This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

World Spirits Report 2022: Irish whiskey

By Alice Brooker2022 has seen Irish whiskey go from strength to strength, with attention focused on expansion and innovation.

Jameson, the World Whisky Brand Champion 2022, remains the world’s biggest-selling Irish whiskey. As it increased its volume sales by more than a quarter (25.4%) in 2021, the brand put its success down to continuing to experiment with flavours, including its Orange, Lime and Ginger, and Cold Brew bottlings.

John Kelly, CEO of Belfast Distillery, says: “It is worth noting that there are currently more than 40 Irish whiskey distilleries on the island of Ireland, which is tremendous growth over the past 15 years – with this growth will come more innovation.”

On a global basis, Irish whiskey’s sales climbed by almost half a million nine-litre cases in one year: it reported 11.5m case sales in 2021, which are expected to reach 11.9m in 2022, according to Euromonitor International. In 2023, Irish whiskey is forecast to hit 12.6m cases sales.

Particular attention is being paid to the category’s growth in the premium-and-above segments, as drinkers lean “towards drinking less but reaching for the premium spirits”, says Kelly.

Brendan Buckley, international marketing director of Irish Distillers, adds: “Irish whiskey is at home in [the premium] space and we’re seeing incredible growth in the luxury category. This is driven both by enhanced awareness of existing quality luxury offerings.” One of these luxury offerings is described by Buckley to be Redbreast Irish whiskey, which exceeded 100,000 case sales this year.

William Lavelle, director of the Irish Whiskey Association (IWA), says the category’s growth in the premium sector is also down to “continuing consumer interest in new and premium expressions”.

However, Irish whiskey is not without obstacles to growth. Lavelle notes: “The war in Ukraine is expected to have an impact on export sales. Last year both Russian and Ukraine accounted for 7% of global exports. There are also challenges facing producers, such as supply-chain issues.”

IWA’s International Trade Report 2022 found 92% of Irish whiskey producers surveyed said supply-chain delays have negatively affected their recent production output, and will likely hit future production output too. Yet, producers are optimistic about expansion – particularly in the US. Following the Distilled Spirits Council of the US reporting sales of Irish whiskey in the States grew by 17.8% in 2021, while sales of Scotch grew by 3.3%, the IWA projected that Irish whiskey sales in the US would overtake Scotch sales this decade.

Growth in ‘non-traditional’ markets is also on the horizon, says Buckley, with Jameson this year having surpassed the 100,000 nine-litre-case sales mark in India and Zambia, and 200,000 cases in Nigeria for the first time. Plus, with investment seen in Ireland, such as Sazerac acquiring Lough Gill Distillery in June this year, and Sliabh Liag Distillers launching a crowdfunding campaign to raise €2m (US$2.14m) to boost its production capacity to 600,000 litres per year in the same month, the future looks bright for Irish whiskey.

Brands to watch in 2023

Jameson

After witnessing a phenomenal 2022, surpassing a record 10-million-case sales globally for the first time, and seeing growth of 22% compared on 2021, Jameson has big plans to maintain its hold on the Irish whiskey category. With the continued rollout of its Widen the Circle campaign, introduced this year, the brand will also introduce “innovative new product launches”, including additions to its Jameson Anthology Series. “Additionally in 2023 we will continue to focus on Jameson Black Barrel and its role in bringing a super-premium Jameson offering to those elevated drinking occasions,” says Brendan Buckley, international marketing director of Irish Distillers.

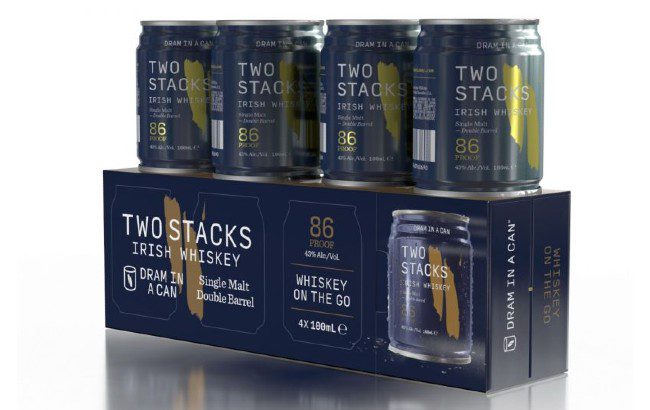

Two Stacks

One to watch next year is Two Stacks, a disruptive brand that surpassed its targets in 2022: it aimed to increase its five export distribution partnerships to 15 this year, and “completely smashed this target, with more than 25 new export partners”, says co-founder Shane McCarthy. Its year-on-year growth in revenue has also hit 50% from this time last year, McCarthy notes. Next year, the brand hopes to “throw the rule book out the window” as it attempts to expand its global footprint, spotlight innovation and promote its new premium Double Irish Cream Liqueur, which launched this month.

McConnell’s

By the end of the year, McConnell’s will be available in 25 markets, a “significant expansion in comparison with last year”, explains John Kelly, CEO of Belfast Distillery. Eyes are definitely on the brand, especially as it has started building its state-of-the-art J&J McConnell’s Distillery and Visitor Experience, which will open next autumn. The brand will also support whiskey tourism to attract more visitors to Northern Ireland and its home in north Belfast. Plus, McConnell’s will be targeting strong double-digit growth to win a greater “share in the very competitive Irish whiskey category”.