Inflation leaves ‘little to celebrate’ for UK drinks trade

The rate of inflation for alcohol is four times the UK government’s target leaving “little to celebrate” for the drinks industry, the Wine & Spirit Trade Association (WSTA) warned.

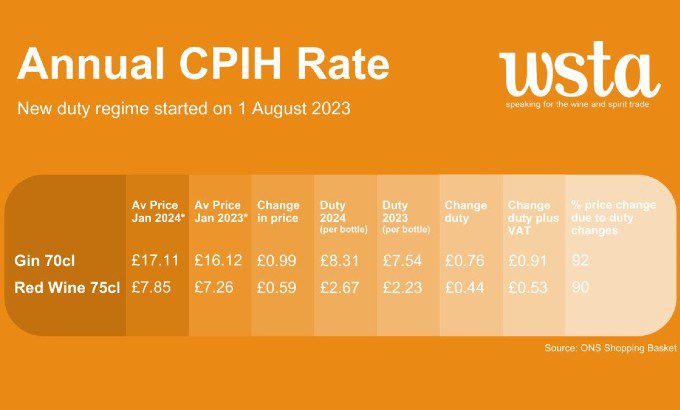

Inflation in the UK remained higher than expected at 4% in January. The 10.1% alcohol duty increase on 1 August 2023 has been largely cited for fuelling the situation.

Furthermore, the tax hike has cost the Treasury more than £100 million (US$125.6m) in lost tax revenue.

Miles Beale, chief executive of the WSTA, said: “While it’s a relief that the headline rate of inflation is unchanged, food and drink inflation remains much higher: alcohol inflation if running at twice the headline rate and four times the government’s target.

“Overall, there is little to celebrate for our great British drinks industry. Last year’s record excise duty rises are by far the major factor driving alcohol inflation, forcing up prices for consumers, reducing demands and leaving SMEs [small-medium enterprises] struggling to stay afloat.

“The government’s own figures show that last year’s historic duty increases are fuelling inflation. Over 90% of the price increases consumers have been forced to suffer are down to duty increases introduced by government (see table below).

“If the government is serious about taking measures to cut inflation and keep prices down, the simple answer is to cut alcohol excise duty at the next budget and stop the duty system reforms where they are now.”

As the spring budget nears, the drinks industry is urging a duty cut for alcohol to support the sector. Duty was frozen in chancellor Jeremy Hunt’s autumn statement.

Related news

Golf drives Glen Moray push in UK travel retail