South Korea shows promise for spirits

With a burgeoning young middle class, South Korea looks set to be a hotspot for alcohol consumption in Asia Pacific. While soju might rule the roost, producers from other drinks categories are keen to make their presence felt.

*This feature was originally published in the May 2023 edition of The Spirits Business magazine.

K‐Pop – Korean popular music – has become the international face of South Korea. Groups such as BTS and Blackpink have become global icons – and, as a result, interest in South Korea has been piqued like never before over the past few years. K‐Pop may not have caused a spike in spirits interest in South Korea, but over the same period, international alcoholic beverage brands have been showing increasing interest in the Asian market.

Korean soju brand Jinro remains the world’s biggest‐selling spirit – and saw a serious sales increase in 2022. Its nine‐litre‐case sales rose from 94.5 million cases in 2021 to 100.9m in 2022, marking a 6.8% increase from an enormous starting point.

“As the Korean wave is spreading out to all around the world, Korean food and drinking culture is also having a great impact on overseas consumers,” says Kim Kang‐wook, overseas business headquarters global strategy team manager, at Hite‐Jinro, parent company of the Jinro soju brand. “Korean soju is also influencing overseas consumers, so the Korean market is a very important starting point for our company, as the competitive edge in the Korean market leads to overseas markets.”

National spirits

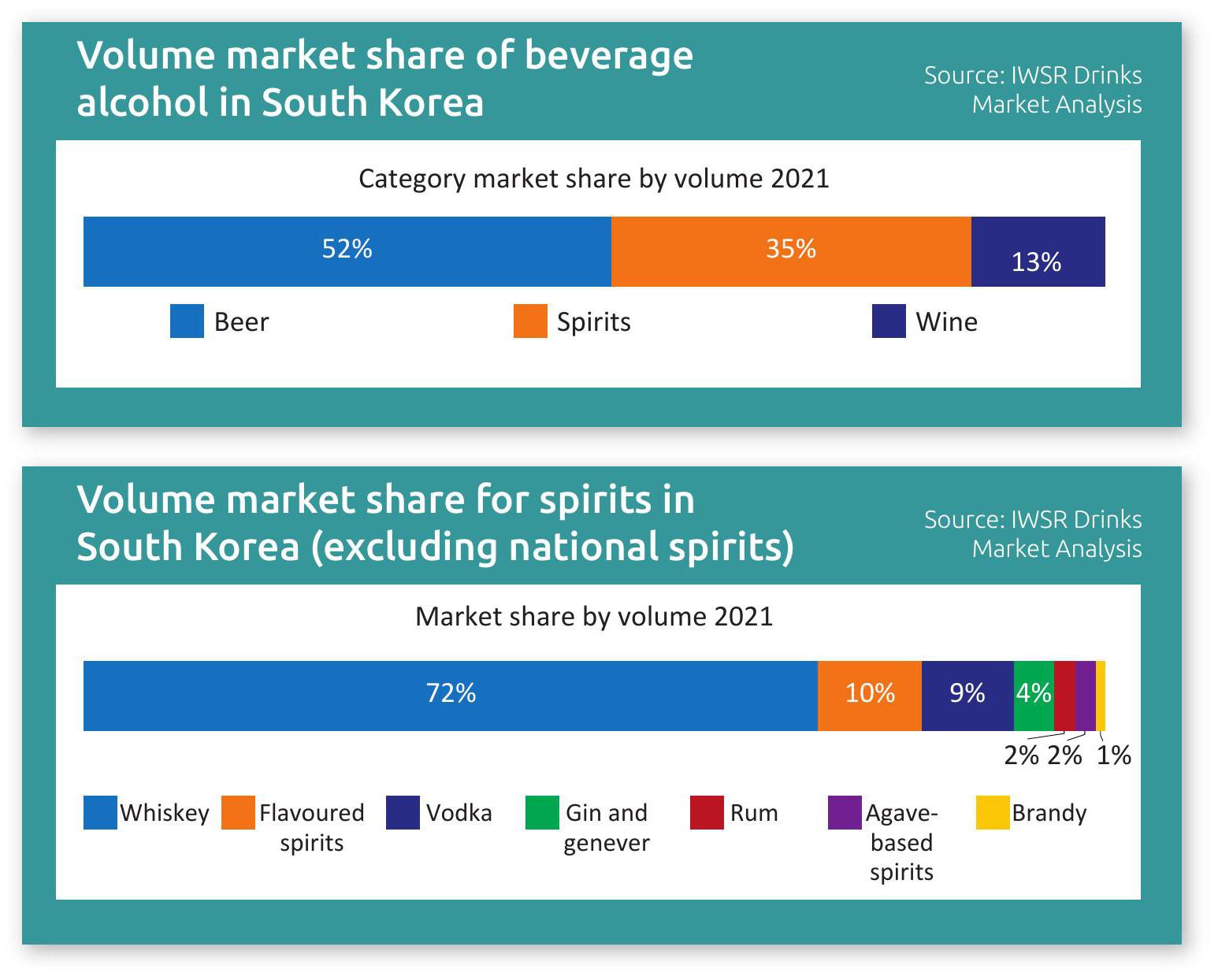

National spirits made up more than 95% of spirits volume consumption in South Korea in 2021, and 80% by value, according to data from IWSR Drinks Market Analysis. Beer is the majority shareholder of the South Korean market, followed by spirits, then wine. Looking at the volume market share for spirits in South Korea alone (excluding national spirits), whisky is the dominant category, commanding 72% in 2021, according to IWSR Drinks Market Analysis. During the Covid‐19 crisis, South Korea coped relatively well during 2020, when cases remained in the hundreds. But 2021 was when the pandemic was felt with full force. The emergence of a new variant of Covid‐19 caused the South Korean government to extend its ‘administrative order’ during the first 10 months of the year.

The country’s ‘traditional on‐trade’, such as karaoke or hostess bars, was highly affected, while the ‘modern on‐trade’ faced limitedcapacity restrictions and early closing times. At‐home drinking meant a rise in off‐trade sales – but it was still wine that benefitted the most from this occasion‐shift.

Spirits categories that ‘rely heavily’ on the modern on‐trade channel – gin, rum, Tequila, vodka, and American whiskey – increased in 2021, thanks due to more at‐home drinking, IWSR Drinks Market Analysis notes. By contrast, soju saw a ‘modest decline’ in 2021, attributed mainly to the Covid‐19 restrictions. “A huge decrease would have been expected during this period,” notes Jonathan Ho Chen Chong, marketing analyst at IWSR. “However, soju is the staple drink for Koreans, and it is easily available via other channels.

Convenience stores and marts were not fully closed, and consumers were still able to get soju from nearby stores.” It shows the power soju commands in its home market.

“Considering the substantial market share of local soju, any shift in other spirits may seem comparatively insignificant,” Ho Chen Chong continues. Take soju out of the equation, and no “major changes” are expected in South Korea’s spirits consumption. “Vodka is expected to continue its downwards trend, while whisky is expected to remain the dominant category, with Scotch whisky projected to gain further market share from other types of whisky, particularly those with lower alcohol content that are based on Scotch,” Ho Chen Chong adds. “In the Scotch whisky category, malt Scotch is expected to continue its expansion and increase its market share. We foresee a growing consumption of Irish whiskey.”

Valuable market

Figures from the Scotch Whisky Association (SWA) support Ho Chen Chong’s insights. In 2021, South Korea was worth £63.8m, or 8.4m bottles in direct exports, the SWA notes. In 2022, this number jumped to £124.5m, or 14.1m bottles, making South Korea to the 17th most valuable market for Scotch exports globally – and the seventh largest in Asia Pacific by value. However, the figures portray a post‐Covid‐19 recovery year, SWA points out, and the figures are still significantly below the 2009 peak, according to the trade body.

“South Korea is an increasingly premium market,” notes Emily Roads, head of trade (Asia Pacific) at the SWA. “While bottled blended Scotch whisky makes up the majority of exports (around 65%), there has been strong growth in demand for single malts, which accounted for about a third of exports in 2022, up from a 3% market share in 2012, and a 13% market share in 2019. This premiumisation has helped maintain South Korea as an important export market for Scotch whisky, despite a significant fall in exports over the past decade.”

The trends Roads sees in South Korea mirror those in the wider Asia Pacific region. Last year, the area became the highest valueexport market for Scotch – overtaking the EU for the first time. “In 2022, the region was worth £1,818m [US$2,271.8m] (29% of global exports), and was the second largest by volume, totalling the equivalent of 479m bottles (29% of global exports),” Roads adds.

“There are significant opportunities for further growth in the region, with markets such as Vietnam, Malaysia, Thailand and the Philippines all showing strong signs of growth, and with a growing young middle‐class population, we can see greater interest in high‐quality, premium products like Scotch whisky.”

Let’s return to Ho Chen Chong’s note about foreseeing a “growing consumption in Irish whiskey”. Following Scotch whisky’s entry route into South Korea, it would make sense for the category’s Irish counterpart to follow suit – with an audience familiar with whisky in waiting. Belfast Distillery Co is already eyeing up the market. The owner of McConnell’s Irish whiskey secured a distribution deal with Goldenblue in South Korea this year, including a shipment of almost 10,000 bottles to South Korea. The partnership was supported by government agency Invest Northern Ireland’s new team in the South Korean capital, Seoul.

Free trade between the UK and South Korea is under discussion, as the UK government launched an eight‐week consultation in December 2022 regarding formulating an enhanced free trade agreement between the two nations. The aim is to create a “more modern and fit‐for‐purpose deal” that builds on the existing £14.3 billion deal. What potential impact could this have on the spirits scene? “This is of special interest to the Scotch whisky industry, as we look to iron out a number of trade barriers and market‐access issues that could grow our exports to this market,” advises SWA’s Roads.

“Examples of change we’d like to see include tariff‐free access for products that arrive in the market via distribution hubs such as Singapore: a longstanding concern for the Scotch whisky industry.”

E‐commerce is another area that holds potential – but the rules in South Korea are strict. Currently, the law only allows clickand‐collect online alcohol orders, not home delivery. The exception to this rule is the ordering of traditional alcohol, like soju. Understandably, this is something the SWA is keen to have amended. “Improving this issue in line with international best practice will help ensure the e‐commerce market in South Korea is a safe and responsible sales avenue,” says Roads.

“With the right support from governments on both sides of the UK‐South Korea FTA negotiations, the Scotch whisky industry can continue to boost exports to a market that remains an important player in the Asia Pacific region, while ensuring that consumers have choice and access to a wide range of Scotch whisky products.”

Bryan Do, the founder of Korean distillery Three Societies, says the introduction of clickand‐collect via the Smart Order policy in 2020 has “made high‐end spirits more accessible to consumers”. At the start of 2023, three Societies released the first South Korean single malt whisky, called Ki One (40% ABV). The producer also introduced its Cask Strength whisky (57.7% ABV). A single malt gin, Jung One, is also in the works. Do notes two key trends influencing consumer drinking habits in South Korea: premiumisation and lower‐ABV spirits.

“Many people are looking to enjoy and ‘flex’ through social media when drinking, so the premium bottles are being sought after more,” Do adds, and says consumers in their 20s and 30s are increasingly seeking something new, whether it be from local or imported brands. “With an increasing focus on health, many people are trending towards drinking better quality products in a lesser amount.” He notes how the soju market in South Korea is “very competitive”, but less so for Western spirits. “The local market is less aware of these spirits, such as gin, brandy, or Cognac. However, since whisky is ubiquitous, imported single malt whisky is very competitive.”

Taiwanese whisky brand Kavalan has also enjoyed recent success in South Korea, but from a different channel to Scotch and Irish. In 2022, its sales more than doubled with 169% growth, led by a 115% rise in travel retail. The brand credits South Korean movie Decision to Leave for its success. Created by South Korean director Park Chan‐wook, the film features a brief cameo from Kavalan Solist Oloroso Sherry.

“Exposing Kavalan as a whisky endorsed by celebrities positions it as a premium brand,” says Britney Chen, regional brand ambassador and global PR officer, Kavalan. It also helped to “minimise price‐increase issues, and created positive viral content”, Chen adds. “Consumers were introduced to Kavalan as a competitive brand that has excellent taste and a competitive price among major brands.”

Chen says South Korea has become one of Kavalan’s biggest export markets thanks to the “continued growth of Korean culture globally”. “As such, it likely to remain an important market, not only in Northeast Asia but also globally. We remain modest and cautiously optimistic about its potential for further growth in the Korean market, especially with the Sherry Cask series.”

Could South Korea be the next big spirits market in Asia? It is looking increasingly likely.

Related news

Cocktail stories: Speed Bump, Byrdi