This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

The biggest spirits stories of 2021

The past 12 months have seen major developments in every corner of the spirits industry. Here’s our selection of the top stories of 2021.

2021 has brought both devastating upheavals and impressive victories for the spirits sector. The industry has continued to feel the damaging effects of the Covid-19 pandemic, but it has also made promising strides towards recovery.

Producers in South Africa, for instance, have been reeling from multiple bans on alcohol throughout the country. Meanwhile, whiskey makers in the US finally experienced some relief as the EU promised to roll back its tariffs on the spirit.

All along the way, The Spirits Business has reported the highs and lows – and as the year draws to a close, we’ve combed through our archives to pick 10 of the most significant stories from the past 12 months. Read on for our top picks.

Japanese whisky changes

Producers of Japanese whisky experienced a shake‐up in February when the Japan Spirits and Liqueurs Makers Association issued new guidelines for the category in the name of greater transparency. The regulating body said the purpose of the standards was to ‘protect the interests of consumers, ensure fair competition among businesses and improve quality’. Among the stipulations is a requirement that saccharification, fermentation and distillation must take place in Japan, and that maturation must take place there for at least three years.

While producers have until 31 March 2024 to adhere to the new regulations, Asahi-owned whisky maker Nikka has already taken the opportunity to distinguish which of its spirits meet the new criteria on its website.

“We feel this is an important step towards ensuring customers clarity so they can reasonably decide which products to buy and information will be updated if the status changes,” the producer said.

South Africa’s booze bans

As part of the fight against Covid‐19, the South African government enacted bans on alcohol sales at various points throughout the pandemic, which had a major impact on spirits brands and bars in the country.

The first ban came into effect on 27 March 2020 and ended on 1 June 2020; a second period of restrictions lasted from 12 July 2020 to 17 August; the third was in place from mid‐December 2020 to February 2021; and the most recent ban came into effect at the end of June and was lifted in July this year.

According to the South African Liquor Brand Owners Association (Salba), the first three bans resulted in a sales loss of South African rand R36.3 billion (US$2.4bn) for the industry. The trade group said the bans led to a “significant rise” in illicit trade, with consumers purchasing more illegal, low-quality alcohol as a result.

“Roughly 15% of market share is accounted for by illicit trade,” said Salba CEO Kurt Moore. “That’s a significant portion in the hands of syndicates who have only been further entrenched by the lockdown period.”

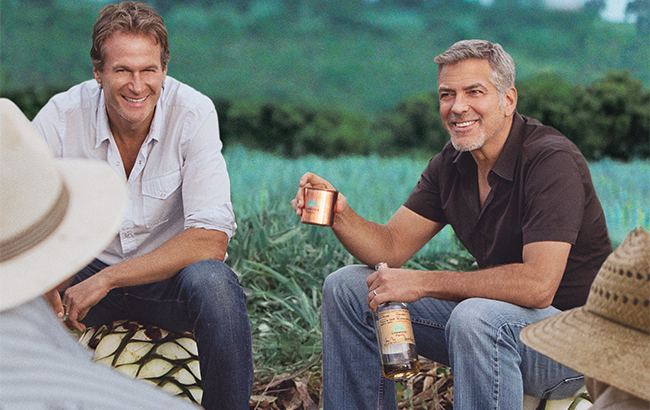

Casamigos hits 1m cases

Casamigos, the Tequila co‐founded by actor George Clooney, showcased the popularity of both celebrity‐backed spirits and all things agave when it became a million‐case‐selling brand, as revealed in The Spirits Business’ Brand Champions 2021 report.

The Tequila was created in 2013 by Clooney and entrepreneurs Rande Gerber and Mike Meldman, and was acquired by Diageo in 2017 through a massive deal worth up to US$1 billion.

That same year, Casamigos sold 100,000 nine‐litre cases; by 2019, its volume sales had increased to 600,000 cases. In 2020, it posted sales of 1.1m cases – a jaw‐dropping increase of 82.3%.

Casamigos CEO Lee Einsidler said that the brand benefited from “accelerated growth in the off‐trade”, while its use in takeaway cocktails helped its presence in the on‐trade channel. Its performance was boosted by strong sales in the US, the Caribbean, Europe and Australia.

Moët Hennessy and Campari unite

Two titans of the industry united in the name of e‐commerce in July, when Moët Hennessy and Campari entered into a partnership to build a premium online business for wines and spirits.

Campari agreed to contribute its stake in premium online retailer Tannico to the joint venture, with Moët Hennessy purchasing 50% of the e‐commerce business’ equity capital for €25.6m (US$30.3m). Tannico already has a 30% share of the premium wines and spirits market in Europe, and with this momentum, the companies aim to transform the retailer into “a premium pan‐European wines and spirits e‐commerce player”, said Philippe Schaus, president and CEO of Moët Hennessy.

Tannico CEO Marco Magnocavallo is staying on to lead the venture. “Tannico will offer a qualitative, sizeable and integrated route‐to‐market option catering to the needs of all its wines and spirits suppliers,” Magnocavallo commented.

Influencer marketing crackdown

Producers in the spirits sector doubled down on their commitment to responsible social media advertising this year by establishing the first industry‐wide standards for influencer marketing.

In partnership with advertising and public relations agencies, the 12 alcohol companies that form the International Alliance for Responsible Drinking (IARD) pledged to conduct diligence on the influencers they partner with; use age‐affirmation technology where possible; and advocate for responsible drinking.

“This is a world‐first initiative in raising collective standards of responsibility across multiple digital channels,” said Henry Ashworth, IARD president and CEO.

The companies also created a set of five safeguards that apply to influencers working with alcohol brands, and tools and videos to guide the content creation of brands and influencers.

Heineken buys into Distell

In November, brewing giant Heineken secured one of the largest acquisitions of the year when it agreed to buy a stake in South African drinks group Distell for €2.2 billion (US$2.5bn).

Dutch firm Heineken and Amarula liqueur owner Distell entered into discussions about a potential takeover in May. If approved, the deal will see Distell split into two businesses: Newco, which will combine Distell’s portfolio of spirits, wines, ciders and ready‐to‐drink beverages with Heineken’s Southern Africa and export markets business; and Capevin, covering the firm’s remaining assets, including its Scotch whisky business, consisting of the Bunnahabhain, Deanston and Tobermory brands.

Heineken will own a minimum 65% stake in Newco, while Distell’s largest shareholder, Remgro, will retain Capevin – meaning Heineken will not take on Distell’s Scotch whiskies. “The offer is testament to the strength of Distell’s leading position in South Africa and growth in select African markets,” said Distell CEO Richard Rushton.

Bacardi and Brown-Forman battle

While spirits giants Brown‐Forman and Bacardi officially ended their 18‐year distribution partnership in the UK in 2019, the fallout from the split has been ongoing.

In August 2020, Brown‐Forman sued Bacardi UK for £51.5 million (US$73m), citing payments allegedly owed through a cost‐sharing deal.

In May 2021, a London court ruled Bacardi was not required to make the payments – but a further arbitration ruling in December reversed the decision, ordering the rum giant to return the £51.5m sum to Brown-Forman.

“We are very pleased that the tribunal ruled in favour of Brown-Forman,” said Jeremy Shepherd, Brown-Forman, managing director, UK and Ireland.

“Most importantly, this decision allows Brown-Forman United Kingdom to focus our attention, energy, and resources on continuing to grow our business in the world’s fourth-largest market for American whiskey.”

Bacardi did not respond to requests for comment. From 1 January 2022, the companies will also end their distribution partnership in Austria.

End of American whiskey tariffs

American whiskey producers finally gained some relief from punitive tariffs when the EU and US reached a trade deal at the end of October. The agreement will see the EU roll back its 25% tariffs on American whiskey and other goods from 1 January 2022.

The tariffs were put in place in 2018 in retaliation to duties placed on EU aluminium and steel by former US president Donald Trump, and have had a devastating impact on the category. Between 2018 and 2020, American whiskey exports to the EU plummeted by 37%, from US$702 million to US$440m, according to the Distilled Spirits Council of the US (Discus).

“We have a long way to go, but are fully committed to building back American whiskeys better in the EU,” said Chris Swonger, Discus president. “The end of this long tariff nightmare is in sight for US distillers, who have struggled with the weight of the tariffs and the pandemic.”

Australian agave

Could Australian agave spirits become the next big thing? Melbourne‐based producer Top Shelf International (TSI) hopes so.

This year, the firm revealed plans to build a distillery and visitor centre on its 430‐hectare farm in north Queensland, which is home to more than 50,000 blue agave plants. To spearhead the operation, called the Australian Agave Project, TSI hired Trent Fraser, former president of LVMH’s Volcan De Mi Tierra Tequila brand. The company also began raising funds for the new facility, seeking AU$35 million (US$26.3m). The hydrogen‐ and solar‐powered distillery is expected to open in mid‐2023, with the capacity to produce more than 1.5m bottles each year.

“A stunning agave liquid profile that has been carefully nurtured to flourish outside of its native Mexico will be the next chapter in agave’s future,” Fraser said.

RTDS rocket

The ready‐to‐drink (RTD) category continued its meteoric rise in 2021, with IWSR Drinks Market Analysis predicting it will increase its market share of the total alcohol sector to 8% by 2025 – up from 4% in 2020. The forecast was laid out in IWSR’s RTD Strategic Study, which covered 10 markets comprising 85% of RTD volumes worldwide.

“RTDs are still growing at higher rates than spirits, wine and beer, signalling a major shift in consumer interest in this category across all demographics,” said Brandy Rand, chief operating officer of the Americas at IWSR Drinks Market Analysis.

RTDs have been the fastest‐growing major drinks category by volume since 2018, and are expected to increase at an approximate compound annual growth rate (CAGR) of 15% in the five years to 2025. This is compared with around 1% CAGR for total beverage alcohol. In the US, the RTD category has already surpassed the total spirits category in terms of volume, and IWSR anticipates it will overtake wine by the end of this year.