New challenges for Japanese whisky

Japanese whisky has soared in recent years, but with major players hiking up bottle prices, how are brands maintaining their fan base?

*This feature was originally published in the October 2024 issue of The Spirits Business magazine.

There are very few spirits categories that can demand a high price. Japanese whisky has been on an upswing ever since Suntory’s Yamazaki Sherry Cask 2013 was crowned the “best whisky in the world” by the Whisky Bible in 2015.

With only a limited amount of Japanese whisky bottled and produced at the time, many expressions that sold at a reasonable price disappeared quickly from the shelves of specialist retailers. These days, there appears to be more liquid on the market, with newer players entering the fold and established distillers ramping up production after major investment.

Suntory Spirits recently announced that it would raise the prices of its domestic premium whisky products starting with shipments going out from 1 April 2024. Three of its top-shelf whiskies – Hibiki 30 Years, Yamazaki 25 Years, and Hakushu 25 Years – experienced a price increase of 125% from between ¥160,000 (US$1,110) to an eye- watering ¥360,000. Meanwhile, Hakushu 12, Yamazaki 12, and Chita Single Grain saw a price hike of 50%.

Suntory said the reason for the price increase is to help improve the product quality and upgrade its production facilities. Undoubtedly inflation has also played a part in the price hikes.

Strong demand

Demand remains as strong as ever for the category’s leader. In 2023, Suntory Global Spirits noted doubledigit gains for its Japanese whiskies, led by 100th-anniversary releases for Hibiki, Yamazaki, and Hakushu. These included Hakushu 18 Years Old Peated Malt, priced in the UK at RRP £1,275 (US$1,586), Yamazaki 18 Years Old Mizunara at £1,600, and a 21-year-old Hibiki with a price tag of £5,200.

Japanese spirits retailer Dekantā has seen the demand for Japanese whisky sit at a stable rate, according to operations director Liam Hiller. The online retailer has been able to fulfil demand as more brands and retailers of Japanese spirits come into the market, Hiller explains.

“We’re seeing sales tracking in line with last year compared with two years ago,” he says. “It’s definitely slightly down a bit. It’s not the same as it was during the boom. I think it’s going to level out a little bit. Demand is not where it was certainly three or four years ago, but it is still high. People are still really interested in Japanese whisky. One of the reasons that demand is not the same as it was a few years ago is when it exploded it became very, very popular, then as people get more used to a product in the market and more used to its availability, it kind of becomes less desirable, I suppose. One of the things that made it so popular back then was the fact that it was so hard to find.”

The US is the biggest market for Dekantā, and Hiller has noticed that bottles have become more widely available there. “Three, four years ago, you would get allocations going into the US maybe once or twice a year, but it would be really small allocations, and they would sell out really, really quickly, whereas I was in New York six months ago, and the bottles are available on the shelves now, almost year-round,” he explains, citing the likes of “really popular bottles” such as Yamazaki 12 and 18.

Price rises

It’s not just Suntory that has put up its prices, with Asahi-owned Nikka also increasing its prices, Hiller adds. However, he notes that in other parts of the industry, prices are levelling. “If you look at a graph of how Japanese whisky exploded, it was kind of vertical, going directly up, and that can’t continue forever. So there’s always that kind of levelling. If you look at the old and rare market, for example, especially in Asia – like Karuizawa – the prices are down by up to 30%,” he says, noting this is evident at auction houses such as Sotheby’s and Bonhams.

“Other old and rare bottles are not commanding the prices they once were. People aren’t spending as much on it when they are buying it. It’s an interesting time right now, and for us, it’s all about just making sure that we’re as competitive as we can be [in pricing]. Whether that’s old and rare or new releases from new distilleries, or the classics like Suntory and Nikka, it’s just about keeping on top of that, and making sure that prices are what consumers expect.”

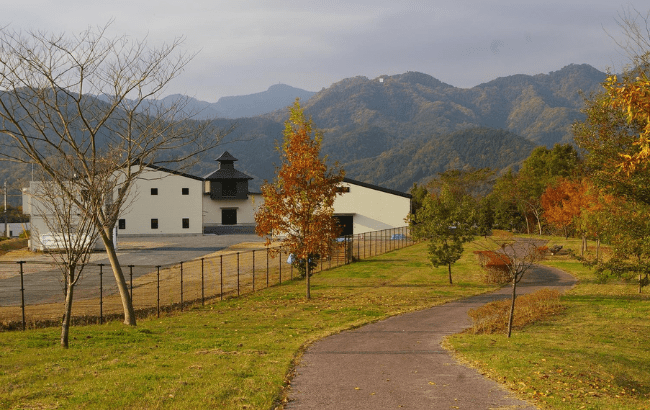

Dekantā recently partnered with Japan’s first farm-to-bottle producer, Kiyokawa, to offer casks of its single malt whisky for sale on its site. The brand is preparing to launch its first whisky next year from its Iiyama Mountain Farm Distillery, in the mountains of Nagano.

Dawn Davies MW, head buyer for The Whisky Exchange and Speciality Drinks, notes the interest in Japanese whisky is “still strong”, and despite being dominated by several brands, the company has seen “good growth” as “more distilleries come online”.

However, she has seen demand “start to soften so we don’t have to allocate stocks or control the flow of stock into the market like we used to. With new distilleries like Fuji and Kanosuke coming online we are able to offer diversity to the customer, which has also helped soften the pressure on stocks.”

In August 2023, Fuji entered the European market after partnering with Pernod Ricard, and the brand has also found its way into the US, Australia, Singapore, China and, more recently, the UK.

Depressed market

Davies notes that all Japanese whisky brands have increased their prices over the past few months, except for Kanosuke and Chichibu.

“It was the right move for them to hold the current pricing as the market is depressed so those that hold pricing are more likely to move stock,” she adds.

In regard to price points, Davies has noticed there has been “less of the top-end selling but not necessarily an increase on the lower end – the midrange of the market is where we have seen steady sales”. She points to brands such as Kanosuke and Fuji, which have “benefitted as they sit in [the mid-range] category, and are new to market”.

Kris Elliott, co-founder of High Road Spirits, which distributes Akashi, Akesshi, Kanosuke and Mars in the US, cites that one of the biggest issues facing producers is the “ultra weak” yen rate. “Japan as a country doesn’t manufacture a lot of raw material,” he explains, adding that distilleries are “purchasing everything from afar” including caps, labels and glass. “The vast majority of the malts are being imported from the UK. The glass is being imported from Germany or elsewhere. So their cost of goods have definitely increased.”

Elliott notes brands from Japan have a “sense of quality and value”, so an importer, retailer or restaurant can “charge a premium. We’re very aware that consumer spending is decreasing so we’re adjusting price where we can. The reality is that the strong dollar against the yen has given us the ability to decrease pricing or at least hold our prices against the increased prices we’ve received from our producers.”

Striking a balance

Elliott says his company considers the exchange rate between the US and Japan, as well as other costs such as freight when it comes to setting prices. “If we have seen price increases, we’ve eaten most of it because it’s always a balance of the currency exchange, coupled with the cost of freight. So we were in this sweet spot with the dollar being so strong that we were able to internalise any of the cost that they were increasing. We’ve taken freight cost increases from the producers, but we went in the opposite direction and brought prices down, just based upon the price.”

Recently there has been significant investment from major players in the category. In 2023, Suntory announced a ¥10 billion (US$77 million) investment in Yamazaki and Hakushu that included upgrading the visitor centres and installing floor maltings at both distilleries. Meanwhile, in 2021 Diageo took a minority stake in family-run Kanosuke through its drinks incubator Distill Ventures. Kanosuke entered the UK and the US in the summer, and the brand is also available in France, Germany, China, Taiwan, Hong Kong, Singapore, Macao, Indonesia, Malaysia and Australia.

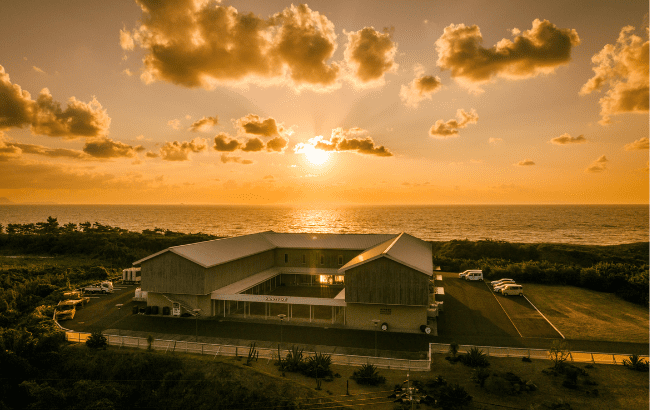

Kanosuke has since doubled its production from 100,000 litres of pure alcohol per year to 200,000 litres. Yoshitsugu Komasa, founder of Kanosuke Whisky, says the aim was to create a premium whisky brand.

“We didn’t think of making cheap whiskies,” he says. “So we started kind of high.” Prices for the brand in the UK start at £89 for the single malt, going up to £94 for Hioki Pot Still Grain Whisky, and £98 for Yumi Yoshikawa, global brand ambassador for Chichibu, is also eager to meet demand for Japanese whisky. But the brand is focused on building up slowly.

Yoshikawa says: “It’s important to remember that whisky production is a time- intensive process. Our priority is to maintain the exceptional quality of our products and ensure we have sufficient inventory for future releases. Given our limited production capacity, we are focused on gradual expansion and development, always ensuring we maintain the high quality of our whiskies.”

Strong brand

With Japanese whisky commanding high prices, could the category see a shift, with consumers seeking out more affordable options in a tougher inflationary environment? Chris Seale, managing director at Speciality Brands, which distributes Nikka and Chichibu in the UK, is confident about the category. He says: “Japanese whisky is a strong brand in its own right and, as such, maintains a strong and dedicated following. We find that in this market, whisky drinkers recognise the unique qualities of the sector, and therefore are still, despite a challenging environment, willing to pay a premium for it.”

He highlights this year’s release to mark the brand’s 90th anniversary, called Nikka Nine Decades. “This limited edition is a world blended whisky incorporating whiskies from the 1940s to the 2020s. Despite an RRP of £2,500 we have already pre-sold most of the stock.”

Yoshikawa adds: “The whisky market has indeed become more competitive, with consumers increasingly focusing on brand’s and producer’s reputations rather than just the country of origin. We believe that by prioritising quality and transparency with care, Chichibu can distinguish itself in this crowded market, and become a brand that remains largely unaffected by price.”

How do you balance the price of your whiskies? Has demand driven up prices?

Serdar Pala – global sales director, Yoshino Spirits:

“We balance our pricing by considering both production costs and market demand. While demand has influenced price adjustments, we implement these in cycles to minimise impact on trade and consumers. Our goal is to maintain fair pricing without compromising the exceptional quality that our whisky range is known for.”

Related news