Fawn Weaver: ‘Stop saying the spirits industry is in decline – it’s not’

Is the spirits industry in trouble? Or is the trade simply in a state of recalibration following the Covid-19 pandemic? Fawn Weaver, founder of Uncle Nearest Premium Whiskey, shares her thoughts.

Recent headlines claim the spirits industry is in trouble, citing declining consumption due to the rise of non-alcoholic beverages, GLP-1 weight-loss drugs, increased marijuana use, and shifting generational preferences. But until now, no one has compiled the full picture in one place. When you analyse all the data together, a different story emerges – one that challenges these prevailing narratives.

Temporary market corrections are not signs of permanent decline. Data shows premiumisation is driving strong consumer spending in spirits. This is not a collapse – it’s a return to normalcy.

A historical parallel: post-pandemic corrections

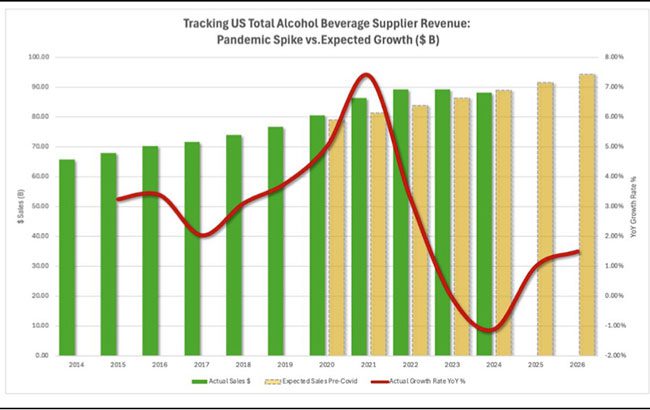

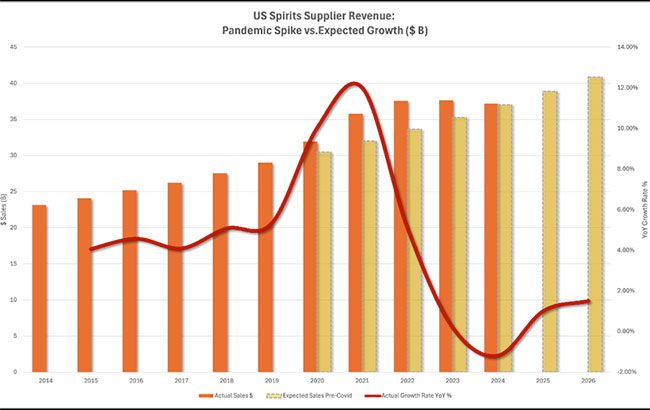

The 1918 Spanish flu pandemic led to a temporary pullback in drinking at bars and restaurants. Once the world reopened, alcohol sales spiked, then stabilised. A century later, history is repeating itself. Covid-19 created an artificial surge in alcohol sales as consumers stocked home bars and replaced nights out with at-home cocktails. That surge was never sustainable, and the industry is now adjusting back to pre-pandemic norms. Much like today, early predictions of long-term decline were misguided. The market is correcting, not collapsing.

Consumers are drinking less, but spending remains strong

It is true that consumers are drinking less than they did at the peak of the pandemic, but that does not mean the industry is shrinking. During Covid-19, at-home drinking skyrocketed. However, as offices reopened and business travel resumed, this habit declined.

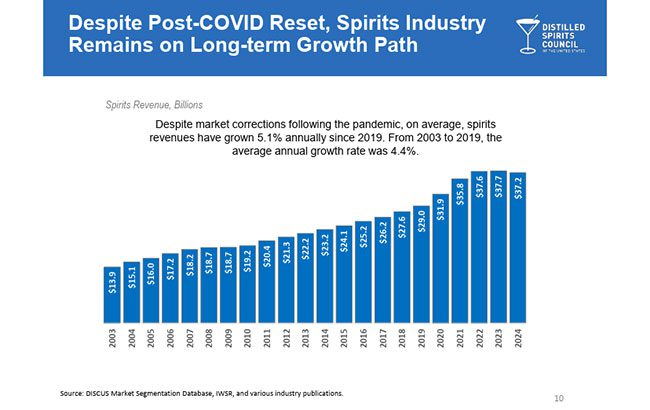

From 2013 to 2018, spirits sales grew at an average annual rate of 4.3% before accelerating to 5.34% in 2019 and spiking to 10% in 2021 and 12.23% in 2022. According to NIQ, US retail alcohol sales – including beer, wine, and spirits – peaked at US$113.6 billion in 2023 before settling at US$112.9bn in 2024, a modest 0.8% decline. This adjustment was expected, yet some industry analysts are reacting as if it signals a crisis.

The Distilled Spirits Council of the US (Discus) recently released its annual report, showing a 1.1% decline in US supplier gross revenue across spirits, beer, and wine – a correction milder than historical patterns would predict. However, if the spirits industry had continued its pre-Covid growth trajectory, averaging 5% annual growth, its 2024 revenue levels would not have been reached until 2025.

At the same time, spirits market volumes rose in 2024, increasing 1.1% to 312.2 million nine-litre cases. This further contradicts the notion that consumers are drinking less. The strong growth of ready-to-drink (RTD) beverages played a key role in shifting revenue, as their lower price points slightly reduced overall sales figures. However, the data makes one thing clear: America is still drinking.

The spirits market isn’t shrinking; it’s stabilising.

Premiumisation: consumers are trading up, not out

In addition to the strong growth of RTDs, a major trend that is often overlooked is premiumisation – the shift towards higher-quality alcohol. Some consumers are choosing easier with RTDs, while others are choosing better with premium spirits.

Recent NielsenIQ data confirms that while total alcohol sales have adjusted downwards, spending on premium and ultra-premium spirits continues to rise. In the most recent Nielsen report, Uncle Nearest grew 22.3%, while other top Bourbons – including Blanton’s, Angel’s Envy, and Colonel E.H. Taylor – saw gains between 20% and 55%. High-end Tequilas like Lalo, Tequila Ocho, and La Gritona surged between 23% and 124%.

Each of these Bourbon and Tequila brands has sustained double-digit growth over the past 26 weeks, reinforcing that this is not a temporary trend but a long-term consumer shift towards higher-quality spirits. Consumers are making more intentional choices, favouring well-crafted, 100% additive-free spirits. Pure and authentic Bourbons stand apart as all-natural spirits – naturally sugar-free, carb-free, fat-free, and gluten-free – appealing to health-conscious consumers seeking superior choices without compromise.

The non-alcoholic trend is overstated

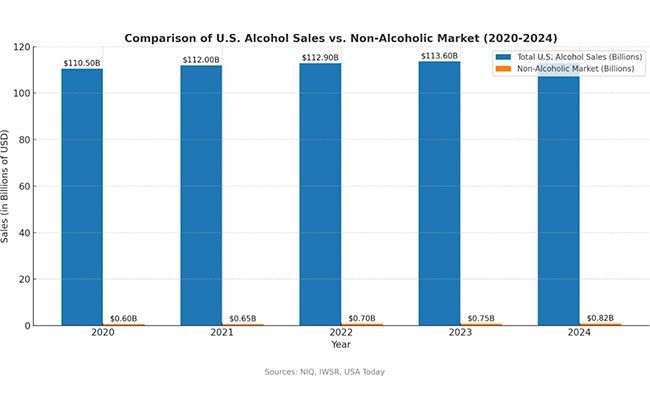

Yes, the non-alcoholic category is growing, but its impact remains small, and growth is already slowing.

The US non-alcoholic market reached US$823m in 2024 and is projected to grow to nearly US$5bn by 2028, according to IWSR. However, growth is already decelerating. The non-alcoholic category grew by 35% in 2023, 26% in the past year, and 20.6% in 2022, yet its projected CAGR from 2024-2028 is just 18%. If this were a true industry disruptor, we’d expect growth acceleration – not a slowdown.

Even recent reports showing strong single-year growth don’t change the reality that momentum is fading. While some analysts claim non-alcoholic alternatives are reshaping the industry, the data tells a different story: this remains a niche category, not a widespread shift away from alcohol.

The overwhelming majority of this growth comes from non-alcoholic beer, which accounts for 84% of total non-alcoholic sales. Since beer already has a naturally low ABV of 4%-6%, removing alcohol while maintaining taste was relatively easy – leading to broader consumer adoption.

Meanwhile, non-alcoholic ‘spirits’ barely exceed 1% of total no-alcohol sales. Unlike beer, replicating the complex taste and mouthfeel of Bourbon, Tequila, or vodka without alcohol has proven challenging. To compensate, many non-alcoholic ‘spirits’ rely on artificial additives, excessive sugar, or other compounds, contradicting the very health-conscious appeal that initially attracted many consumers.

If non-alcoholic spirits were truly disrupting the industry, they’d be more than just a rounding error. At barely 1% of the non-alcoholic category – excluding beer and wine – let’s just say no one should be holding their breath for a non-alcoholic Bourbon or Tequila boom, at least not in this lifetime.

Election years and consumer behaviour

Political uncertainty has historically impacted consumer spending, including alcohol. Following the 2016 election, the industry saw a temporary slowdown, with growth declining from 3.38% in 2016 to 2.04% in 2017 (Discus) – a 1.47 percentage point drop. While the reasons for this are not entirely clear, post-election uncertainty or the emotional responses of voters may have contributed.

We are witnessing a similar pattern now. While some analysts attribute industry softness to broader economic shifts, historical data suggests political transitions can have short-term effects on discretionary spending, including alcohol. If history is any guide, this too will pass.

GLP-1 drugs: a variable, not a verdict

According to a May 2024 KFF Health Tracking Poll, 12% of adults have used GLP-1 drugs, including 6% who are currently taking them – and it is unclear how many of them were regular alcohol consumers before starting the drug. A study by Blue Health Intelligence found that over 30% of patients discontinued these medications within the first four weeks, despite recommendations to continue treatment for at least 12 weeks.

Given this high rate of early discontinuation, the long-term impact of GLP-1 medications on alcohol consumption remains uncertain. Past health-driven trends like the Atkins diet and clean-eating movement did not lead to a lasting decline in alcohol consumption. There is no reason to believe this time will be any different.

Cannabis and alcohol: not a one-for-one trade off

Some suggest that increased cannabis use is replacing alcohol, but studies do not support this claim. A 2022 review published in the National Library of Medicine – Patterns of cannabis and alcohol co-use: Substitution versus complementary effects – analysed 95 studies, and found both substitution and complementary effects between cannabis and alcohol, meaning some individuals use cannabis instead of alcohol, while others consume both together.

If marijuana were truly replacing alcohol at scale, we would expect to see dramatic declines in alcohol sales in states where cannabis has been legal the longest. While some substitution effects have impacted beer sales, overall alcohol sales have not declined more in legalised states than in those without legalisation.

Gen Z is not rejecting alcohol for health reasons

Gen Z is drinking less than previous generations did at their age, but their preferences indicate a shift towards quality over quantity. The decline in consumption appears to be driven more by premiumisation than by health-consciousness, as their engagement with other substances – such as vaping – suggests a more complex shift in behaviour rather than outright rejection of alcohol.

Gen Z is vaping at unprecedented rates, consuming nicotine in ways previous generations abandoned. Unlike the cigarettes their parents and grandparents smoked, modern e-cigarettes and vapes often contain significantly higher levels of nicotine, making them even more addictive.

This suggests that their drinking habits will evolve, not disappear. Millennials initially moved away from beer before later embracing premium spirits and craft cocktails. The alcohol industry has always adapted to generational shifts, and it will do so again.

Regulatory pressures are nothing new

Some have suggested that potential cancer warning labels on alcohol pose an existential threat to the industry. However, history tells a different story. Similar warnings were once issued for red meat, coffee, and artificial sweeteners – only for those claims to be revised or retracted as new research emerged.

In December 2024, the US Department of Agriculture (USDA) and the Department of Health and Human Services (HHS) released their Scientific Report, notably declining to issue new recommendations on alcohol consumption. The agencies concluded that more comprehensive reviews were needed before considering any changes, meaning the existing federal guidelines – up to two drinks per day for men and one for women – remain unchanged. This decision reinforces the reality that even within regulatory agencies, the current data does not justify a drastic shift in alcohol consumption guidance.

Even if labelling changes are proposed, implementation would take years. The surgeon general’s recent advisory on alcohol and cancer risk represents a shifting narrative rather than settled science.

Meanwhile, obesity remains one of the leading risk factors for cancer, yet sugar-sweetened beverages (SSBs) – a primary contributor to obesity – face no equivalent push for cancer warning labels. A major study published in The BMJ found a clear link between higher consumption of sugary drinks and an increased risk of overall cancer and breast cancer. Despite this, public health officials have not proposed mandatory warning labels for sodas, even though they directly contribute to obesity-related diseases – which is demonstrably a far greater cancer risk.

If public health is truly the priority, risk messaging should be consistent across all dietary contributors to cancer, not selectively targeted at alcohol. The alcohol industry has long promoted responsible drinking, and existing federal guidelines emphasise moderation, not abstinence.

A market reset is already under way – and that’s a good thing

Inventory levels at distributor warehouses are elevated, reflecting a natural adjustment after the pandemic-induced surge. Before distributors resume normal purchasing patterns, they must work through excess stock – but this is a short-term reset, not a long-term decline.

The biggest mistake industry observers and investors are making is assuming that this correction signals a permanent decline. If analysts had abandoned alcohol after the Spanish flu, they would have missed the Roaring ’20s. If they had written it off during Prohibition, they would have failed to anticipate its resurgence the moment the ban was lifted. If they had panicked during the low-carb craze, they would have ignored the explosion of craft cocktails and premium spirits. Every major shift in consumer behaviour has led to predictions of the industry’s demise – yet the industry has always rebounded, stronger than before.

This time is no different. The real mistake isn’t in the market’s adjustment – it’s in failing to recognise it for what it is: temporary and necessary.

Related news

Uncle Nearest unleashes Master Blend nationwide