Spirits trends to watch in 2022

The spirits industry is one that develops at breakneck speed, with trends coming and going all the time. Here, The Spirits Business looks at the five main movements that are likely to dominate the sector in the next 12 months.

At the end of every year we make our predictions for the trends that are set to shake up the spirits sector in the next 12 months.

In 2021, we predicted the rise of the ready-to-drink sector, the emergence of luxury spirits and the soaring success of agave spirits.

Among our 2022 forecasts is a movement towards sustainability, a boom in functional drinks and a shake up of the traditional whisky industry.

To see our pick of the top cocktail trends to watch this year, click here.

Going green

Brands are ramping up their efforts to become more sustainable, with many firms releasing their products in lighter bottles and with eco‐friendly labels. Pernod Ricard and Diageo revealed several packaging updates for their brands, including Beefeater, Plymouth Gin and Gordon’s gin. More brands will likely follow suit in 2022 with innovative eco‐friendly designs.

Companies are also seeking to champion sustainability in their campaigns. Rum brand Diplomático sought to tackle food waste in on‐trade venues in the US through a new programme, while Scotch producer Whyte & Mackay is looking at the potential of home‐grown oak as a sustainable alternative to the industry’s common practice of importing casks from abroad.

Brands have also spent millions of dollars in protecting the environment. Beam Suntory recently pledged more than US$4 million to restore 1,300 hectares of peatlands by 2030, while Licor 43 owner Zamora Company invested US$7.8m in its sustainability plan.

Year of Tequila

According to IWSR Drinks Market Analysis, agave spirits have overtaken rum as the third‐ largest spirits category in the US. E‐commerce alcohol platform Drizly expects Tequila to surpass vodka this year. Drizly’s 2021 Bev Alc Insights Retail Report says almost 80% of retailers intend to list more Tequila this year, on a par with Bourbon.

Major companies have invested heavily in expanding their Tequila operations, including Diageo, which acquired Mezcal Unión. Celebrity spirits continue to prove popular, evidenced by Kendall Jenner’s 818 Tequila brand. It claims to be the best‐selling new Tequila of 2021 in the US, with sales of 136,000 cases in its first seven months.

And in June 2021, Constellation Brands snapped up a minority stake in Bryan Cranston and Aaron Paul’s Dos Hombres mezcal. According to the WSTA, UK consumers purchased more than 1.5 million bottles of Tequila in shops and supermarkets in the year to 11 September 2021.

On-demand boom

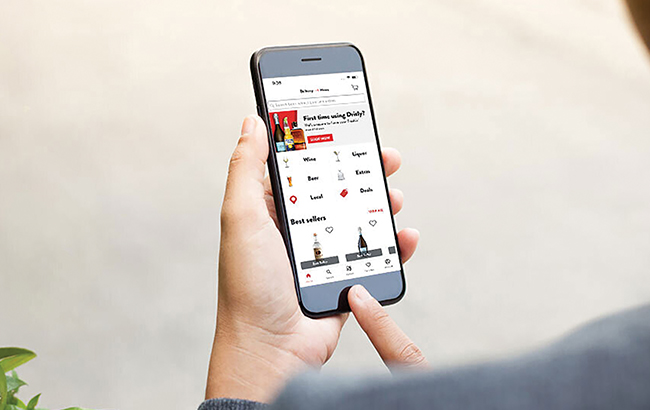

Consumers have become increasingly used to having their alcohol delivered online, and major firms have recognised the potential for delivery apps and specialist retailers. There’s been a swathe of acquisitions in the space. The past year has seen Pernod Ricard snap up spirits retailer The Whisky Exchange, Reserve Bar buy Mini Bar Delivery, and Uber acquire Drizly.

In July 2021, drinks firms Campari Group and Moët Hennessy entered into a partnership to build a premium European e‐commerce business for wines and spirits.

IWSR Drinks Market Analysis has also predicted that the value of alcohol e‐commerce will grow in global markets in the five years to 2025. The US is set to become the biggest market for online alcohol by 2025. As the space becomes more competitive, it is likely companies will strengthen their online offerings through streamlined systems and on‐demand services, while catering to the demand for personalised products.

Functional drinks

An increasing number of brands are releasing products that offer added benefits, and are steering away from high sugar. Consumers are looking for more unusual features such as mood‐enhancing benefits, including CBD and nootropics or ‘smart drugs’. These products tend to have little or no alcohol, tapping into the trend for health and wellbeing.

Alcohol‐free brands such as Three Spirit and Spirited Euphoria aim to offer stimulating effects without the alcohol. Plant‐based Three Spirit claims to be ‘the world’s first naturally uplifting, zero‐alcohol elixir’, and is described as a non‐alcoholic ‘social elixir’ for happier, healthier, more connected nights out.

Meanwhile, Spirited Euphoria claims to offer a ‘feel‐good’ sensation and is made from the ‘real’ hemp plant (cannabis sativa) and a ‘complex blend of high‐quality, natural, active and uplifting ingredients’.

2022 is likely to bring more new products with ‘added benefits’, as consumers seek new drinking experiences.

Modernisation of whisky

In recent years, whisky brands have sought to shift their strategies to attract younger consumers with new products created to be mixed, including Glenmorangie X and the ‘sweeter’ Johnnie Walker Blonde. There are now more lower‐ABV and flavoured spirit drinks from the likes of Haig Club, with its ‘accessible’ Mediterranean Orange flavour at 35% ABV and Ballantine’s Light, clocking in at 20% ABV.

Brands are also hoping to tap into the at‐home cocktail boom, offering recipes for classic serves that would typically call for vodka or rum and replacing them with whisky. More traditional whisky categories, such as Scotch and Japanese, have seen their guidelines shift in recent years in a bid to drive innovation, allowing them to compete with other regions that have long benefitted from more relaxed rules.

There is now whisky being produced in non‐traditional countries such as Mexico, China and New Zealand. We can expect to see more whiskies that challenge more traditional offerings in the future.

Related news

Cocktail stories: Speed Bump, Byrdi