Why vodka is finally back in action

With vodka sales projected to surpass US$40 billion by 2030, we examine the health of the category and its potential to capture a new generation of drinkers.

*This feature was originally published in the September 2023 issue of The Spirits Business magazine.

Dynamism and bombastic growth; they’re not usually words associated with this oft-overlooked, workhorse of a category. Long stagnant or declining, vodka delivered a convincing post-pandemic bounceback. But could it really be on the cusp of substantial growth?

A study by Research and Markets recently predicted the global vodka market could be worth US$40.25 billion by 2030, up from its current value of US$25.95bn, citing a projected compound annual growth rate (CAGR) of 5.6%. But is that really possible?

According to IWSR Drinks Market Analysis, despite strong performance since the post-pandemic reopening of the off-trade, vodka’s global performance has remained fairly static. From 2017 to 2022 volumes fell by 0.3%, while value has risen, but only at 0.4%.

“Vodka has not been exciting,” says Spiros Malandrakis, industry manager – alcoholic drinks at Euromonitor International. “In this inflationary environment, it’s much more useful to look at volume because value creates so many complications. There’s also so much statistical noise because of Covid. World volume growth for vodka is around 3% for 2022, which is a good number considering that during Covid it was always either static or experiencing massive declines.

“However,” says Malandrakis, “it’s mostly ‘bounced back’ rather than received renewed momentum. Europe and the West in general has been fascinated with gin, single malt whiskies, Tequila and many other categories, and much less fascinated with vodka. It remains the workhorse for many cocktails. But it hasn’t really captured the imagination of Gen Z consumers, or younger Millennials. It only seems to have been attempting to do that in the past one or two years.”

Celebrity endorsements

Vodka hasn’t been the ‘it’ drink, at the white-hot end of the market, for some time. But from celebrity backing (and a celebrity bust-up, with P Diddy suing Cîroc owner Diageo), the shift of a number of RTDs from malt based to premium spirits, an acceleration in flavours, the emergence of mid- and lower-strength SKUs, a revival in products designed for shots, brand revamps and more, it’s fair to say the sector hasn’t been short of activity.

There have been disposals, and acquisitions. Brown-Forman announced its exit from the vodka category in June with the sale of Finlandia for US$220 million to Coca-Cola Hellenic Bottling Company (HBC).

Having distributed it for 17 years, Zoran Bogdanovic, CEO of Coca-Cola HBC, said the purchase was strategically shrewd for accelerating its on-premise business.

The brand’s organic sales rose by 15% in the three months to 31 July 2023, according to Brown-Forman’s latest financial results. In Q1 2023, Finlandia gained share in Central and Eastern Europe, most notably in the key markets of Poland by 0.6 percentage points (pp) and in the Czech Republic by 1.3pp.

There have been rebrands. In August, targeting ‘mindful’ consumers, Proximo Spirits refreshed Three Olives Vodka, with new liquid and a packaging change. Originally launched in the hot and heady vodka heyday of the 1990s, its new iterations deliver low-calorie and zero-sugar options in its 13 expressions. That’s 100 calories per serving for its 40% ABV Original Vodka, and 80 for its lower 30% ABV ‘all-natural’ flavours.

There have been rebrands. In August, targeting ‘mindful’ consumers, Proximo Spirits refreshed Three Olives Vodka, with new liquid and a packaging change. Originally launched in the hot and heady vodka heyday of the 1990s, its new iterations deliver low-calorie and zero-sugar options in its 13 expressions. That’s 100 calories per serving for its 40% ABV Original Vodka, and 80 for its lower 30% ABV ‘all-natural’ flavours.

There have been brands from other categories entering vodka for the first time. This year hard seltzer brands White Claw and Truly launched a ‘first-of-its-kind’ wave-filtered, and triple-distilled flavoured vodka lines respectively.

And brands such as Au – with its flavoured line that includes Pink Lemonade, Blue Raspberry, and Pineapple Crush – have been making enough Millennial- and Gen Z-directed noise, to have incurred ad complaints, bans, and U-turns galore. Launched in 2016, the British brand was named the UK’s fastest-growing company by the Growth Index 100, after registering annual turnover of £43.9 million (US$54.7m), and was named the second most-popular spirit brand on the internet in 2021, according to a study by mixer producer Fentimans. It recently withdrew its Gold Gang Money Gun (which does exactly what you think it does) from sale after a complaint by the Wine and Spirit Trade Association. Three of its Instagram posts were banned by the UK’s Advertising Standards Authority for linking alcohol with ‘tough and aggressive behaviour’ and illicit drugs.

New flavours

So alongside a proliferation of new flavours from the world’s leading brands the category’s gaze appears to be firmly on bringing new consumers in, by offering excitement. “Premiumisation trends in the global vodka category have been accelerating since 2019,” says Nicholas Pelis, global marketing director, vodka, at Skyy owner Campari Group. He reports that value is growing four times faster than volume, “as suppliers elevate their product lines with new flavours, higher-quality ingredients, and experience-based drink solutions.

So alongside a proliferation of new flavours from the world’s leading brands the category’s gaze appears to be firmly on bringing new consumers in, by offering excitement. “Premiumisation trends in the global vodka category have been accelerating since 2019,” says Nicholas Pelis, global marketing director, vodka, at Skyy owner Campari Group. He reports that value is growing four times faster than volume, “as suppliers elevate their product lines with new flavours, higher-quality ingredients, and experience-based drink solutions.

“In 2018, we started our journey to re-establish Skyy Vodka as a high-quality and innovative vodka brand that inspires consumers’ hearts and minds,” Pelis says.

A 360-degree refresh included the use of water enriched by Pacific minerals sourced from the ocean water surrounding San Francisco, where the brand was founded.

“The added freshness and character of our mineral-enriched water is paving the way for our future innovation pipeline that will recruit consumers through new, exciting products and flavours,” he adds.

It appears to be working. Posting its results for the first six months of 2023, Campari Group said Skyy Vodka had a positive performance of 7.3%, with gains in China, Australia, South Korea, Japan, and in global travel retail. The IWSR predicts a modest ‘surge’ for the category. Volumes are set to increase by 4% from 2022 to 2027, whereas value is set to rise by 1% it says. Flavours, it agrees, will be a big driver of that growth.

“The long-term rise of flavours continues,” says Marten Lodewijks, director of consulting, Americas, IWSR. “Globally, flavoured vodka accounted for 3% of volume in 2001, 6% in 2011, and 10% in 2021. This share is expected to grow over the forecast period.”

Lodewijks further notes that the move by existing RTD brands, such as White Claw and Truly, into the vodka category is intended to make them relevant in more occasions. “This flavour-forward approach is consumer-driven, aiming to build on the current levels of brand awareness established from their RTD success through a more premium product/occasion proposition,” he says.

However, brands such as Absolut are using RTDs as a tool of category recruitment for vodka. In April it launched a three-strong RTD range, Absolut Cocktails. Available in Passionfruit Martini, Espresso Martini, and Strawberry Spritz, the 5% ABV range taps into trending cocktails. In the US, it has also partnered with cranberry juice brand Ocean Spray, packaging the popular serve in a 355ml can. It says between 5% and 10% of those who buy the RTDs, then purchase its full-strength products.

Speaking about Research and Markets’ US$40bn forecast, Quentin Meurisse, vice-president of business acceleration and planning for The Absolut Company, says: “This prediction is not totally unrealistic. I think it’s a bit bullish. But fundamentally, it’s not at all impossible, especially because we see that vodka has been overperforming in the last years versus the projections.

“It will still require a very strong performance. But if we take the CAGR we’ve known in the past three to four years, it’s really possible.

“RTDs are expanding our category. Consumers that have never consumed Absolut are entering the brand through these RTDs. In the beginning, we questioned if it was going to eat share from the full-strength proposition. But RTDs are performing more as a recruitment tool from beer and wine. And there is a recruitment into full-strength. So, we’ve been pretty convinced that it’s a place where we will continue to invest.”

Driven by flavour

Absolut’s other recent innovations have also been flavour-driven. That’s nothing new for this brand, true. But a series of locally relevant flavours and lower-strength products have been strategic for positioning vodka at the forefront, as the focus, rather than as a cocktail-making tool.

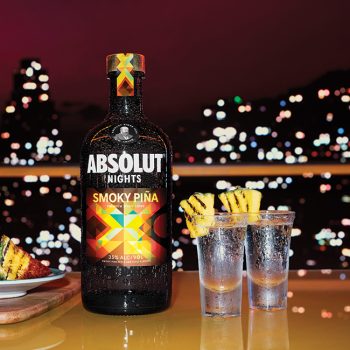

In March it launched its first product intended for shots. Smoky Piña (35% ABV) debuted in Mexico, and is described as the first in a new series of premium shot drinks, intended to elevate the moment. “It’s really this idea of trying to reframe that category,” says Meurisse. The perfect serve is with a pineapple wedge and salt.

In March it launched its first product intended for shots. Smoky Piña (35% ABV) debuted in Mexico, and is described as the first in a new series of premium shot drinks, intended to elevate the moment. “It’s really this idea of trying to reframe that category,” says Meurisse. The perfect serve is with a pineapple wedge and salt.

In Germany, the brand has rolled out Absolut Sensations, a range of 20% ABV flavours that debuted with a Tropical Fruit variant. It also has its eyes on the growing Asian market, with some soon-to-be-announced “locally, culturally relevant” shot flavours. While the US has proved challenging because of the dominance of ‘local’ brands, such as Tito’s Handmade Vodka, growth markets include Germany, the UK, France, Spain, Brazil, Mexico, and global travel retail, alongside smaller markets such as India, Turkey and Morocco.

In China, Absolut also recently partnered on a design with Dr Samuel Ross, a growing name in China’s creative and fashion scene, targeting Gen Z consumers.

“Absolut is recruiting very, very fast and very heavily around the younger consumer,” adds Meurisse, “because of its cultural relevance, and because Absolut stands for LGBTQ+. That’s highly relevant, especially now that the public debate is getting stronger and stronger.”

Younger consumers

Vodka’s relevance to younger consumers, to a new generation that don’t remember its last heyday, is vital for its future growth if such lofty figures are ever to be achieved.

“Because vodka has not been exciting, I think that’s what could provide this opportunity for it to come back up from the doldrums,” says Euromonitor’s Malandrakis. “For the past couple of decades, we’ve drunk whatever it was our parents did not drink. That historical psyche is essentially what depressed the fortunes of vodka over the past five to 10 years. Vodka was previously doing so well. We’re slowly moving out of that, and the nostalgia factor might kick in in the next five years. Vodka is everything for everyone. It’s flavourless, tasteless, without even a scent most of the time. That allows it the most versatility out of every category. It’s exactly that versatility that it now has to take advantage of, and create hyper-focused product targeting to a very specific target demographic. Because vodka was the least cool kid on the block, it might have the opportunity in the next couple of years to start coming back up.”

How did your brand perform in the past year? What has been the biggest driver of growth?

John McDonnell – managing director, international, Tito’s Handmade Vodka

“We’re up double digits in all of our international domestic markets for Tito’s Handmade Vodka, not only because consumers across the world are increasingly discovering our high-quality vodka and what our brand stands for, but also because of our careful efforts to find the right distributors in each market we enter, companies that are true brand builders and demonstrate strong routes to market. We’re also seeing continued success in the global duty free channel, especially as more Americans are travelling again to destinations in Europe, Asia, and the Middle East.”

Frank Grillo – co-founder, Altamura Distilleries

“We launched our vodka in February 2022; the 12 months to August of 2023 has been a time of fast growth, significant recognition, and market expansion for us. I would attribute this rapid progress to the quality of our liquid – we’ve been awarded 11 gold medals in the past year – the authenticity of our story, the provenance and terroir of our product, and our focus on appealing to the mixology world and leading mixologists. These have allowed us to expand from just Italy, to now Austria, the UK, the US, India, and soon China, and to be served at some of the most important bars in the world.”

Yuriy Sorochynskiy – CEO, Nemiroff

“In 2022, despite challenges and restrictions, we boosted product exports by 32% and net revenue by 3.86%. Despite a profit drop in the first half (H1) of 2022, we persevered and set even higher goals for global growth. Our focus on working, paying salaries/taxes, and global promotion led to 12 new markets, a 42% export-revenue share, and solidifying as Ukraine’s top vodka exporter. Some European markets saw growth double that of 2021. Nemiroff’s portfolio highlights premium line growth. De Luxe, The Inked Collection Burning Pear grew by 40% in H1 2023, De Luxe Rested In Barrel doubled its previous performance.”

Related news

Cocktail stories: Speed Bump, Byrdi