What’s driving the RTD boom?

The ready-to-drink (RTD) sector is changing, but what is leading the charge: spirits and mixers, hard seltzers, or pre-mixed cocktails?

*This feature was originally published in the January 2025 issue of The Spirits Business magazine.

Alcopops, spirits and mixers, canned cocktails, bottled cocktails, hard seltzers – the ready-to-drink (RTD) category is expansive, and has established itself as an alcohol segment in its own right, sitting alongside spirits, wine and beer. The RTD cocktail segment has been a success in recent years, helped by its convenient format and a boom in cocktails at home during the height of the Covid-19 pandemic. What is evident in recent years is the rise of canned cocktails, specifically, with an abundance of new entrants to the category.

According to new data, the RTD category is predicted to have a 3% stake of the global alcohol sector within the next five years, according to IWSR. The segment’s growth has been charted by IWSR in its annual RTD Strategic Study in recent years, with it being the only alcohol category to record growth in 2023. Global volumes for RTDs rose by 2% last year, and both volume and value are forecast to grow at a compound annual growth rate (CAGR) of 3% between 2023 and 2028. Between 2019 and 2023, RTD volumes soared by 12%.

Pockets of growth

“Although overall growth rates are tailing off from its peak during the pandemic, there are pockets of strong growth across focus markets,” says Susie Goldspink, head of RTD insights, IWSR. Brazil, Germany and Australia are expected to drive volume gains between 2023 and 2028. In the UK off-trade, the RTD category has more than doubled its worth from around £228 million (US$287m) in 2014 to an estimated £543m in 2024 (according to NIQ data cited by Global Brands’ RTD Canned Cocktails report).

In terms of specific segments, IWSR has noted a differing picture in terms of which are driving category growth. Goldspink notes the fastest growth rate of RTD subsegments include hard tea (driven by the US), which is expected to grow by 18% in volume CAGR 2023-28, from a relatively lower base. Other segments in growth include RTD cocktails/long drinks (with an estimated 4% CAGR 2023-28) and flavoured alcoholic beverages (FABs), which could rise by 3% over the same period.

Speaking specifically about the ready-to-serve (RTS) segment, Goldspink notes: “Generally, across the markets performance is varied but premiumising. There has been innovation away from larger-format, low-priced bottles and bag-in-box-style products to higher-strength, smaller-serve cans and ready-to-pour bottles.”

IWSR notes that RTS products came to market in response to the rise of the at-home cocktail occasion, but product launches started to tail off in 2023 after a post-pandemic peak. The RTD category has become more mature, evidenced by fewer new product launches (fewer than 1,000) in the first half of 2024, compared with the 3,300 RTD innovations in 2021. “New product development in the category is slowing,” says Jo Taylorson, head of marketing and product management at Kingsland Drinks.

“While we’re seeing less innovation from brands, there have been smarter and more effective launches as the category matures and has a clearer view of the consumer.”

The RTS category, which typically refers to pre-mixed spirits-based cocktails in larger bottles, accounts for US$300m of the total US$10.9 billion RTD category in the US off-premise, according to NIQ data for the year ending 30 March 2024.

Meanwhile, in the UK off-trade, alcopops (otherwise known as ‘coolers’ or FABs in North America), which tend to be single-serve drinks lower in alcohol at 3% ABV-7% ABV, saw their value drop slightly over the past decade, according to the RTD Canned Cocktails report. This segment is estimated to be worth £129m in 2024 in the UK off-trade, down from £133m in 2014.

Meanwhile, RTS cans have grown from £89m in 2014 to £411m in 2024. Spirit and mixers have the biggest share of RTS cans, with sales valued at £241m in 2024 (up from £79m in 2014). However, canned cocktails are increasing at a faster rate than spirit-and-mixer variants, reaching a value of £94m in 2024, up from £4.7m in 2014.

Higher-ABV canned cocktails have been identified as a growth area by a number of brands. Goldspink noted that “Tequila cocktails with higher ABV, and strong flavours like Margarita and Paloma continue to do well”, alongside “lighter Spritz serves”, while adding that Gin and Tonic combinations “have tailed off”.

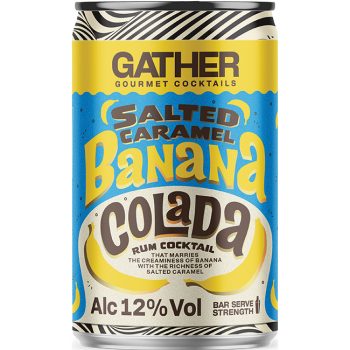

To tap into this higher-ABV segment, Global Brands released its Gather RTD cocktail line, which are offered in 150ml cans, with ABVs ranging from 12% to 14.9%. Gather made its debut in October 2024 with five flavours including Salted Caramel Banana Colada and Chocolate Honeycomb Espresso Martini.

Global Brands is the UK’s number one branded cocktail supplier to the off-trade by volume (NIQ data), and is behind canned cocktail brands All Shook Up, Shake Baby Shake, and its ‘bar-quality’ Be range, as well as alcopops Hooch and VK.

Matthew Bulcroft, marketing director at Global Brands, has highlighted “enhanced RTDs” as an area that’s growing. “The rise of 8% [ABV] have always been restricted to convenience but now the big retailers seem to be turning onto this, particularly as caffeine is disappearing from the category.” Speaking about this “enhanced RTD” segment, Bulcroft cites NIQ data for 12 months to September 2024 that notes it is worth £40.6m, and growing at 19% annually.

Edinburgh-based Whitebox Cocktails is also keen to focus on single-serve cocktails with its range of 100ml cans. They pack a punch, with ABVs varying from 21.3% ABV for its Pocket Negroni to 32.6% ABV for its Tiny Tee’s Dirty Martini. Co-founder Ben Iravani has noticed a growth in classic cocktails, which the company focuses on, with the Martini and Spicy Margarita being among its best-sellers. As such, the company plans to expand its range of Martinis and move into the sour family of cocktails next year. “We follow the cocktails trends, the drinks that are most popular in the on-trade,” he explains of how the team of bartenders create the drinks, citing the likes of the Margarita, Negroni and Espresso Martini.

Tequila-based ready-to-drink brand Pimentae has also recognised the growth potential of canned cocktails, with the brand moving outside of bottled drinks for the first time in 2023. The 125ml canned range includes Tommy’s Chilli Margarita, Cucumber Margarita, and Spicy Margarita, which are also available in a 500ml bottled format. Pimentae has also tapped into bag-in-box cocktails, offering five-litre formats for its trio of Margaritas, as well as kegged cocktails at events in the UK and in some on-trade venues.

Co-founder Alice Parmiter explains that the brand launched into cans due to their accessibility, allowing Pimentae to tap into events where glass bottles are normally prohibited. “The bottle was great, but it was at a higher price point,” she explains, with a can introducing more consumers to the brand where they would spend several pounds instead of £30 for a bottle. She believes the bottle lends itself well to gifting occasions, with a “huge push” behind the glass format during the fourth quarter, offering it in hampers. The canned range is now leading growth for Pimentae in terms of volume, Parmiter adds, particularly when it comes to retail. The bottles are “definitely less of a focus, especially with a new glass tax coming in 2025, so prices are going to go up, inevitably”, she says. The UK is introducing a tax on packaging waste for manufacturers, called the Extended Producer Responsibility, which will apply to glass drinks containers from April 2025.

For Australian RTD producer Curatif, the reason to launch in cans was to maintain the freshness of its ingredients. Co-founder Matt Sanger explains: “To make real cocktails, you have to use fresh ingredients. You have to use fresh lime, fresh lemon, or fresh pineapple. The thing about fresh, authentic, real ingredients is they don’t survive in glass bottles. You’ve got UV [ultraviolet] degradation. You can’t control the environment the same way you can in a can.”

He says food manufacturers have been using cans for decades due to elements like retort and pasteurisation. “Predominantly it’s around preventing oxygen leakage. It’s about preventing the ingress of UV,” he adds.

Cans over bottles

First to market with the bag-in-box cocktail format was the UK’s The Drinks Bureau, according to its founder, Frankie Snobel. Despite the competitive market, The Drinks Bureau has seen success with its canned and bag-in-box cocktails, particularly the Espresso Martini and Spicy Margarita. But she notes the company won’t go into bottles for multiple reasons. “It really limits when you’re trying to get into the event space, for example, with breakages. There’s actually quite a lot of CO₂ emissions when you’re transporting glass, versus a flat-packed bag and box of cans. Cans are infinitely recyclable, [as is glass, but with some challenges] so there’s a sustainability element there, which is great.”

The RTD Canned Cocktails report also highlighted the key consumption behaviours of canned cocktail shoppers. Despite the rise of the can format, a good portion of category shoppers prefer to drink canned cocktails from a glass, with 43% stating they sometimes decant their purchases, and 31% saying they always do.

Kegged cocktails is also a segment that is starting to grow, according to IWSR, with some bars also adopting this option for convenience. “We would foresee more growth with premium-quality kegged cocktails than bag-in-box, due to the lower-priced associations with the bag-in-box and its connection to certain value-subcategories,” IWSR’s Goldspink says. “Kegged cocktails are on the rise, allowing consumers to access quality cocktails in the comfort of their home, and offer an on-trade option to resource-strapped bars.”

Issues around tax also persist in the US, where in some states spirits-based RTDs are treated differently to their malt- or wine-based counterparts, despite having the same ABV.

Britt West, chief commercial officer of Gallo, which owns leading spirit-based hard seltzer High Noon, says market access is a challenge.

“There are still many markets where RTDs of similar ABVs are discriminated against based on their base alcohol type.

“Consumers have clearly spoken in favour of RTDs, and it is a shame that certain markets block consumer access,” he says.

IWSR’s Goldspink notes that “where spirit-based products are taxed like spirits can be a factor in hindering growth”.

In the UK, spirits tax was hiked by 10.1% in August 2023, while in Australia the duty increases twice a year in line with the consumer price index. The tax in Australia, which has recently risen to AU$103.89 (US$65.01) per litre of pure alcohol, is now the third highest in the world. “It’s more than 50% of our cost of goods. It’s an extraordinarily burdensome tax environment,” says Sanger at Curatif, which is based in Melbourne. The brand works with spirits partners such as Tia Maria and Planteray rum to create its canned cocktails.

“We import these incredible spirits, so we actually don’t get access to the alcohol manufacturers’ excise remission in Australia, which is a AU$350,000 remission that every distiller in Australia gets access to. So on our starting blocks in this running race of every calendar year, we start from AU$350,000 behind everyone else. We’re in a position where, [the same as] a lot of manufacturers in Australia, it actually makes no sense for us to be selling here. We would be better off selling in almost any other market.”

He adds: “We’re so much more competitive in any market from a price perspective, because we don’t have to pay this insane Australian tax.”

As brand owners strengthen their investments in the space, adjacent categories are also driving momentum, from functional drinks to alcohol-free RTDs from a small base. With so much interest from younger consumers and innovation in a category that previously suffered from its alcopops syndrome, the growth opportunities appear to be limitless.

Which segments are driving growth in RTDs (canned, bottled, or draught cocktails)?

Godelief van Erve – global marketing director, De Kuyper

“The RTD segment is growing across all the three formats mentioned, with trends varying by market. Draught cocktails are specifically driving growth in Western Europe. Canned cocktails are expanding rapidly in almost all markets due to their portability and broad appeal. Meanwhile, bottled cocktails like our De Kuyper Ready-to-Serve range are steadily growing in specific markets like the Netherlands and Germany, responding to the demand for premium, at-home cocktail solutions. Market-specific preferences continue to shape the success of these segments.”

Sip by sip: what’s behind the RTD category’s boom?

The Global Brands RTD Canned Cocktail category report highlights four core flavours that are driving the most value and volume for RTDs: Passion Fruit Martini, Piña Colada, Mojito, and Daiquiri. Of these, the Piña Colada is seeing double-digit value growth of more than 20% over the past year (NIQ data for 12 months to 24 February 2024).

Cocktails like the Margarita and Espresso Martini are also increasing in popularity, adding £4m and £2.3m in category value respectively. Tequila-based Palomas are now worth £1.1m.

In the US off-premise, Nielsen by NIQ data showed that spirit-based RTDs are driving rapid growth in the 12 months to 30 March 2024 – contributing 40% more to total RTD sales than a year ago. Flavoured malt beverages have risen by 16% in value, and wine RTDs rose by 9.2%, while hard seltzers plunged by 15.6%.

By segment, spirit-based seltzers led value growth, with a 56.8% share of total RTD sales, followed by hard soda (39.1% share), hard tea (36.2% share), wine-based cocktails (34.7% share), and spirit-based cocktails (27.9% share). Spirit-based Ranch Water had a 2.3% share.

Related news

Surfside: 'We want to be the Coca-Cola' of RTDs