Slow US recovery hits Rémy Cointreau sales

French firm Rémy Cointreau saw sales fall by 22.2% in the first half of 2023/2024, with a double-digit decline expected for the full year.

From April to September 2023, the company’s organic sales reached €636.7 million (US$672.7m), with second-quarter revenue falling by 10.8%.

It followed a sales decrease of 35% in the first quarter (April to June).

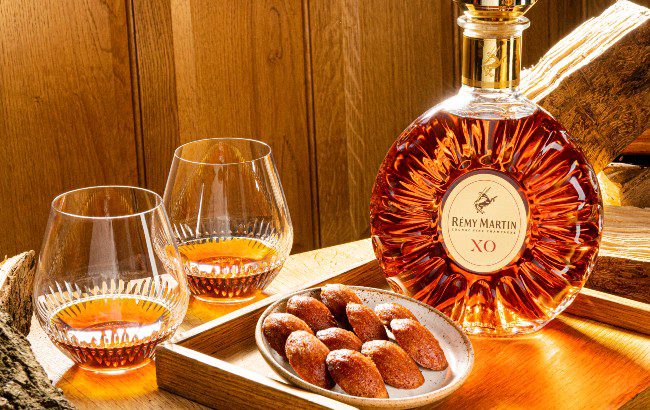

Rémy Cointreau’s Cognac division fell by 30.1% to €416.1m (US$440m) over the six-month period. The company attributed the sales drop to a ‘steep decline’ in North America, where it faces a normalisation of consumption and an ‘intense’ promotional environment.

Within Asia Pacific, Cognac reported ‘solid’ sales growth in China during the Mid-Autumn Festival, despite a ‘slower than expected’ recovery from the pandemic.

The Cognac division also reported a ‘very strong’ performance in Latin America.

The group’s liqueurs and spirits arm rose slightly by 0.1% to €206.7m (US$218.4m), driven by a double-digit sales gain in the second quarter (up 12.1%).

Rémy Cointreau reported a ‘steep’ sales rise in the second quarter, boosted by Cointreau liqueur, Bruichladdich whisky and The Botanist gin.

First-half sales in the Americas plummeted by 49.9%, while Asia Pacific declined by 16.6%. However, sales in Europe, the Middle East and Africa (EMEA) rose by 8.9%.

Adjusted outlook

The French firm has altered its predictions for the 2023/2024 full year after ‘worsening market conditions’, mainly in the US.

In the US, Rémy Cointreau said a rise in interest rates has cut distributors’ financing capacity. The group had forecast a rebound in the third quarter, but this is now anticipated in fiscal 2024/2025.

A slower rate of sales is also expected in Latin America due to the gradual post-Covid recovery. More moderate growth is predicted in the EMEA region.

To protect its profitability, Rémy Cointreau will tighten its overheads by maintaining a ‘strict’ pricing policy, ‘significantly’ reducing its operating costs, and ‘selectively’ cutting its marketing and communications spend.

As such, the group has adjusted its full-year objectives to a predicted decline of between 15% and 20% in organic sales.

Exchange rates are also estimated to negatively impact the group’s sales by a decline of between €50m and €60m (US$53m-US$63m) for the full year.

For the current financial year, Rémy Cointreau expects its Cognac inventories in the US to return to ‘healthier levels and absorb the effects of post-Covid normalisation before heading into 2024-25 in the best possible conditions’.

Related news

Tariff uncertainty hits H1 sales for SMWS owner