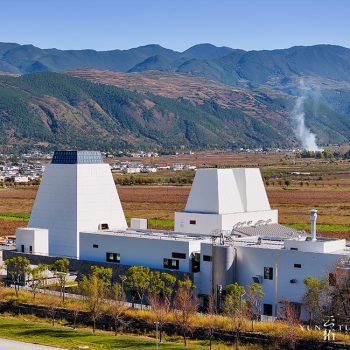

Meanwhile, multinational spirits companies have been setting up whisky distilleries of their own in the country. In 2021 production began at Pernod Ricard’s The Chuan Malt Whisky Distillery in Emeishan, while last year doors opened at Diageo’s YunTuo Single Malt Whisky Distillery in Eryuan County, Yunnan Province. Also in 2024, whisky production began at Guqi Distillery, a joint venture between Cognac producer Camus and Chinese baijiu maker Gujinggong, in Anhui province.

“The line between domestic and imported spirits is blurring, with Chinese whisky being a prime example of a traditionally imported spirit becoming a national spirit,” says Ryan Camus, general manager of Guqi Distillery, and business development director for Camus. “This creates a perfect space for Guqi, as we represent the best of both worlds.”

More generally, Camus is also seeing the negative impact of current economic conditions. “Cognac is particularly challenged due to high price points,” he says. “However, whisky enthusiasm continues to grow, especially among 20- to 30-year-olds in major cities.”

Kevin Song, co-founder of Beijing’s Hide & Seek bar, describes the whisky market in China as “a volatile landscape”, adding: “Premium products are showing a declining trend, while affordable offerings are on the rise”. Tommy Wong, is managing director of spirits distribution business EEDC in China and Six Days Distribution in Hong Kong, as well as co-founder of bars Hope & Sesame in Shenzhen and CMYK in Changsha. He says: “Domestically, the real estate market has completely crashed, and that’s affecting the way that people consume. Back in the day you might be very comfortable with drinking a 15- or 18-year-old single malt, but now you’re okay with a 12-year-old blend.”

Consumer surveys from an IWSR Bevtrac 2024 Wave 2 China report, released in November 2024, confirm this, stating: “Recalled spend on whiskies is in decline as consumers cut back on luxury spending; higher-end whiskies have a lower price ceiling while Irish whiskey and blended Scotch have seen a drop in typical spend.”

China remains an important emerging market for Ireland, however, according to Irish food and drink promotional agency Bord Bia, which reports an increase of 36% in Irish spirits exports to China from 2023 to 2024. The agency launched its Spirit of Ireland initiative in Shanghai last year.

European brandy, meanwhile, has been significantly affected by China’s anti-dumping investigation into imports of the category, thought to be in response to EU tariffs on Chinese electric cars, introduced in October 2024. “Because the conclusion of the investigation has since been delayed until July 2025, much uncertainty remains for Chamber members operating in the sector,” says Eskelunds.

On the subject of tariffs, there are those between the US and China to consider. “As they have just been introduced, it is too early to tell specifically what impact tariffs adopted as part of the US-China trade war will have on the industry,” adds Eskelund.

Carey says: “The latest tariffs tied to the US-China trade tension haven’t triggered full rewrites, but they’ve shifted the energy behind procurement. That said, this isn’t China’s first rodeo.

“The industry has weathered this kind of tension before, whether it was with Australian wine or, more recently, Cognac. The difference now is everyone’s designing menus that can flex. Tariff-proofing is becoming standard operating procedure.”

Camus sees this accelerating the trend of international spirits firms becoming involved with local production. “While Guqi wasn’t specifically created in anticipation of tariffs, our local production model now provides a significant advantage,” he says.

On the flipside of all of these challenges, there are categories in strong growth.

The IWSR 2024 Preliminary Read reports year-on-year volume increase for agave spirits of 38% between 2023 and 2024, while rum rose by 28%. Gin and genever, meanwhile, soared by 27%.

“Agave spirits have real pull right now,” says Carey, citing the success of agave cocktail bar Coa Shanghai. He also notes the growth of domestic spirits in China. “Imported spirits still set the benchmark for international recognition, especially in gifting and top-shelf placement, but the gap is narrowing.”

Ethan Liu, co-founder of cocktail bar CMYK in Changsha, in China’s Hunan Province, says: “Local brands of gin, rum and whisky still need time to grow, but I’m happy there are more people looking into making Chinese local spirits.”

More generally, Liu is seeing a shift in the priorities of spirits consumers in the country. “The market is on the rise for independent, boutique and interesting brands with a story – Chinese consumers love a good story behind the brand,” he says. “People are spending money based on emotional attachment, on whether a product can trigger some sort of reaction emotionally.”

Carey agrees. “Guests aren’t always paying more for rare – they’re paying for resonance. Whether it’s a bar’s sustainability system, a bartender’s story, or a brand’s local collaboration, emotional equity is becoming part of the price tag.”

Flexibility is vital

This is just one way in which the country’s on-trade has changed in recent years. “Menus are being engineered for adaptability, with flexibility baked in. Beliefs are great, but only if they survive costings. The best bars are managing to do both,” he adds.

Song notes broader changes to China’s on-trade. “As China’s economic growth slows down, the overall market has experienced some shifts in the night economy,” he says. “The overall trend is more conservative, with all cocktails growing but spirits overall on a downward trend.”

For Wong, many of the changes can be attributed to Covid-19. “A lot of the traditional on-trade, such as nightclubs, couldn’t operate for a long time, and were forced to shut down, and if they reopened they were downsized to one-third of the size,” he says. “People eventually got used to it, and with the economy sliding, a lot of businessmen and businesswomen decided that there was no point in going out like that any more.”

This has shifted the focus to a different style of venue, he adds. “Everybody’s looking for an experience, which has really benefitted cocktail bars, because people are looking for a smaller venue to have decent conversation in and watch bartenders put drinks together with a bit of storytelling, instead of just getting a table and popping bottles.”

Liu is seeing a resulting shift in the way that spirit brands approach the on-trade. “I see them switching their strategy to focus more on house pours, partly because people don’t have enough money in their pockets, so they go with the bartender’s choice. Also, in China the consumer age is getting younger and younger, so their spirits knowledge is often limited to categories and not brands.”

Throughout all of this, online spirits retail has been on the rise. “All the top players are now better than ever with their efficiency, speed, and pricing, basically taking over from all of the traditional off-trade,” says Wong. “People go to them because they are the most strict with authentication, and they also get some exclusivities due to their purchasing power from suppliers.”

This success is having an impact on the on-trade too. “Digital platforms are now shaping menus almost as much as guest feedback,” says Carey. “Bars aren’t just looking at supplier samples – they’re watching what’s trending on [social media networks] Xiaohongshu, Dianping, and Douyin before committing to new listings. Visibility and virality have become real-world sales levers.”

Factors like these contribute towards what is clearly a rapidly evolving market for spirits, with no shortage of challenges, but plenty of potential too.

Related news

Desi Daru features at Sushisamba