The biggest-selling vodka brands in 2023

Vodka was one of the more resilient categories in 2023. In a year when many million-case-selling spirits struggled to grow or maintain sales, the majority of vodka brands stayed strong. But how did the world’s biggest labels perform?

According to Euromonitor International, the vodka category is estimated to have risen slightly last year from 341.5 million nine-litre cases in 2022 to 345m in 2023.

The category has been relatively stagnant in recent years – but has been enjoying a new lease of life of late. Trends such as lower-ABV options, ready-to-drink (RTD) beverages, and natural flavours are seeming to find favour among consumers.

In the US, vodka-based RTDs are leading the RTD space, even ahead of the fast-growing agave spirit Tequila.

But how did the world’s biggest vodka brands perform in 2023? Our top-10 list comprises some of the biggest names in the business.

Below, we count down the biggest vodka brands by volume in 2023 from the brands who supplied data for The Brand Champions 2024 report, which is now available to read online.

10. Nemiroff

2023: 3.4m

2022: 2.4m

% change: 41.7%

Place last year: N/A

Ukrainian vodka brand Nemiroff had a challenging 2022 – unsurprising given the Russia-Ukraine war. Its volume sales plummeted by more than half as a result of the challenges it faced.

However, 2023 painted a very different picture for the brand, which was crowned this year’s Vodka Brand Champion 2024.

Nemiroff grew its volume sales by 1m cases in 2023, equal to a 41.7% increase and 3.4m cases. Last year, the vodka brand not only continued to pursue new markets, it also tapped into the luxury sector with the launch of ultra-premium vodka Lex by Nemiroff.

9. Pyat Ozer (Five Lakes)

2023: 4.2m

2023: 4.2m

2022: 3.9m

% change: 7.2%

Place last year: N/A

For the first time in several years, Pyat Ozer – owned by Alcohol Siberia Group – fell to below the four-million-case mark in 2022. Thankfully, the brand was able to recover those sales, and then some, to break past the four-million-mark again last year. With 4.2m cases to its name in 2023, this was the brand’s highest volume since 2019.

8. Soplica

2023: 4.2m

2023: 4.2m

2022: 4.1m

% change: 2.7%

Place last year: 10

Owned by Maspex Group, the Polish vodka brand delivered a comfortable 2.7% growth last year. This marked a return to growth for the vodka brand – but its volume sales are still below its 2020 peak of 4.3m cases.

7. Grey Goose

2023: 4.2m

2022: 4.2m

% change: 0.0%

Place last year: 9

In a year that saw many brands decline following a ‘bumper’ 2022, Grey Goose did OK to maintain its volume sales in 2023. The vodka brand delivered the same volume sales last year as it did in 2022, keeping the brand at its highest levels in five years.

Innovation from the brand last year included a bottled Martini launch, while this year has welcomed an ultra-premium vodka, distilled at subfreezing temperatures. Could this propel Grey Goose towards growth in 2024?

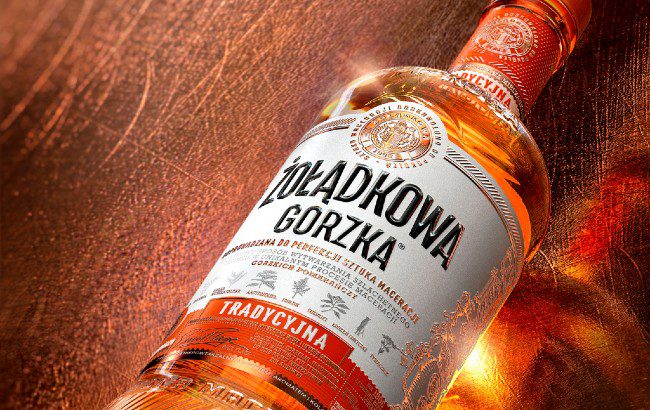

6. Żoładkowa

2023: 4.4m

2022: 4.2m

% change: 4.5%

Place last year: 8

After a double-digit decline in 2022, Polish vodka Żoładkowa bounced back to growth in 2023. Owned by Stock Spirits, the vodka brand grew its volume sales from 4.2m cases in 2022 to 4.4m in 2023 – a 4.5% increase.

The vodka brand made its debut in the list of biggest-selling vodka brands last year.

5. Arkhangelskaya

2023: 4.4m

2022: 4.0m

% change: 11.0%

Place last year: N/A

This vodka brand first launched in 2015 and hit the million-case mark for the first time in 2019. Since then, the Arkhangelskaya, owned by Novabev, has delivered strong growth year after year.

In 2023, the vodka brand delivered double-digit growth to hit 4.4m cases. This is a huge increase from the 1.6m cases sold in 2019.

4. Magic Moments

2023: 6.2m

2023: 6.2m

2022: 4.8m

% change: 29.2%

Place last year: 7

Indian vodka brand Magic Moments had a year many brands would have envied in 2023. Its volume sales were up by almost a third, growing by 29.2% in 2023 to reach 6.2m cases. The brand has enjoyed consistent year-on-year growth since 2020.

3. Żubrówka

2023: 9.5m

2022: 10.5m

% change: -9.3%

Place last year: 3

2023 was the first year that Żubrówka was under Maspex Group’s ownership for the full 12 years, following its acquisition from Roust the year prior. The brand fell to its lowest volume sales in five years in 2023, 9.5m, representing a 9.3% decline.

However, towards the tail end of 2023, Żubrówka released a lower-ABV range of spirit drinks, called Fresh Żu. And it hasn’t stopped there; earlier in 2024, the vodka brand revealed a new slogan and updated design for its Bison Grass and Biała expressions, indicating it is serious about securing a return to growth for 2024.

2. Absolut

2023: 11.9m

2022: 13.0m

% change: -8.1%

Place last year: 2

Pernod Ricard was unable to maintain growth for Absolut in 2023 – however its volume sales remained just above its 2021 performance. The brand dropped by 8.1% last year to 11.9m cases.

The brand remained active in 2023, partnering with singer Olly Alexander, and tapping into the burgeoning RTD segment in collaboration with Sprite.

So far this year, we have seen a number of new product developments from Absolut, including a honey-flavoured vodka and two ready-to-drink cocktails. If these launches can resonate with consumers, the brand has every chance to return to growth in 2024.

1. Smirnoff

2023: 26.0m

2022: 28.1m

% change: -7.7%

Place last year: 1

Will Smirnoff ever be toppled from the top spot as the world’s biggest-selling vodka brand? It will take some feat to catch up to the brand’s 26m-case lead.

Despite a 7.7% decline in 2023, the Diageo-owned vodka brand remains the biggest vodka by volume in the world. However, its 2023 volume sales fell to below its 2021 levels (26.5m). Diageo did report a ‘challenging’ six months to the end of 2023 following a strong 2022 and an ‘uneven global consumer environment’ last year.

However, its outlook for the remainder of 2024 and into 2025 remains optimistic. With the right marketing and products, Smirnoff could be back to growth by next year’s report.

Related news

Inside the ‘spiritual home’ of Scotch