Diageo to focus on premium acquisitions

Johnnie Walker owner Diageo said it would continue to focus on acquiring brands from within the premium spirits category.

The firm released its half-year fiscal 2023 results yesterday (26 January), in which it credited its ‘diversified footprint’ and advantaged portfolio for its 9.4% growth across all regions.

The company’s acquisitions and disposals over the last six months have led to a diversified portfolio, which is said to have supported the company’s sales growth.

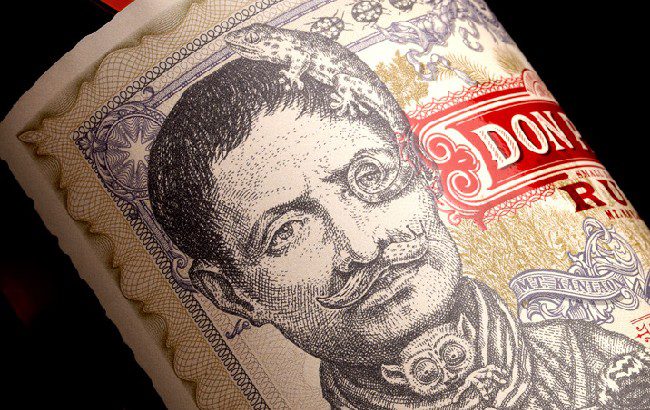

Speaking to The Spirits Business, CEO Sir Ivan Menezes said: “What we’re most interested in is high-quality brands at the premium end of the market that have a good runway for growth. What we saw in Don Papa was a very differentiated brand that’s doing really well.”

Diageo agreed to acquire Philippine rum brand Don Papa for an initial €260 million (US$281.5m) earlier this month.

The firm also acquired Australian premium-priced coffee liqueur Mr Black in September, and added Texan single malt whiskey producer Balcones Distilling to its portfolio in November.

Menezes confirmed future acquisitions would not be based on gaps in the company’s portfolio, but rather on “the quality of the brand”.

“You can expect us to keep [looking for premium, quality brands],” he said, while noting that finding brands that fit that criteria was “not easy”.

“We have a strong balance sheet and we will continue to stay active to add attractive brands. Our mergers and acquisitions team are constantly evaluating everything that’s out there, and as you can see, we’re disposing of less attractive parts of the portfolio to balance that.”

Last year, Diageo sold peach schnapps brand Archers to De Kuyper for an undisclosed sum.

Innovation versus acquisition

While Diageo owns more than 200 brands, the industry giant has not produced a million-case-selling brand since it launched Cîroc Vodka in 2003, with all of its other million-case-selling brands being the result of acquisitions.

Despite this, Menezes confirmed that research-and-development and innovation were still very much a part of the business, and it was not giving way to acquisitions.

“We definitely have innovation in the business,” he said. “And we punch above our weight; we get disproportionate share out of innovation.

“We’re not shifting away from innovation to acquisitions.”

Related news

Diageo named Live Nation festival partner