Hitting the wall: Australia’s spirits taxes block expansion

Australia’s distillers say the international expansion they crave is being blocked by punitive spirits excise tax. Luke McCarthy investigates.

Australia’s complicated relationship with spirits excise tax is longstanding and convoluted. From the 1820s onwards, distillers in the country have continuously locked horns with governments to establish an even-handed approach to excise that also allows for sustainable growth for the spirits industry.

On 1 August this year, the excise rate on Australian distilled spirits rose to AU$100.05 (US$63.86) per pure litre of alcohol following the latest six-monthly increase in line with the consumer price index.

Australia now has the third-highest spirits tax in the world, behind Iceland and Norway. With more than 600 distilleries and spirits manufacturers in operation, supporting more than 50,000 direct and indirect jobs, the spirits industry is calling for a freeze on excise increases and a rethink of the current system.

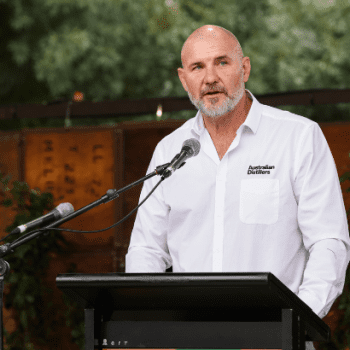

“AU$100 a litre is a devastating blow,” says Paul McLeay, the chief executive of the Australian Distillers Association, the industry’s peak body for producers. “When these policy settings were introduced in 1983, 40 years ago, there were two producers paying this tax. Now there are over 650 businesses that are caught up in this. The policy settings have stayed the same, yet the industry has significantly changed.”

The change McLeay speaks off is the explosion in new Australian distilleries. Whereas around 50 were active a decade ago, now more than 350 are operating throughout the country.

Two-thirds of these distilleries are located in regional areas, says McLeay, providing manufacturing jobs, tourism opportunities and support for other industries.

Cameron Brett, president of the Tasmanian Whisky and Spirits Association, and co-owner of gin and whisky producer Spring Bay Distillery, has seen first hand how distilleries can reinvigorate the regions.

Brett and his wife, Suzanne, founded their distillery in 2015 in the rural locality of Spring Beach, with a population of around 100 people, on Tasmania’s stunning east coast.

“It’s almost as if every town in Australia has a distillery now, and everyone loves their local distillery. But the excessive excise increases have put a handbrake on our ability to grow. These costs significantly reduce our capacity to reinvest in our businesses and break into new markets, and that’s a concern for the whole industry.”

With so many Australian distilleries now releasing award-winning spirits, the export market is shaping up as the next goal.

International visitors

The recently held Tasmanian Whisky Week (7-13 August) attracted global visitors to the island state, many of whom would like to get their hands on more of the area’s sought-after single malts. But scaling up distilleries to produce enough product to export is the next big hurdle. “For the medium- to large-scale distilleries that are looking to export, the excise rate significantly reduces their capacity to competitively price their products against international competition,” says Brett.

“As an industry, it’s hindering our ability to grow and enter new markets as we try to build the Tasmanian whisky and spirits brand internationally.”

The international market for Australian spirits was firmly on the mind of Leigh Attwood, co-founder of Backwoods Distilling Co, when he recently visited the US. Attwood was a part of a delegation of Australian distillers that attended the Distilled Spirits Council of the US’ annual conference in June, one of America’s leading spirits industry events. “The major problem with excise in Australia is scaling up our distilleries,” says Attwood. “Nothing emphasises that more than a trip to the US, where massive distilleries are everywhere, and they’re supported by an excise rate that’s almost a tenth of what we pay.”

Backwoods Distilling is located in the small rural town of Yackandandah, three-and-a-half hours north of Melbourne. Attwood and his wife, Bree, founded the distillery in 2017, and have quickly found a devoted following for their rye and single malt whiskies, and a range of popular gins.

When they started, they took advantage of a rebate that allows eligible distillers to receive a full remission on any excise they pay up to an annual cap of AU$350,000, a scheme that was implemented in 2021.

But with their business now well established, and demand for their spirits increasing, like many Australian distillers, they face a roadblock. “In Australia, there’s no incentive to grow beyond the AU$350,000 rebate,” says Attwood.

“We want to grow and we want to employ more people, but it’s almost not worth pursuing growth because once you start running your business above that threshold it’s a completely different game.”

Australian spirits producers are also targeted much more punitively than wine and beer makers, with different excise rates applied to products depending on their type and alcohol content. “We think the system is broken,” says McLeay. “Australians pay more than double per standard drink for spirits than what they pay for beer, and far in excess for what they’d pay for a glass of wine. The government is basically saying don’t drink craft spirits, we’d prefer you drink beer and wine, and we don’t think that’s the government’s role.”

Address the issues

McLeay and other spirits industry bodies want the Australian government to put a freeze on excise and stop the twice-yearly increases. Tasmanian producers would also support an indexing of the rebate, says Brett, so at least small businesses can grow until the larger systemic issues are addressed.

“Our industry has grown faster than any of the regulators or politicians can keep up with, but there’s a huge opportunity to support a sector that ticks a lot of boxes,” he says.

“Our businesses are very environmentally friendly – a lot of our distilleries here are either carbon neutral or close to it. They employ people in more remote areas, and we have great tourism offerings that stimulate rural economies and get people travelling to the regions. We could be the darling of a rebuilding economy post-Covid-19 if we can get the settings right.”

Related news

Spirits in limbo as RNDC exit disrupts California