How SaaS can combat counterfeiting and more

SaaS technology is revolutionising the spirits industry, from streamlining internal operations to widening international distribution opportunities.

*This feature was originally published in the May 2024 issue of The Spirits Business magazine.

Counterfeit alcohol is an expensive problem for the drinks industry. Fake wine, beer, and spirits cost the European Union €3 billion (US$3.2bn) in lost sales every year – equating to €1.2bn in lost government revenue, as calculated by the What’s your poison: the true cost of fake alcohol and how to catch the culprits report from 2023. It is also stealing jobs, approximately 23,400, the report details.

So, how do you solve a problem like counterfeit spirits? SaaS – software as a system – technology is more commonly being adopted to tackle the problem. “Prevalent fraud and counterfeit casks are an issue for the industry,” says Rob Hollands, CEO of Proofworks. The UK company was built to bring “greater transparency, efficiency and compliance” to the spirits sector; its SaaS technology digitalises the spirits supply chain from production, maturation and bottling to customer engagement and digital ownership.

Proofworks’ CaskPassport and BottlePassport features aim to directly address the challenges of ownership, investment fraud and counterfeits. “The control and ownership of casks today is still largely through paper-based transactions and documentation that can – and often does – lead to error,” Hollands continues.

“With Proofworks, every cask and bottle has a unique digital identity, and is connected through technologies such as NFC (near-field communication), or QR (quick response) code with an immutable record of the physical product recorded on the blockchain.”

He explains: “This reduces the possibility of fraud, and introduces new efficiencies as the trading process is significantly speeded up, and provides peace of mind to all stakeholders.”

However, Proofworks’ services extend beyond fighting fraud. Its blockchain-powered platform allows distilleries, warehouses and brokers to manage all aspects of production and storage. This includes tracking raw ingredients, creating recipes, advanced monitoring of maturation, and the ongoing storage and ownership of casks. “We have live deployments in Scotland, Ireland, Asia and the US, and are delivering connectivity across supply chains that has previously been unachievable,” says Hollands. “While the technology we’re using is advanced, a fundamental principle at Proofworks is that users don’t need to learn anything or be familiar with blockchain concepts, NFTs or Web3 to use our products and services. On the surface, we’ve created simple interfaces that are underpinned with the security, integrity, and future opportunities that Web3 technologies offer.”

Remain competitive

In the alcohol trade it is widely acknowledged that the industry has been slower to develop digitally than other sectors. This was accentuated by the Covid-19 pandemic, which forced the industry to swiftly improve its e-commerce availability.

“As is the case for almost every industry, digitalisation is critical to remain competitive, and to meet the demands of consumers,” Hollands says. “The spirits industry is steeped in tradition and craft, spanning hundreds of years. A perfect blend of old meets new.”

But as a highly regulated industry, selling alcohol online comes with extra challenges. Eoin Bara, CEO and founder of Tipple, faced this issue when he founded the Mór Irish Gin distillery. “In 2019, we were trying to grow as a brand, but were struggling to get new distribution; there were a lot of gins around,” he recalls. “A lot of international customers would come to Ireland, love the product, but then they wouldn’t be able to buy it in their home country. It’s super complicated to buy alcohol over the internet. We spent two-and-a-half years figuring out how to do it. We thought rather than having a warehouse for shipments in every country, why can’t we have one cross-border warehouse and manage it centrally? It was a big problem – and we thought if we have it, others will have it too.”

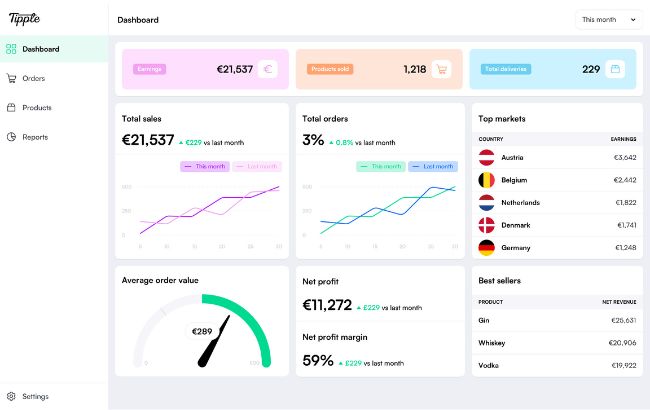

Bara exited Mór Irish Gin in 2022 to focus on Tipple. The aim is, to a degree, relatively simple: to make direct-to-consumer-selling easy for alcohol brands. Tipple has made an end-to-end tax and logistics technology company to give flexible solutions for D2C/B2B (direct-to-consumer/business-to-business) expansion across Europe.

“Selling D2C isn’t something typically done in the alcohol industry,” Bara notes. “The idea here is not that we’re trying to replace the distributor, we’re trying to help brands grow their business using D2C advertising. We’re trying to make it like any other industry; breaking down barriers by handling all the boring shit nobody else wants to do, or shouldn’t have to do. In no other industry are you forced to use traditional routes to market. If I don’t have a distributor, I should be able to sell to a country and be able to make money back. Everyone is going omnichannel.”

The idea is to keep operations as easy as possible for the brand. Tipple’s white-label plug-in has been designed to seamlessly work with brands’ existing online stores. The Tipple platform then also allows brands to self-manage their pricing, inventory, and access reports. Setup takes just four hours “and then it’s just a case of moving stock into a warehouse”, Bara explains.

At present, Tipple has a warehouse in Amsterdam, and is about to open a new one in Paris in July. The French hub will be the B2B warehouse for shipments to bars, restaurants and retailers. “Paris is really centralised, we can have trucks delivering into 22 cities on 24/48-hour service, so offering really speedy delivery,” Bara says. New warehouses are also set to open in the UK and Ireland, the latter scheduled for this July or August.

“Certain places, like Poland, we can’t do just yet because there’s a law that you have to send stock from inside Poland,” Bara notes. “Certain markets are a little bureaucratic. Spain requires you to have a duty stamp, but you need to record which duty stamp goes on which bottle. But we are expanding into Spain and Italy, the Czech Republic, and Switzerland.”

Bemakers is another SaaS business striving to break down export barriers for spirits brands across Europe. The company is also focused on creating a direct selling point for its customers. Morten Rinder Stengaard, its co-founder and CEO, is noticing growing interest from brands who already have an established D2C channel in their home market but are now looking to grow internationally. “Some brands are also looking to complement their B2B efforts with more direct brand-building efforts that will create synergies across the channels,” says Stengaard. “Interest also comes from brands that already have a large export business but are looking to go direct in certain markets to complement other existing efforts.”

Bemakers is essentially a one-stop shop that brands can work with to launch and build their businesses across Europe through multiple avenues: D2C, B2B, distributor/ importer sales, listing on Nordic monopolies, building trade sales through Bemakers Trade, or via third-party sites such as Amazon, Faire, and Ankorstore. “All reporting and compliance is taken care of,” assures Stengaard. “The brand can then focus on the commercial activities, sales and marketing to drive revenue.

“We take on the responsibility of all operational, legal/compliance-related requirements – and we provide the integrated fulfilment network with customers and excise warehouses, diverse carrier networks, and support handling to ensure that the customer experience is complete.”

There is also flexibility to pivot to a distributor with relative ease, should the brand so wish. As Stengaard explains: “Brands further have full control over which markets/channels are open and how [they are] activated. So if they suddenly have a change in strategy or wish to go with a distributor vs direct in a specific market, then they can do that.”

For the past two decades Bevica has been honing beverage business software. From large conglomerates to smaller-scale startups, the company’s tools have a proven track record of improving how firms manage their finance, reporting, supply-chain management, warehousing, production, inventory, and duty management.

“We have a standard product, which we call Bevica, and we implement that in wineries, distilleries, breweries, and wine merchants. Basically anyone who’s got an alcoholic product they need to sell,” explains Claudio Martell, Bevica product director. “It can do everything those sectors need to do, from finance reporting, production, KPIs, inventory. For 70% of our customers, we don’t need to go any further than that. It’s just a case of configuration. Now the other 30% still get that base functionality but mostly because they are larger companies, they will want some sort of bespoke work for some things that make them unique.”

An example Martell offers is automation. He explains that 100 orders a day might be manageable for one person in a small startup. But: “If you’ve got 2,000 orders a day, and you want to keep your headcount down, you try to automate things. So there’s a process for a lot of our customers where goods are delivered directly from the producer to the supermarket, say. That can be automated.”

Its software is all powered by Microsoft Business SaaS in the cloud. For Martell, that is the uniqueness of Bevica’s offerings.

“We have links into Outlook, into Excel, into Word, into all the other Microsoft products – no one else can do that,” he says. “Then the industry-specific software that we’ve written is the cherry on top, I suppose.”

The ability to track data, trends and sales using SaaS is an important benefit too, notes Martell. For the wine merchants and specialist spirits retailers Bevica works with, who sell across multiple brands, Bevica enables them to internally report on the profitability of each brand and “learn for themselves, and to report back to the brand owners”, Martell adds.

“We have the capability to track sales, products, even costs in the system to particular brands. So let’s say someone’s selling a particular brand of gin, they can do a P&L [profit and loss] by that brand so they can see how profitable for them it is, and they can then report back to the brand name and say: ‘We want a bit more locked-in contribution from you or your pricing; these need to come down’.”

Tracking data

For distilleries, Proofworks’ Hollands says tracking data using SaaS technology is also an intuitive way to communicate a producer’s sustainable efforts. As a topic that is being increasingly scrutinised by both the trade and consumers, he believes it is all the more reason for companies to think seriously about how SaaS can elevate their ways of working.

“The focus on sustainability goals today means spirits businesses need robust data that stands up to stakeholder and consumer scrutiny when making public sustainability statements,” he adds. “Our Proofworks platform can provide crucial data on sustainability metrics such as energy and water usage. We’re at a key milestone in the digitalisation of the spirits sector.

“The landscape as we know it is at a point of significant change, and we’re laying the foundations for brands to solve current challenges and unlock future opportunities. We’re supporting the industry in implementing proven technologies that deliver the kind of transformation the industry needs to protect brand heritage while embracing exciting new innovations.”

Related news

Spirits in limbo as RNDC exit disrupts California