Celebrity-backed Tequilas up 16% in 2023

IWSR data has found that celebrity-backed spirits brands often outperform the growth of their categories globally, with Tequila receiving the biggest boost.

While the rate of celebrity brands entering the global market has slowed from 2022, IWSR found that brands that are owned or highly backed by celebrities tend to see larger volume growth than the global category as a whole.

In 2023, celebrity whiskies grew by 8% in volume, compared to 2% for the whisky category as a whole.

In the same year, celebrity rums rose by 11% – majorly outperforming a category that declined by 4%.

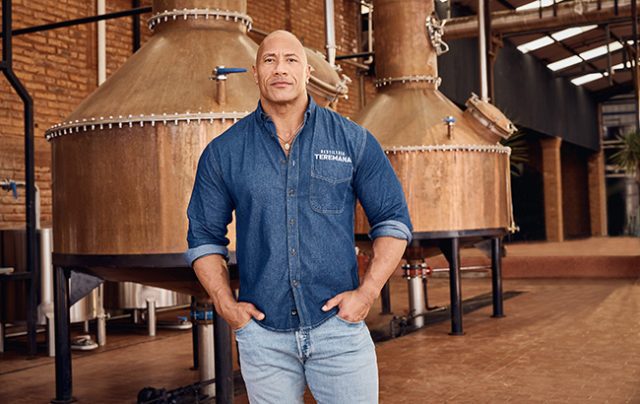

However, the category that has seen the biggest impact from star involvement is Tequila.

In 2022, Tequilas founded by celebrities soared by 40%, three times the category growth rate of 13%, while last year the figures were 16% for celebrity Tequilas against 3% for the category as a whole.

IWSR attributes this growth to timing, with the renaissance of the Tequila category coinciding neatly with the rise of celebrity spirits.

Furthermore, the category is attracting large numbers of new drinkers who are looking for something premium but reassuring – two things that endorsement from a famous person can provide.

Consumer trust

IWSR’s report noted that star association with brands offers consumers, particularly fans, a ‘degree of trust’ when purchasing spirits.

In addition, associating with a household name brings an instant potential consumer base for brands, who are primed to be ‘inherently receptive’ to the product and ‘instantly accessible’ by a larger social media network.

As such, products can enter the market almost fully-formed.

Emily Neill, chief operating officer of market research, IWSR, explained: “With celebrity involvement, a brand immediately has a personality ready-made. Non-celebrity brands, by contrast, have to work over a period of time to create their personality and positioning.”

Last year, celebrity brands accounted for 10% of spirits sold in hospitality insights platform Union’s venues in the year ended 31 July 2023, with Diageo-owned Casamigos (co-founded by George Clooney) the most popular choice.

It was also found that ‘star power’ encouraged consumers to spend more, with the average price of a celebrity spirits drink at US$16.25, compared with US$9.38 for all brands.

No guarantee of success

However, star power does not always guarantee success for a spirits category.

In 2023, despite launches from the likes of Brad Pitt, Emma Watson and Margot Robbie, volumes of celebrity-owned or backed gins declined by 1%, against a gin category that grew by 4%. The previous year saw celebrity-backed gins soar by 32% while the category rose by 8% globally.

Neill added: “When a category is trending, like Tequila, you can see celebrity brands outperforming. But when a category is beginning to struggle and the boom has ended – like gin – being a celebrity brand doesn’t always insulate you from that downturn.”

Related news

The most successful celebrity-backed spirits brands