Call to ‘fix’ spirits tax system in Australia

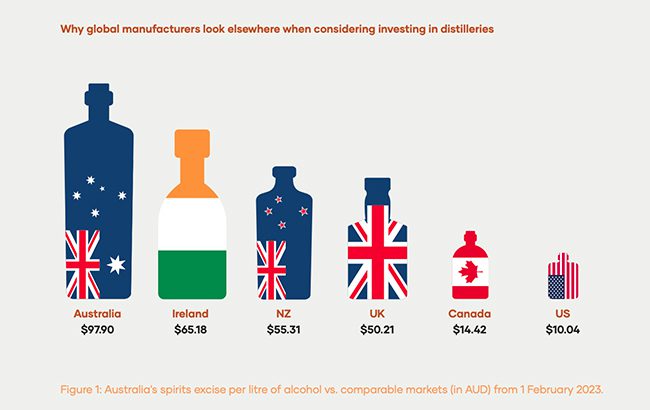

By Nicola CarruthersTwo trade groups have called on the Australian government to reduce excise tax on spirits, said to be the third highest in the world.

The Australian Distillers Association, together with trade body Spirits & Cocktails Australia, has lodged a joint Pre-Budget Submission ahead of the government’s 2023-2024 federal budget. The budget is expected to be held on Tuesday 9 May.

In August 2022, Australian distillers were hit with the biggest tax increase in nearly 50 years. Tax rose to AU$94.41 per litre of pure alcohol, based on consumer price inflation (CPI) figures.

From 1 February 2023, spirits tax is due to rise by 3.7% to AU$97.70 per litre of pure alcohol. Tax increases are implemented every six months in Australia.

The submission asks the government to make ‘modest changes’ to the country’s spirits tax regime.

This includes reducing the excise rate for the category to bring it in line with brandy, and freezing CPI on spirits and brandy tax rates for three years.

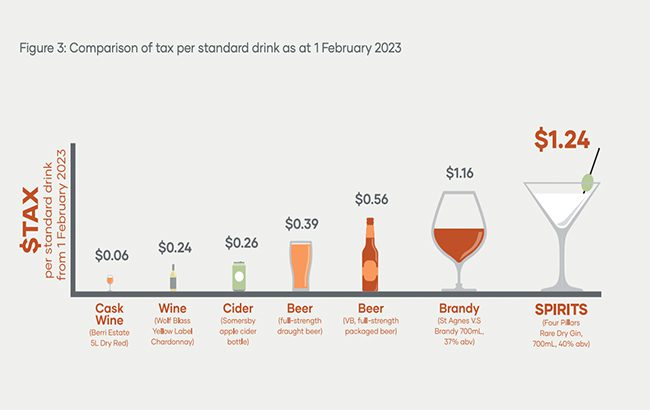

Spirits are taxed at one level if they are fermented from grapes (specifically brandy), and at a higher rate if fermented from grain (such as whisky).

The document called the spirits tax ‘unsustainable’ and noted that it is more than double the duty that is enforced on beer and wine.

The trade bodies said the latest CPI increase means distillers are ‘staring down the barrel’ of paying AU$100 tax per litre of alcohol, compared to beer which hovers at the AU$50 mark.

The document read: “This means Australian distillers cannot adequately invest to expand our businesses and explore new opportunities, like export or distillery door tourism. This particularly impacts regional communities because two thirds of distilleries are based in regional areas. It also runs contrary to the government’s ambition to build local manufacturing capability.”

According to the submission, the Australian spirits industry delivers more than AU$11.6 billion in value to the country’s economy each year, and more than 52,900 direct jobs, with 5,000 of these jobs in spirits manufacturing.

The trade bodies cited analysis from PwC that estimated that a reduction in spirits excise and a CPI freeze would deliver a full-year net increase of AU$143 million to government revenue, and a small drop of 0.22% in alcohol consumption in Australia.

‘Comparative disadvantage’

From 31 July 2021, brewers and distillers could receive a full remission of any excise tax, up to AU$350,000. The submission noted that while this benefitted distillers, it limited their plans to ‘grow beyond craft-sized operations’.

Furthermore, it disincentives smaller distillers from producing more than around 12,500 bottles of a 40% ABV product annually, equal to 250 bottles per week.

Small wine and beer producers can produce higher volumes of products due to their lower tax rates, meaning it takes them longer to hit the excise-free threshold, the trade body noted. As such, distillers face a ‘comparative disadvantage’.

The document said countries with more favourable tax systems are benefitting from investment that could be made in Australia.

The trade groups are calling on the public to write to their local MPs to ask them to ‘fix’ the spirits tax system.

Australia recently restricted alcohol sales in the Northern Territory to improve community safety.

Related news

Altos teams up with Australian Open