Can single malts from India compete with Scotch?

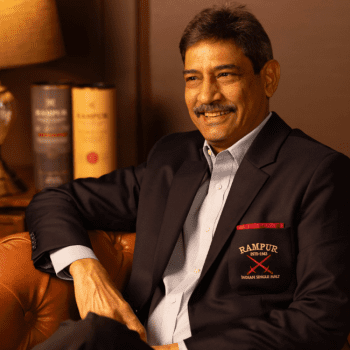

As alcohol volume sales in India ramp up, it will be sooner rather than later that its single malts are competing well with Scotch whisky, Sanjeev Banga, president – international business at Radico Khaitan, has forecast.

In the same sense that New World wines are now competing with traditional regions, and are considered premium like their traditional counterparts, Sanjeev Banga, president – international business at Radico Khaitan, doesn’t see why Indian single malts won’t transform in the same way.

Speaking to The Spirits Business, he said: “No offence to the Scotch whisky industry, but the consumer today is looking at innovation, new products, they’re looking at new experiences, which new world single malts, like those from India, are giving it to them.”

As one of the largest alcohol beverage companies in India, Radico Khaitan produces 310 million litres of alcohol a year. It has brands such as Indian single malt Rampur under its banner, produced at the foothills of the Himalayas. Banga said although “everyone is talking about Indian single malts right now” and the category is the “new kid on the block”, it is still very much in the early stages of its growth – and this extends to Indian-made spirits in general.

The years from 2022 to 2027 have been pinpointed as the period when spirits will see rapid growth (according to IWSR Drinks Market Analysis), but Banga contends that before measuring figures, the category hasn’t “tested the waters completely”. “In terms of our Rampur Indian Single Malt, we are in a very strange situation – for lack of a better word – because the demand outstrips the supply,” Banga explained.

“Most of Rampur still remains on allocation, and a lot of the malt, which has been resting and maturing in the casks, is now getting ready for bottling this year onwards. The true test of how the category is growing will come only after we start supplying what the market demands.”

So what is the potential? He said: “We’ve just touched the tip of the iceberg, as they say, and there’s a long way to go before we say ‘yes, now we’ve reached a certain stability in the volumes for our single malt in a particular market’.”

Banga also said the company was yet to tap into the “unlimited” potential that Rampur has in India itself. “Just to put it in perspective, we have seven Rampur expressions available internationally, and only one expression is available in the domestic market – our footprint within India is minuscule at the moment.”

Leaning into luxury

Outside of Rampur and single malts, luxury spirits made in India are finding big appeal internationally – this goes for vodka, gin, rum, almost all the big categories. Banga thinks this stems from “a mysticism about the country”. The focus of Radico’s strategy, he continued, is on the premium segment and premium offerings, which offer the company high double-digit growth. The company has acted as something of a market disruptor with entries into these categories.

For starters, its recent Kohinoor Indian Dark Rum release looked to address the growing demand for rum (especially in the UK), along with the premiumisation trend. Banga said: “Rum distillation or sugarcane molasses distillation actually started in India, then it moved to the Caribbean market, but you never had a premium gin or rum offering from India and it was about time we addressed this segment and filled this gap.”

Then there’s the company’s Jaisalmer craft gin, which looked to overlap with the gin boom in Europe over the past eight years. In addition, the company is planning to launch the fifth and sixth expressions in its Jugalbandi series this year – a limited edition range of eight Indian single malt whiskies, which take after an ancient Indian musical art form. “The consumers are loving the premium and luxury offerings coming from the Radico portfolio. They are very happy about it, not only in India but globally as well,” he noted.

Travel boost

In terms of a global push, Banga highlighted that travel retail has become a significant channel for giving luxury spirits from India a platform on the international stage, though this is still a new development. He believes the void created by the decline in Chinese citizens travelling has been filled up by Indian travellers, who are “spending far more”.

“Air traffic is growing significantly in India and more Indians are travelling than ever these days, and they would love to take [Indian spirits] for their own consumption, as well as gifts to their friends and relatives overseas,” he said.

Could Indian single malts and luxury spirits be the next big thing? The future is bright, visibility is clearly increasing, and growth is looking healthy in areas such as Europe, but Banga is coy on when we might see its full potential.

“There’s still a long way to go, but the world is recognising and accepting that India is producing world-class spirits,” he assured. “And it’s about time they experiment and experience that uniqueness that India has to offer to the world.”

Related news

Clydebuilt reveals new batch of single malts