Kanosuke optimistic for future growth

Despite challenges in the Japanese whisky market, Kanosuke sees “huge opportunity” for growth through global expansion.

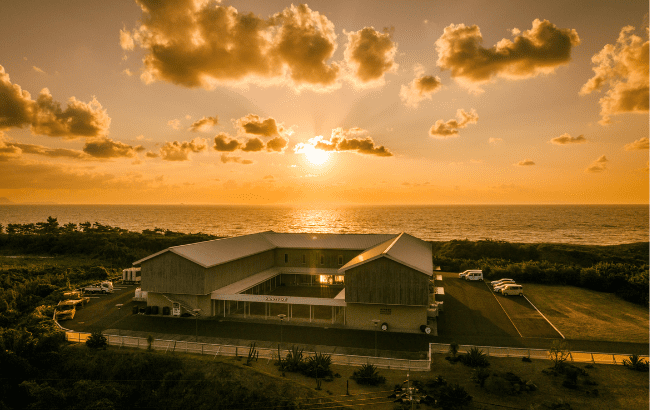

This year, the Diageo-backed Japanese whisky maker, based in the southern coastal region of Kagoshima, launched its core range in France, Germany, the US and the UK.

The distillery’s core range consists of a flagship Japanese single malt, a Hioki Japanese pot still grain whisky and a Double Distillery blended whisky.

The distillery’s founder, master blender, and CEO Yoshitsugu Komasa said that it cannot supply to all markets yet, but that it is “carefully rolling out expansion to different territories to ensure a sufficient supply of whisky to the advocates we are creating as we carefully convey the brand values we cherish”.

The distillery launched limited releases while it waited for sufficient stocks of its whisky base alcohol to reach maturation to create the core permanent line-up. Komasa believes “there is a huge opportunity for growth of Kanosuke in line with production capacity and global expansion”.

The distillery is expanding in Asia’s main whisky-consuming markets – China, Hong Kong, Taiwan and Singapore – as well as Australia.

Meanwhile, in Japan, the brand is working to boost its profile. Komasa notes that its domestic communications are focused on the on-trade, liquor shops and the duty-free market.

Overall, he adds that “the reception we’ve received in each new territory into which we’ve expanded makes us very optimistic for future growth of the brand. We naturally expect to see future progress as we continue our mission to spread the word about the next generation of Japanese whisky from Kagoshima’s mellow coast.”

The challenges

According to Euromonitor International data, nine-litre cases of Japanese whisky are expected to pass 19 million sales in 2025, having been around 17.8m in 2023. Interest is still high, but there has been a slowdown.

Demand has softened according to spirits retailers such as Dekantā, citing more brands entering the market as a factor, increasing availability and lessening the category’s ‘hard-to-find’ appeal.

Komasa said that with whisky being produced all over the world, there is a “possibility that consumption will slow down once whisky becomes more expensive and distilleries increase in capacity”.

In Japan, he says: “We are facing various issues, such as a decline in consumption, due to the low birthrate and ageing population. There is also a decline in alcohol consumption among young people globally, as well as an increase in the procurement costs of ingredients and barrels due to inflation.”

Exciting times

Nevertheless, Komasa still believes it’s an “exciting time” for Japanese whisky.

The number of craft whisky distilleries in Japan has risen steadily since 2016, with more than 100 in operation today. Kanosuke itself started production in 2017.

“In addition to companies like us – with a 140-year history of distilling Japanese spirits such as shochu – we are also seeing new entrants to the category from entirely different industries and business categories,” adds Komasa. “All these different perspectives will no doubt impact the final whiskies being produced in Japan.”

New regulations came into effect earlier this year, governing the production of some Japanese whiskies.

Komasa notes: “From the very beginning, we have always complied with this new definition and have only ever produced truly Japanese whisky distilled and bottled in Japan. But these definitions are not legally binding, so it is also true that whisky that does not conform to this definition is sold both in Japan and overseas.

“Of course, the major companies that have led the way in Japanese whisky up until now, such as Suntory and Nikka, have been increasing production for a few years and I hear that a sharing system is being put in place.

“I feel that the market is becoming more and more exciting. Watch this space.”

Related news