Top news stories of 2023

2023 was a tumultuous year for the industry, with legal spats, consumer boycotts, and takeovers in the news.

*This feature was originally published in the December 2023 issue of The Spirits Business magazine.

Diageo chief executive officer Ivan Menezes dies

In June, the industry was rocked by the death of Sir Ivan Menezes. The chief executive of Diageo died at the age of 63, following a short illness, during which time the company appointed Debra Crew CEO. Menezes’ death came just weeks before his planned retirement from Diageo after 10 years at its helm.

Javier Ferrán, chairman of Diageo, called Menezes a “thoughtful and passionate colleague and friend – a true gentleman”, and Philippe Schaus, CEO of Moët Hennessy, said: “It is a privilege to have known him and to have worked alongside him. Ivan was a wonderful partner to Moët Hennessy and to myself, and I will remember how jovial, quick-minded, smiling and supportive he was.”

The Scotch Whisky Association’s chief executive, Mark Kent, said Menezes “not only helped to shape the global success of the industry but laid the foundation for future generations”.

Pernod Ricard faces consumer boycotts

Russia’s invasion of Ukraine in 2022 saw many spirits brands halt their operations in the country, but it was Pernod Ricard’s moves in 2023 that saw it face a series of consumer boycotts.

In March the group confirmed that exports of its products to Russia had resumed to “ensure economic viability”, which prompted a backlash in Sweden, the home of its Absolut Vodka brand. In April it halted exports of Absolut to Russia.

Despite this decision, it was revealed that Pernod Ricard continued to export brands from the rest of its portfolio – including its Irish whiskey arm, Irish Distillers, as well as Beefeater gin, and Olmeca Tequila. Protests in London, Edinburgh, and Dublin followed, before the group finally announced in May that it had stopped exports of its international brands to Russia, and said that it was working to end the distribution of its entire portfolio in the country.

The Diddy-Diageo lawsuit

In May, rapper Sean ‘Diddy’ Combs filed a lawsuit against Diageo, alleging that the company had neglected his brand, DeLeón Tequila, because of his race.

In 2014, Combs and Diageo announced an equal partnership to buy DeLeón Tequila. In response, Diageo denied the allegations, and ended its 15-year partnership with Combs. The company’s motion to dismiss the lawsuit was denied by the Supreme Court of New York, allowing Combs to engage in ‘broad discovery’ aimed at uncovering evidence that the company didn’t support his liquor brands. Then, in October, Diageo announced it was countersuing Combs, alleging he had ‘leveraged’ allegations of racial animus to extort the firm. Diageo claimed Combs had not held up his end of the partnership, alleging the company ‘funnelled’ more than US$100 million into the venture, while Combs contributed US$1,000 and a promissory note.

The lawsuit is likely to continue in 2024.

Bushmills opens distillery

Irish whiskey brand Bushmills doubled its production capacity in April with the opening of its £37 million (US$46m) ‘state-of-the-art’ Causeway Distillery.

The project was part of Proximo Spirits’ £60m investment in Irish single malt distilling and maturation at Bushmills. The distillery takes its name from the Giant’s Causeway, and spans 39,000 square feet, taking the brand’s production capacity from five million litres of alcohol per annum to 11m litres.

In 2022, the brand reached the million-case sales mark for the first time.

As well as increasing production, the new distillery aids Bushmills’ sustainability goals, with thermal technology cutting energy use by 30%. Distilling innovations increased material consumption efficiency by up to 10%, and the distillery is run entirely on electricity from green sources.

Additional sustainable endeavours include supplying by-products to local farms as animal feed.

Dutch group Nolet to buy Lucas Bols

All eyes were on the Netherlands in October when it was announced that Nolet Group had agreed to buy Dutch drinks firm Lucas Bols for €269.5 million (US$283.7m). The two companies said that the deal would bring “two leading global spirits and cocktail companies with a rich heritage under one Dutch flag”.

Schiedam-based Nolet is behind the creation of Ketel One Vodka, Ketel One Jenever, and Nolet’s Gin, while Lucas Bols owns several liqueur brands, including Bols, Passoã and Galliano, as well as Tequila Partida.

The Lucas Bols Company retained its identity, name and brands, with its operations remaining in the Netherlands capital Amsterdam. The brand continues to be managed by current Lucas Bols CEO Huub van Doorne and chief financial officer Frank Cocx. Lucas Bols claims to have been founded in 1575.

Tequila overtakes American whiskey in US

The year started with a bang for Tequila, with the Mexican spirit named the second-most valuable spirit category in the US in January. IWSR Drinks Market Analysis said Tequila could overtake vodka in 2023 to be the biggest category by value.

Agave spirits contributed US$1.6 billion to the spirits industry in 2022, IWSR noted. This growth was responsible for 70% of the overall volume growth, and 65% of overall value growth of total US spirits. The report also noted that total spirits volume sales in the US grew by 2% in 2022 – with strong demand for premium-plus products. Premium-and-above spirits sales rose by 13% in volume terms in 2022, with 33% of Americans saying they had spent US$50 or more on a bottle of alcohol in 2022, up from 24% the previous year. The report also found that consumer spending and purchasing volumes were up in 2022 compared with 2021 in most tracked categories.

Baijiu to struggle as other spirits grow in China

American whiskey wasn’t the only spirit to take a hit in 2023, with China’s baijiu sales expected to struggle over the next five years as other spirits segments grow. China’s alcohol market saw a 4% volume decline in 2022, according to data from IWSR Drinks Market Analysis, with spirits volume falling by 17%.

IWSR said China’s alcohol market likely saw its “most challenging year of the past decade”, following renewed lockdowns and consumer caution. The country’s on-trade saw its market share fall by double digits in 2022, significantly below 2019 levels. Spirits are expected to post a volume compound annual growth rate (CAGR) decline of 4% between 2022 and 2027, entirely due to the performance of baijiu, IWSR believed. Excluding baijiu, all other major categories – whisky, gin, vodka, agave spirits, rum and brandy – are forecast to grow sales volumes by single-digit CAGRs (2022-2027).

Albert Baladi steps down as Beam Suntory CEO

Beam Suntory president and CEO Albert Baladi stepped down in October, although he will continue to serve as senior advisor to the company throughout 2024. Baladi had held the role since 2019 and had been part of the company’s executive leadership team for 12 years. During his tenure, Beam Suntory’s annual sales grew at high single digits to surpass US$5 billion.

Greg Hughes, who was formerly Beam Suntory’s senior vice-president chief growth and brands officer, took over as CEO. Hughes joined Beam Suntory in 2015 as president for North America.

Baladi said: “This is a decision I have been contemplating for some time with my family, and, given the strength of the company, the clear growth strategy in place for the future and the right team in place, now is the right time to hand the reins over to my successor, Greg Hughes, and his exceptional leadership.”

CWA launches – and the industry responds

The Cask Whisky Association (CWA) launched in September. The organisation is made up of two boards of members and advisors, and aims to protect cask whisky customers and the wider whisky industry by setting best practices in cask ownership and sale.

However, the launch raised questions for the industry, with members of the trade sharing concerns about its legitimacy. One whisky expert told The Spirits Business that the CWA “lacks transparency and accountability”, and has “clear London bias”.

But Colin Hampden-White of the CWA published a letter explaining that any businesses that operate in the UK could apply to join. He said: “[The CWA] is overseen and governed by an independent cross-industry advisory board, made up of individuals from distilleries and independent bottlers, as well as whisky experts, authors and legal and insurance professionals working in the sector.”

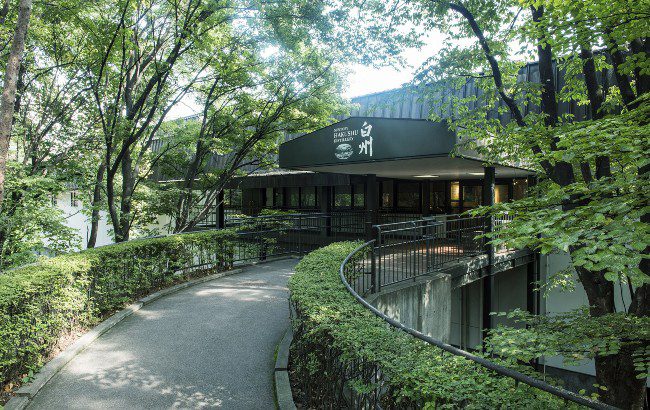

Suntory invests US$77m in Yamazaki and Hakushu

To mark 100 years since Suntory’s whisky production began, the Japanese producer announced it would invest approximately US$77 million into its Yamazaki and Hakushu distilleries by 2024.

Suntory founder Shinjiro Torii began his Japanese whisky journey in 1923, when he started making the spirit at the Yamazaki distillery, located on the periphery of Kyoto in Japan. It was the first malt whisky distillery in the country.

The investment was used to elevate visitor experiences and ‘enhance’ the whisky production processes, which introduced floor maltings at both distilleries. Hakushu Distillery reopened to the public in September, with Yamazaki following in November. The renovated Yamazaki Distillery has a new entrance, a new reception and an ‘enhanced’ interior for the Whisky Museum and a new tasting lounge. Both distilleries introduced new tours, with a regular tour and a premium option available at both.

Related news

Cocktail stories: Speed Bump, Byrdi