Rum sees ‘mixed’ performance in US

The performance of rum in the US has been ‘underwhelming’ in recent years due to a lack of premiumisation and a shortage of new brands.

IWSR’s US Navigator – which tracks monthly volume data in the States for all alcohol segments by price tier – analysed the rum category’s volumes over the past five years.

Looking at the category’s US volumes between January and August 2019 compared with the same period in 2020, rum posted a 4% increase. For the same eight months in 2020, compared with 2021, the category rose by only 2%. Total spirits performed better than rum, with a 5% rise in the US across both periods.

IWSR said rum fell into decline from 2022 to the year to date, with all subcategories posting volume drops. Flavoured rum – the largest subcategory, accounting for 43% of total rum volumes in the US – saw the worst decrease.

From January to July 2024, IWSR data showed that rum in the US fell by 5% year on year with total spirits down by 3%.

Florida is the leading US state for rum sales with 15% of the category’s volumes consumed in the area between January and August 2024, up from 12% in 2019.

This is followed by New York at 8%, California at 7% and Texas at 6%, with Pennsylvania, Michigan, Illinois and Wisconsin each holding a 4% share of the market.

For the first eight months of 2024, all states saw a decline from rum’s peak in 2021. Florida fell by 3%, New York dropped by 1% and California decreased by 7% during the eight-month period, when compared with 2021.

New Jersey, Massachusetts, Georgia, Maryland, Louisiana, Connecticut, Hawaii and Rhode Island all fell by 8% this year when compared with the sector’s high point in 2021.

IWSR says premiumisation in the category has been ‘robust’ but is occurring within lower price tiers than whisky and Tequila.

The vast majority of premiumisation has been evident between value and standard price tiers, the IWSR noted.

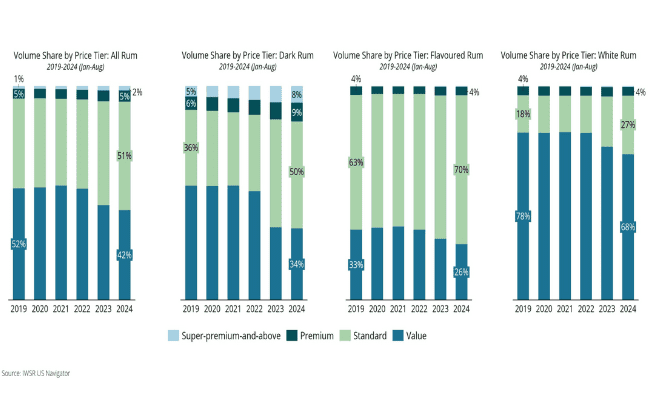

The value price tier for rum between 2019 and 2024 has declined from 52% to 42% in volume share, while standard has gone from 42% to 51%, and premium-and-above has only increased by 1% from 6% to 7%.

In Florida, the standard price tier increased its share of the rum market in the state from 15% in 2019 to 43% in 2024. The value segment shifted from an 80% share to 51% over the same time frame.

It was a different picture in New York, where both the standard and value price tiers lost share to premium-and-above brands, which gained five percentage points to reach 12% of the market in 2024 – the largest gain of the category’s top eight states.

Dark rum drives premiumisation

IWSR believes the premiumisation trend is constrained to dark rum with premium-and-above variants increasing their share from 2019 from 11% to 17% this year.

IWSR noted that white and flavoured rums have not been able to premiumise beyond the standard price segment, while premium-and-above rums sit at a 4% market share.

“The lack of a standardised framework for rum production makes it harder for brands to convey a quality ladder across rum products,” explained Marten Lodewijks, president of IWSR’s US division.

“High-end rums, however, are relatively more affordable than high-end products in competing categories. Brands could lean into this, especially in the current economic climate.”

IWSR has also noticed a shortage of new brands entering the market, resulting in ‘lower consumer excitement’. The analyst believes a focus on rum-based ready-to-drink products could help drive consumer interest.

Related news

Appleton Estate unveils £59,320 51YO rum