Top 10 Brand Champions on social media

By Georgie CollinsThe social media landscape has seen huge changes in the past year, with many spirits brands fleeing Twitter/X. But as our research found, opportunities abound elsewhere.

Over the past year, spirits brands have had to undergo a notable transformation in how they approach social media to keep up with the ever‐changing landscape. Storytelling has taken over from transparent celebrity endorsements, and authentic lifestyle‐focused content and community‐driven, interactive strategies have usurped over‐stylised product shots.

As Instagram has continued to evolve, TikTok has continued to surge, and newer tools such as Threads have gained traction, spirits marketers have had to adapt quickly to stay visible – and compliant.

From leveraging user‐generated content to navigating platform‐specific advertising restrictions, the way alcohol brands engage online has become more nuanced, creative, and responsive.

The biggest elephant in the digital room is the ongoing mass exodus of spirits brands from X (or to give it its full name, ‘X, formerly known as Twitter’). The micro‐blogging social network has undergone an overhaul since tech billionaire Elon Musk took ownership in 2022, and for many brands, those changes have been a sign to abandon ship and invest time and ad spend elsewhere.

Now, brands that put spend behind their posts are rewarded with increased visibility and access to detailed performance analytics, while those who take the free route are left to contend with a significant drop in organic reach, and the inability to optimise content effectively. While the answer is, of course, to invest money into the platform, many brands have found that the audience they’re targeting just isn’t there anymore, as X’s evolving content‐moderation practices have led to an increasingly controversial environment, with an overwhelming presence of hatred masquerading as free speech, antisemitism, and conspiracy theories driving users away.

It was therefore not surprising to find that of the dozens of spirits brands we analysed for this report, 41% had mothballed their accounts in the past few years, while 19% had locked their accounts to followers only. A peep behind the curtain of those brands – most of which belong to Diageo – showed they had not been used since late 2023.

It speaks volumes that brands such as these, with follower counts on the platform in the tens of thousands, have decided that X no longer aligns with them commercially.

But as it continues to sink from favour, many former X users have found themselves staying afloat on platforms such as Threads by Meta, and BlueSky, a decentralised microblogging platform with a focus on open‐ source development and user control.

Higher engagement platforms

Recent research by Buffer revealed that posts on competing platforms such as Threads generate approximately 73.6% higher engagement compared with those on X, and while BlueSky is still an emerging platform, it does already boast approximately 21 million active users. Yes, a much lower figure than Threads’ 320m active users according to Meta’s 2024 data, but BlueSky’s focused community can offer targeted and meaningful engagement opportunities.

Hebe Richardson, founder of drinks‐focused Instagram consultancy Drinks With Hebe, explains that when it comes to deciding where efforts should be concentrated on social media, it is important for brands to evaluate each platform and decide what they want to achieve. “Depending on your goals, different platforms can offer different results,” she says. “It also can heavily depend if you’re an established brand that’s been on the platform for a long time or if you’re brand new. Facebook can be great if you’re already established on there and are looking at an older market, but if you’re a new brand, I wouldn’t recommend putting your energy into it, as without a big budget for paid ads, it’s going to be very difficult to get visibility.”

When evaluating how brands have been using each platform in the past year, this certainly translates. Follow counts are typically higher on Facebook for established spirits brands such as Absolut (7.1m followers) than they are for newer brands, such as Nemiroff (27,000 followers) and Finnish Long Drink, which hasn’t bothered setting up an account at all.

“In comparison,” Richardson notes, “TikTok supports new accounts, and even without followers your content can be seen by a huge audience without the need to put paid spending behind it. You can build a real community on TikTok. However, it’s not as strong for converting to sales – especially on higher priced products like alcohol,” she says, while also recognising the added difficulty of using the platform on account of its rules around advertising alcohol.

However, all is not lost. In August 2024, the app quietly updated its advertising policy to allow alcohol adverts, as it became the latest social media platform to reach the threshold of having at least 73.8% of its audience reasonably expected to be of the legal purchasing age, giving some alcohol advertising the green light – mainly in the US. But the local laws, regulations, and country‐ specific requirements are complex, and while all potential advertisers must work with a TikTok sales representative to determine eligibility, it appears that many brands find it too much of a minefield to navigate. As such, few have hard‐launched their own accounts on the platform and instead utilised the loophole that comes in the form of influencer collaborations and user‐generated content.

Richardson insists Instagram is the platform spirits brands should be prioritising. “It has the most diverse user base, and still has plenty of opportunity for reach if you utilise it properly,” she says. “Instagram is brilliant for sales, so once you’ve cracked the perfect content, you can easily convert views and followers into sales.”

While for this report we examine how brands have used the three major platforms in the last year – Facebook, Instagram and X – it felt unfair to penalise those that have distanced themselves from the latter. This would have meant our Social Media Hero for 2025, which hasn’t used X since 2021, likely wouldn’t have made the cut, despite combining bold creative campaigns with strategic influencer and celebrity partnerships, and a reimagined brand identity that resonates with consumers.

Below you will find the top 10 performing Brand Champions on social media of the last year. Metrics include frequency and creativity of posts, and how much engagement they attracted from followers. We also looked at how responsive the brands were to fans, how relevant the posts were in terms of being reactive, and brand consistency.

Marks are out of 10, and follower numbers were collected in May.

10. Altos Tequila

Followers: Instagram 38,100 | Facebook 81,000 | X 5,741 | Total: 124,841

Score: Frequency 7.5 | Engagement 7.5 | Consistency 8 | Creativity 7.5 | Total: 30.5

Altos Tequila combined playful celebrity-led activations across Instagram with rich cultural content on YouTube, all the while creating bold content designed for shareability.

In spring 2024, the brand partnered with actress Busy Philipps to launch the Altos Tequila Emergency HotLime campaign across both platforms. Consumers who called the hotline had a chance to win fresh limes and cocktail kits, which encouraged users to share their Margarita-making attempts at home, sparking fresh user-generated content for the brand to further promote the campaign.

9. Beefeater

Followers: Instagram 140,000 | Facebook 512,000 | X 10,400 | Total: 124,841

Score: Frequency 8 | Engagement 8 | Consistency 9.5 | Creativity 8 | Total: 33.5

This Pernod Ricard-owned gin brand tapped into social media’s love of a cultural bandwagon in summer 2024, launching a fun influencer-led campaign in honour of its pink expression that utilised a spin on the playful Mean Girls tagline: #OnWednesdaysWeDrinkPink. Influencers across UK, US, Australia and more created vibrant content each Wednesday, paired with photogenic cocktail kits and branded carafes.

The campaign exploded on Instagram, with four million engagements, 3.5 million story views, and a 1,500% surge in organic user-generated content.

Beyond that, Beefeater offered a consistent brand world across its platforms, staying true to its ‘Spirit of London’ messaging and visuals, sustainable packaging, and responsible messaging, all of which helped to reinforce its authenticity.

6. Jameson

Followers: Instagram 302,000 | Facebook 400,000 | X 42,600 | Total: 744,600

Score: Frequency 8 | Engagement 8.5 | Consistency 9 | Creativity 9 | Total: 34.5

We jump from ninth place to sixth now, as our next three brands all achieved an equally impressive score of 34.5.

While utilising the traditional social platforms, Jameson also dipped its toes into the world of gaming earlier this year as part of its partnership with the English Football league, collaborating with the much-loved Football Manager game.

Florian Sallaberry, global head of communications and content for Jameson, explained: “When it came to taking our first steps in gaming, to tap a key growth audience we’d identified, we wanted to extend our football platform to reach the hordes of avid football fans in the gaming space. And there’s no group of gamers more avid that the Football Manager community.

“The campaign was designed to drive awareness of Jameson amongst a new gaming audience and it did this far beyond expectations, with 10m impressions and 3.9m people reached. More importantly, the depth of engagement among viewers far exceeded conventional benchmarks, with 365,000 total minutes watched, and over 5,000 unique chatters actively engaging with the streams.”

Could we start to see more brands moving into this unconventional but extremely popular social realm in order to reach new audiences? It seems like for some, it’s a no-brainer.

6. Aperol

Followers: Instagram 210,000 | Facebook 1,100,000 | X 10,100 | Total: 1,320,100

Score: Frequency 8 | Engagement 8.5 | Consistency 10 | Creativity 8.5 | Total: 34.5

In the same way you can spot an Aperol Spritz several tables away from you at a bar, you can spot Aperol’s social media accounts without even having to look at the handle. The signature orange hue is the brand, and it is as consistent as British rain in winter. That is why the Campari-owned apéritif achieved a perfect score in that category.

Beyond its own channels, the brand made several appearances across social media last year, thanks to its sponsorship of US festival Coachella – the ultimate influencer’s festival. In fact, Aperol’s social strategy capitalised on multiple immersive experiences – from festival tents to brunch tables – all supported by influencer partnerships and strong user-generated content.

6. Grey Goose

Followers: Instagram 397,000 | Facebook 2,300,000 | X 82,800 | Total: 2,779,800

Score: Frequency 8 | Engagement 9.5 | Consistency 9 | Creativity 8 | Total: 34.5

Grey Goose seamlessly blended sports, luxury lifestyle, entertainment and travel on social media last year, all with digital-savvy execution. By melding event-based activations and social influencer strategies, the brand was kept top-of-mind and culturally relevant across multiple contexts.

However, social virality was at the core of the Grey Goose social media success last year, as the brand’s famed Honey Deuce cocktail – made and served exclusively for the US Open tennis championship – sold 556,782 units (equating to US$12.8m in sales), surpassing previous years, all with the help of fans and influencers contributing significantly to its cultural status via clips and other social media chatter.

5. Havana Club

Followers: Instagram 158,000 | Facebook 2,300,000 | X 10,000 | Total: 2,468,000

Score: Frequency 9.5 | Engagement 9.5 | Consistency 9 | Creativity 8 | Total: 36

Throughout the year, Havana Club has deepened its social media presence by engaging members of the drinks trade through educational contests, while also launching seasonal bottle designs that were promoted on Instagram stories and reels using custom animated assets, such as mint swirls, ice cubes, sugar splashes – all of which was designed to drive engagement and highlight the limited edition bottle in summer digital campaigns

The brand also utilised cross-category collaboration, which allowed it to expand its reach all while reinforcing its status as a culturally rich, premium rum brand.

4. Teremana

Followers: Instagram 785,000 | Facebook 100,000 | X 21,500 | Total: 906,500

Score: Frequency 9 | Engagement 9.5 | Consistency 9 | Creativity 9 | Total: 36.5

Teremana is a brand that has benefitted from its celebrity affiliation, growing its total social media following to 100,000 shy of a million in just five years, including a decent total on Facebook, which newer brands may typically find to be a harder platform to penetrate.

The brand is active on all three platforms, though it doesn’t appear to be wasting much time generating unique content for X, but rather resharing what has been created on Instagram. A clever way to not shun its 21,500-strong audience on the micro-blogging site.

3. Baileys

Followers: Instagram 234,000 | Facebook 4,800,000 | X 9,449 | Total: 5,043,449

Score: Frequency 8.5 | Engagement 8.5 | Consistency 10 | Creativity 9.5 | Total: 36.5

It is interesting to note that the three brands that have landed positions on the Social Media Heroes podium this year all fall within the liqueur category. Could this be because liqueurs have the ability to not take themselves too seriously – a trait that seems to be increasingly favoured on social media these days? All signs point to yes.

Continuing the social media strategy that earned it the Social Media Hero title in 2023, Bailey’s achieved a perfect score in the ‘consistency’ category, with more playful and shareable recipes, indulgent imagery, and a marketing message that reminds us that alcohol is to be enjoyed.

2. Malibu

Followers: Instagram 106,000 | Facebook 2,300,000 | X 14,200 | Total: 2,420,200

Score: Frequency 10 | Engagement 8.5 | Consistency 10 | Creativity 9.5 | Total: 38

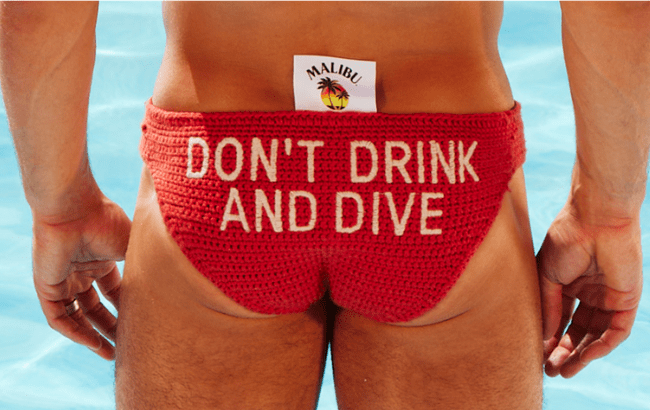

Over the last year, Malibu has balanced playful, viral content with responsible messaging, building a consistent summer-year-round presence across digital platforms.

In August 2024, the liqueur brand teamed up with Olympic diver Tom Daley for a water safety initiative. Across Instagram and TikTok, hero videos, user-shared ‘Daley Reminders’, floating billboards, and a capsule knitwear collection were all pushed – all driving home the message about responsible drinking around water.

Meanwhile, Malibu also chose to continue reinforcing it fun, summery identity with bright, tropical, cocktail-driven content, sharing Instagram reels that showcased the quintessential ‘clock-off’ feeling and weekend chill scenes.

1. Social Media Hero 2025: Kahlúa

Followers: Instagram 50,600 | Facebook 765,000 | X 1,518 | Total: 817,118

Score: Frequency 9.5 | Engagement 9.5 | Consistency 10 | Creativity 10 | Total: 39

In the past year, Pernod Richard‐owned coffee liqueur Kahlúa has enjoyed a major resurgence on social media. Central to its success has been a series of campaigns, notably its ‘Stir Up’ push featuring actor Salma Hayek, which used over‐the‐top telenovela‐style ads to reposition Kahlúa as an everyday indulgence, and its ‘Short n’ Sweet’ collaboration with Espresso singer Sabrina Carpenter.

Strategic influencer collaborations also helped expand the brand’s reach on platforms like Pinterest, TikTok and YouTube, as it recruited content creators to bring humour and buzz to campaigns such as the seasonal ‘Espressohoho Martini Bauble’ promotion, and the St Patrick’s Day ‘Schneaky’ Espresso Martini glass activation. Meanwhile, new cocktail recipes and visually striking content were shared in abundance. Kahlúa’s multi‐platform strategy has successfully transformed it from a nostalgic liqueur into a vibrant, culturally relevant brand, making it a worthy Social Media Hero for 2025.

Related news

The best-selling local spirits Brand Champions 2025