Spirits Capital debuts barrel exchange platform

Digital cask investment company Spirits Capital has launched a barrel exchange platform that aims to ensure transparency in the industry.

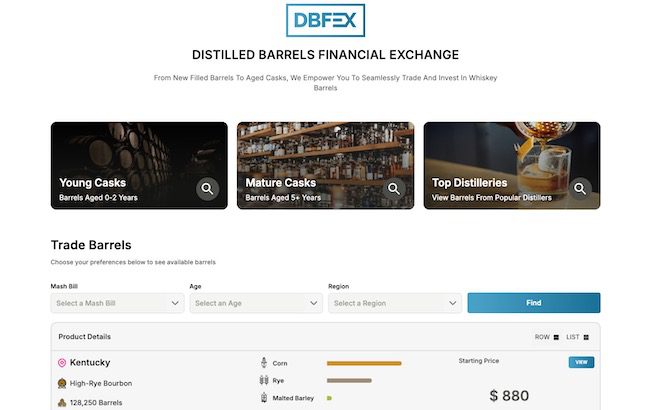

Spirits Capital, an Arizona-based company that merges technology with the global production, management and transactional needs of the barrel-aged spirits market, has launched the Distilled Barrels Financial Exchange (DBFEX).

The platform, which seeks to ethically facilitate the sale of wholesale barrels, opens with more than 200,000 casks from multiple distilleries, collectively valued at approximately US$400 million.

“We’re working closely with independent and branded distilleries, brokers, and institutional investors to onboard inventory into the management software system and onto the DBFEX platform,” chief revenue officer Ray Franklin said.

“This collaboration enhances market access and streamlines the entire transaction process.”

Franklin joined Spirits Capital in November, leaving Atlanta-based spirits company Staghorn, which he founded in 2017. In his role at Spirits Capital, he will oversee DBFEX operations.

The exchange platform uses proprietary machine learning technology and a subscription-based software as a service inventory management and compliance tool, which creates a transparent and secure process for distillers, investors, brokers, and brands to buy and sell barrel-aged spirits.

“Our platform offers disruptive tools, supported by a scalable, cloud-based infrastructure, ensuring the reliability and adaptability needed to respond to evolving market dynamics,” CEO and chairman Todd Sanders explained.

“Before DBFEX, the buying and selling of barrels were controlled by a limited group of brokers, with pricing determined by the scope of each individual transaction. DBFEX changes the game by offering real-time access to quantities, prices, and valuations to all potential buyers and sellers, ensuring a more transparent and efficient market.”

Related news

The English unveils ‘once-in-a-generation’ whisky